Within the rapidly expanding Cloud AI market, hyperscaler leaders Amazon (AMZN) (via Amazon Web Services) and Alphabet (GOOGL) (via Google Cloud) stand out—one as the market share leader and the other as the fastest-growing among its peers. While I remain bullish on both companies, a closer analysis using the TipRanks’ Stock Comparison Tool suggests that Amazon offers slightly better value based on a combination of factors, including sales and margin expansion, as well as valuations.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Analyzing the Potential of the AI Cloud Market

Before diving into the investment theses for Amazon and Alphabet, it’s important to understand the broader landscape of the cloud computing market, particularly the rise of cloud AI. Third-party data estimates the size of the cloud AI market at $67.5 billion in 2024, with projections suggesting that it will reach around $274.5 billion by 2029, representing a CAGR of 32.4%.

Additionally, according to Cisco Systems (CSCO), the volume of big data is expected to surge as companies increasingly adopt cloud AI solutions. From 2016 to the present, the amount of data has grown from 51 exabytes to 403 exabytes, reflecting a growth rate of nearly seven times.

These figures illustrate the immense scale and rapid growth of the AI cloud market, which is still in its early stages. As of this year, the leading players in the industry are Amazon Web Services (AWS), which holds 31% of the global market share, followed by Microsoft’s (MSFT) Azure at 20%, and Alphabet’s Google Cloud with 12%. Other key competitors include Alibaba Cloud (BABA) with a 4% market share, as well as Oracle (ORCL) and Salesforce (CRM), holding 3% and 2% market shares, respectively.

AWS Is Amazon’s Cloud Cash Cow

As a long-term Amazon bull, much of my investment thesis centers on the company’s most profitable segment: AWS. Amazon’s cloud business, the most established and profitable of its divisions, offers a broad range of services. A key driver of AWS’s success is its flexibility, which enables high scalability and makes it attractive to both large enterprises and startups.

To put AWS’s growth into perspective, about one-third of Amazon’s profits now come from its cloud business. Over the past five quarters, AWS’s sales growth has accelerated from 12% to 19% in Q3. The key question going forward is how long this growth can be sustained and, more importantly, whether the current strong margins will hold.

In the past three quarters, AWS’s operating margins have been strong, though somewhat oscillating: 37.6% in Q1, 35.5% in Q2, and an impressive 38% in Q3. Amazon attributes this margin expansion to three factors: (1) staffing efficiency, with flat office staff levels; (2) extending the useful life of servers in 2024; and (3) most importantly, higher top-line demand, which drove improved cost efficiencies and profitability.

Because of this strong demand, Amazon expects to spend about $75 billion in capital expenditures for AWS in 2024, with spending likely to increase in 2025, driven by the growth of Generative AI. While Amazon’s management notes that margins may fluctuate over time due to factors such as investments in new products and changes in staffing, they believe that as long as AWS continues to balance supply with demand, its margins will remain robust.

Alphabet Drives Strong Cloud Growth

Although Alphabet generates the majority of its revenue (around 75%) from advertising, one of the main bullish arguments for the company’s investment thesis is its rapidly growing cloud business, which has been expanding faster than its major peers.

In Q3 of this year, Google Cloud’s revenue increased by 34.5% to $11.3 billion, marking the seventh consecutive quarter of growth. While operating margins are still much lower than those of AWS, they improved significantly to 17.4%, up from 11% in Q2. According to Alphabet’s management, this margin improvement is due to strong demand for key AI-driven cloud products, such as Google Cloud Platform (GCP) and Google Workspace, as well as ongoing efficiency initiatives.

One of Google Cloud’s key strengths lies in its integration with other Google services. This synergy allows Google Cloud to offer a comprehensive suite of solutions in areas such as automation, cybersecurity, and productivity.

Much like Amazon’s AWS, the expansion in margins for Google Cloud reflects growing demand and the company’s capacity to deliver high-quality cloud AI services. As a result, Alphabet has already spent $38.2 billion in capex during 2024, marking a 44% increase in investment compared to the same period last year.

Valuation Comparison: AMZN vs. GOOGL

An important aspect of the bullish thesis for AMZN and GOOGL is their valuations, particularly when looking at their price relative to cash flows. Both companies are heavily investing in expanding their cloud and AI infrastructure, and this rising CapEx trend is prominent across the tech sector, which puts pressure on cash flows.

