Almost two years ago, in the late fall of 2022, OpenAI introduced ChatGPT and set off the generative AI revolution. AI itself wasn’t new – but generative AI gave us something more, not a promise but the fact of creative AI, capable of generating original content, images, and even music, based on real-time natural-language instructions.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This is game-changing, and we’re in the early stages of finding out just how much the game will change. It’s not just the world of content creation that will feel it – AI can help us sort our data, sift through videos and images, improve facial recognition, identify trends in current events, and translate languages. Generative AI has only just started its march through the world of consumer internet applications.

For investors, this should naturally direct our attention to AI-adjacent stocks, particularly those that have been generating solid returns for shareholders. TD Cowen’s Matt Ramsay, an analyst ranked 8th among thousands of Wall Street professionals, shares this view. He recommends Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) as the top AI stocks to buy ahead of their upcoming earnings releases.

In fact, it’s not only Ramsay who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Nvidia

Let’s begin with Nvidia, the world’s leading semiconductor chip company. With a market cap of $3.1 trillion, it is not only the largest chip company – over three times the size of second-place Taiwan Semiconductor – but also the third-largest publicly traded firm globally, surpassed only by tech giants Apple and Microsoft.

Nvidia’s rise to the top of the tech world was powered by its leadership in AI-capable processing chips. This is baked into the company’s very DNA; Nvidia got its start as a market leader when it developed the first graphic processing units more than 20 years ago. While GPUs were created to meet the demands of high-end video gamers for improved graphics, the chips’ high processing capacity quickly proved valuable in other realms – professional graphic design, data centers, and AI applications. These are all fields that require rapid computing functions, and Nvidia has been meeting their needs for decades now.

Most recently, