Shares of Chinese e-commerce giant JD.com (NASDAQ: JD) slipped more than 4.8% on news that billionaire founder Richard Liu was exiting his role as a CEO. The company said in a statement that Lei Xu, current President of JD, will assume the CEO role effective immediately.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

JD stock closed down 3.3% at $57.10 on April 7. Its stock has been hammered by the ongoing regulatory overhaul of Chinese-originated, U.S.-listed companies. Year-to-date, JD is down 16.4% and has lost 30.5% over the past year.

Founder Exits CEO Role

Amid the regulatory warfare between China and the U.S., American-listed Chinese companies have taken a severe setback. Chinese tech giants have undergone an exacerbated overhaul by their government to fight their monopolistic behavior, while the U.S. has imposed stringent norms for regulatory disclosures.

Richard Liu is the latest in line to step down from his role as CEO, after many tech billionaires have fled the scene. However, Liu will continue to chair the Board of Directors and will “continue to focus on guiding the company’s long-term strategies, mentoring younger management, and contributing to the revitalization of rural areas,” the company said.

Meanwhile, Xu comes with ten years of experience in various positions in JD and also serves the Board as Director at Dada Nexus (DADA) and ATRenew.

Commenting on the management changes, Liu said, “Lei is highly regarded both inside and outside the company, and has been instrumental in driving JD’s consistent stellar business performance and formulating strategic decisions. I’ll devote more of my time to JD’s long-term strategies and future drivers as we continue to work on the most challenging yet valuable things.”

Wall Street’s Take

The analysts on the Street, however, are highly optimistic about the JD stock, with a Strong Buy consensus rating based on nine Buys and one Sell. The average JD.com price forecast of $86.70 implies 51.8% upside potential to current levels.

Hedge Fund Activity

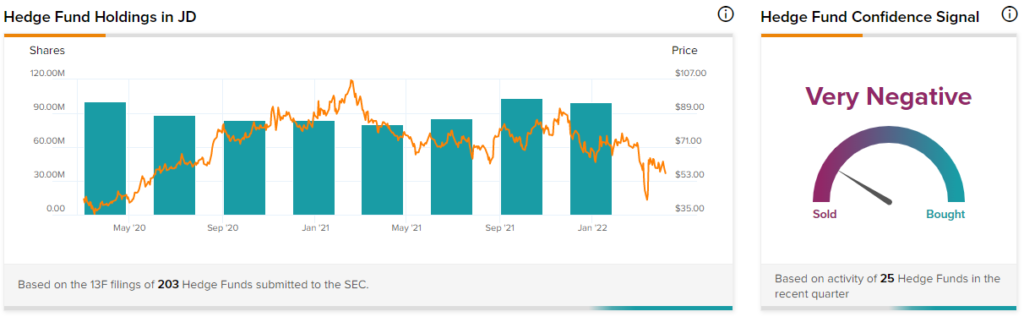

On the other hand, according to the TipRanks Hedge Fund Trading Activity tool, the confidence in JD.com is currently Very Negative with 25 hedge funds decreasing their holdings of the JD stock by 3.9 million shares over the last quarter.

Concluding Thoughts

In its latest results for the fourth-quarter ending December 31, 2021, JD posted upbeat results driven by strong demand for online shopping. However, the company’s stock price remains under persistent pressure from various macroeconomic and regulatory headwinds.

The recent spike in the new COVID-19 variant has also resulted in nationwide shutdowns in China, which may further hurt the company’s performance in the short run. In terms of valuation, the stock trades above industry average multiples, making it a pricey bet.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Bed Bath & Beyond Boards Kroger’s Ship

Levi Strauss Rises on Upbeat Q1 Results

Toyota to Develop Cheap Self-Driving Cars