Multinational oil and gas firm Exxon Mobil Corp. (NYSE: XOM) plans to exit its oil and gas operations in Russia as well as stop new investments following Russia’s invasion of Ukraine, Reuters said citing a company release. The company’s Russia operations are worth over $4 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the plan, Exxon will stop operating three large oil and gas production facilities on Sakhalin Island and halt investment in a proposed multi-billion-dollar LNG facility on the site. It manages the facilities on behalf of a consortium of Russian, Indian and Japanese companies.

The company said, “We deplore Russia’s military action that violates the territorial integrity of Ukraine and endangers its people.”

Exxon is the latest Western company to abandon its Russian operations. Since Russia invaded Ukraine on February 24, several companies, including Shell (NYSE: SHEL), BP (NYSE: BP), Apple (NASDAQ: AAPL) and Boeing (NYSE: BA), have pulled out of the transcontinental country.

Hydrogen Production Facility at Baytown

Separately, Exxon plans to set up a hydrogen production, carbon capture and storage facility at its Baytown site in Texas to reduce its carbon emissions.

The President of ExxonMobil Low Carbon Solutions, Joe Blommaert, said, “Hydrogen has the potential to significantly reduce CO2 emissions in vital sectors of the economy and create valuable, lower-emissions products that support modern life.”

The facility will have a daily hydrogen production capacity of one billion cubic feet. Further, the project’s carbon capture infrastructure will be able to transport and store up to 10 million metric tons of CO2 annually.

By using hydrogen at its Baytown olefins plant, Exxon would cut the facility’s Scope 1 and 2 CO2 emissions by up to 30%. The company aims to achieve net-zero greenhouse gas emissions by 2050.

About Exxon

Texas-based Exxon is engaged in the exploration, development, and distribution of oil, gas, and petroleum products. Its brands include Exxon, Mobil, Esso, and ExxonMobil Chemical.

XOM stock was trading 1.4% up in the pre-market session on Wednesday at the time of writing.

Analysts’ Take

On February 28, Bank of America Securities analyst Doug Leggate maintained a Buy rating on the stock and raised the price target from $105 to $110 (39% upside potential).

Overall, the stock has a Moderate Buy consensus rating based on 9 Buys and 9 Holds. The average XOM price target of $85.17 implies 7.6% upside potential. Shares have gained 49% over the past year.

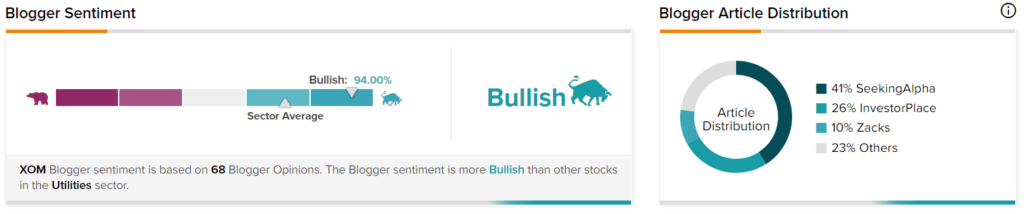

Blogger Opinions

TipRanks data shows that financial blogger opinions are 94% Bullish on Exxon, compared to the sector average of 72%.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Wendy’s Posts Better-Than-Expected Q4 Results

Baidu Posts Upbeat Q4 Results; Shares Jump 7%

Energy Transfer to Sell 51% Stake in Canadian Business for $1.3B