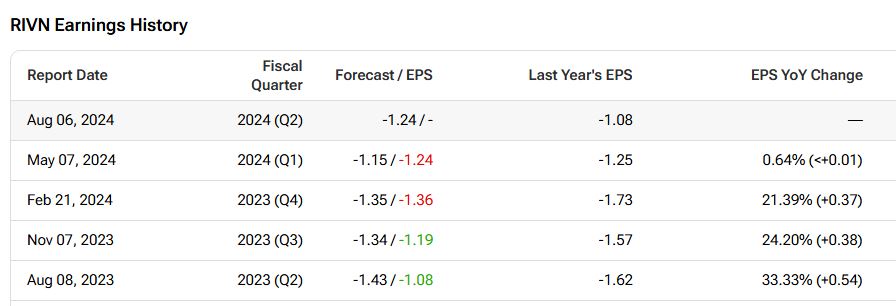

Shares of electric vehicle (EV) maker Rivian Automotive (RIVN) will release its Q2 financials on August 6. Analysts expect Rivian to report a loss of $1.24 per share for Q2 2024, greater than the loss of $1.08 per share in the prior-year quarter. Also, they expect the company to report revenues of $1.09 billion, down 3% year-over-year, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In terms of RIVN stock price, the shares have lost nearly 37% year-to-date, due to macro uncertainty, a slowdown in EV demand, and profitability challenges. Nevertheless, the stock price could get a boost if the company is able to deliver a strong Q2. Further, management commentary about a favorable demand backdrop could act as a catalyst.

Importantly, Rivian has missed EPS estimates twice in the last four quarters, reflecting a weak electric vehicle market.

Insights from the TipRanks Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bullish analysts remain impressed with RIVN’s better-than-expected delivery numbers for Q2. They also noted that the company’s financial outlook has improved, thanks to stronger gross margins and reduced operating expenses. Further, the analysts believe that Rivian’s $5 billion partnership with Volkswagen (DE:VOW) underscores the company’s technological advancement and strategic growth.

Meanwhile, bears remain concerned about Rivian’s unchanged 2024 production outlook, hinting at demand issues. They also note that while Rivian secured about $5 billion in new liquidity from Volkswagen, $3 billion of it will dilute existing shares.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 13.59% move in either direction.

Is Rivian Stock a Buy or Sell?

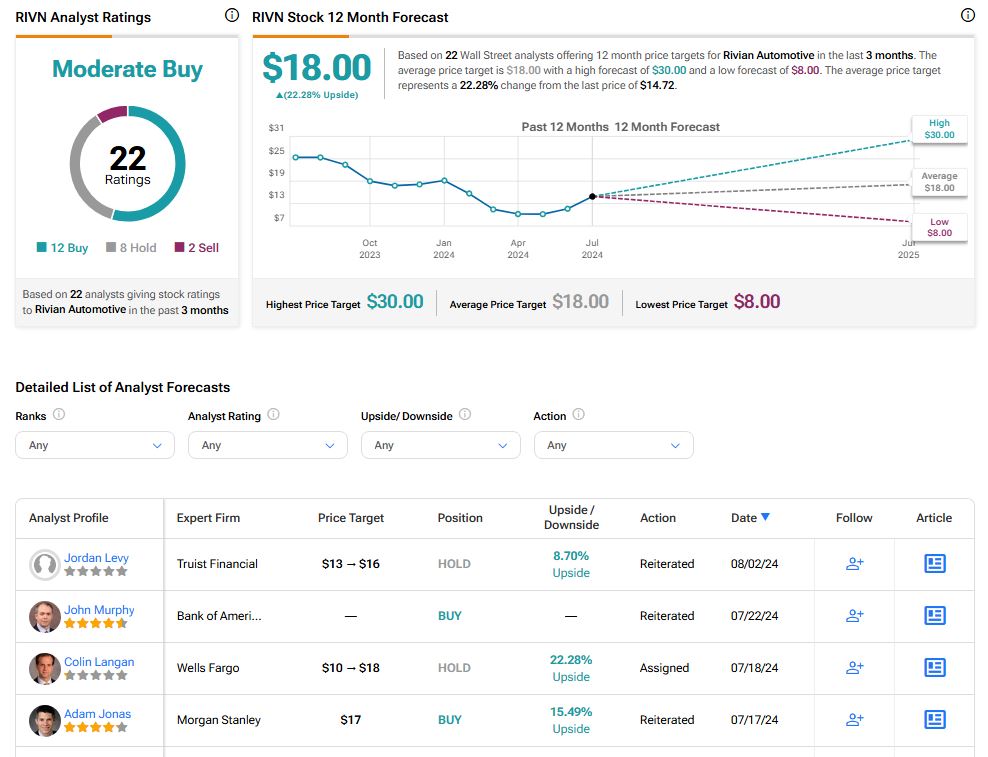

Overall, the Street has a Moderate Buy consensus rating on Rivian stock, alongside an average price target of $18. However, analysts’ views on the stock are likely to change once the company reports its Q2 earnings tomorrow.

Bottom Line

Analysts expect Rivian’s top and bottom lines to stay under pressure due to challenges in the EV sector. Nonetheless, strong Q2 deliveries and the recent $5 billion deal with Volkswagen were positives for the quarter. It will be intriguing to see if management can offer more clarity on demand conditions, the Volkswagen partnership, and the overall EV market.