Oracle (ORCL) has a new electronic health record (EHR) with implications for both the AI and healthcare market. The tech company has been working on gaining a foothold in the medical field for years. In 2022, it acquired healthcare information provider Cerner, known for its work in the medical records space. Now it is taking another step into this growing market and ORCL stock is rising on the news.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What’s Going On with Oracle Stock Today?

Trading has been slightly volatile for Oracle stock today but so far, shares are still trending upward. As of this writing, ORCL stock is up 0.50% and its current trajectory suggests that it will continue rising. Despite declining last week, Oracle has enjoyed an excellent year overall, rising 28% in just the past three months.

Now the tech company is poised for even more growth as it works to procure an even bigger share of the healthcare technology market. EHR software is a critical component of modern patient treatments. And according to CNBC, “Oracle’s latest EHR is equipped with cloud and artificial intelligence capabilities that will make it easier to navigate and set up.”

This new software could be a significant growth driver for Oracle. The company reported revenue growth of 18% after closing its Cerner acquisition. Now it has a product update that can appeal to hospitals and independent physicians across the U.S. and beyond.

Is Oracle Stock a Strong Buy Right Now?

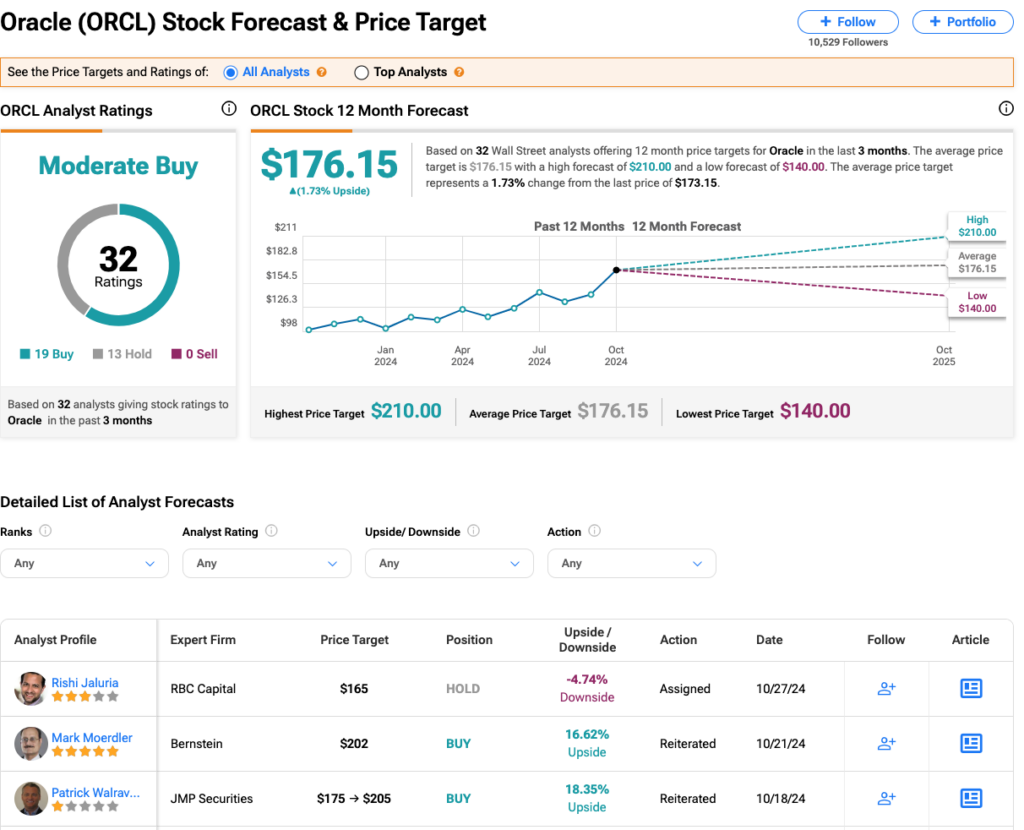

Wall Street is mostly bullish on Oracle stock. Analysts have a Moderate Buy consensus rating on ORCL stock based on 19 Buys, 13 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 72% rally in its share price over the past year, the average ORCL price target of $176 per share represents a 1.73% change from the last price of $173.15.

This positive stance makes sense, given Oracle’s strong performance over the past year. Now ORCL stock can offer investors exposure to both the healthcare and AI markets, both of which are strong and growing quickly. The company is well positioned to continue on its path toward growth and finish the year on a high note.