Currently, Amazon trades at a forward price-to-cash flow multiple of 17.4x, which is nearly 15% below its five-year historical average. In comparison, Alphabet has a forward price-to-cash flow multiple of 16.2x, which is 6.5% below its five-year historical average.

Although Alphabet’s cloud business is growing faster than its peers, its smaller market share means it still has room to catch up. In contrast, Amazon leads the market, has higher margins, and continues to sustain strong sales growth. As a result, I believe Amazon deserves a much higher premium than Alphabet, a discrepancy that doesn’t seem to be reflected in their current valuations.

Is AMZN a Good Buy?

At TipRanks, the Wall Street consensus for Amazon is a Strong Buy, based on 45 analysts. Of these, 44 have a Buy rating, while only one analyst rates Amazon stock as a Hold. The average AMZN price target is $239.10, implying a potential upside of about 18.54%.

Is GOOGL a Good Buy?

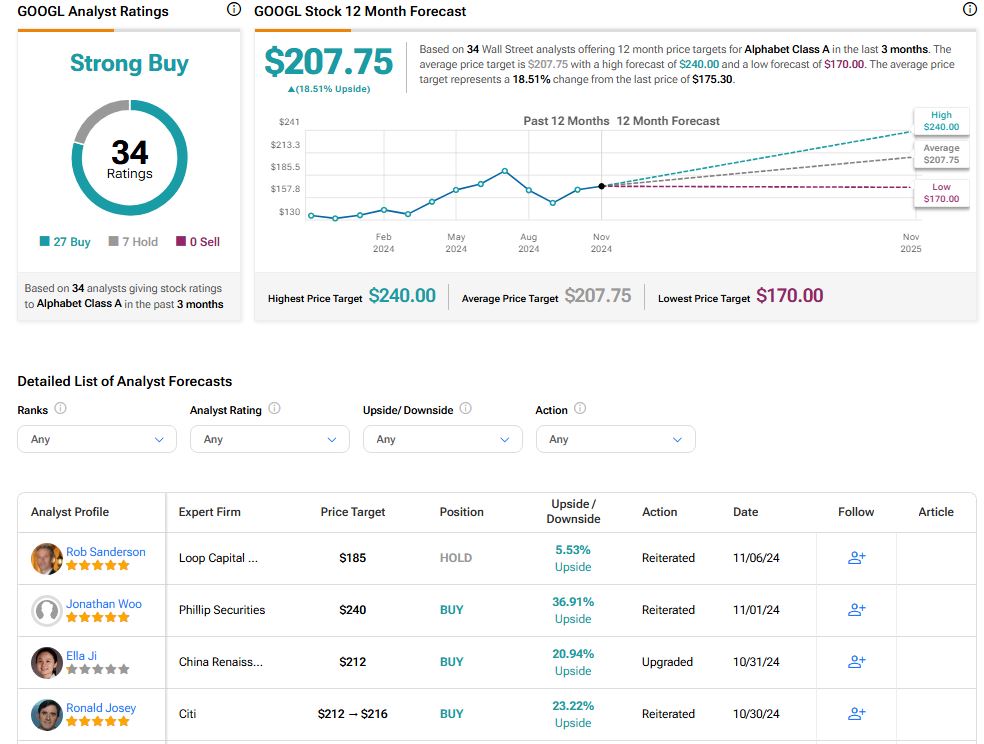

Regarding GOOGL, the Wall Street consensus is also a Strong Buy, based on 34 Wall Street analysts, of which 27 are bullish and seven are neutral. The average price target is $207.75, implying an upside potential of 18.51%.

See more GOOGL analyst ratings

Conclusion

While I’m bullish on both AMZN and GOOGL, Amazon stands out as the more established and profitable player, particularly in terms of margin expansion. Although Alphabet’s cloud business is growing rapidly and could narrow the market share gap, it will likely face challenges in matching AWS’s margins. Moreover, AMZN trades at a cash flow multiple similar to GOOGL’s, which I view as relatively de-risked given its strong position in the cloud AI market.

As such, I currently view Amazon as the more valuable player in the AI Cloud market.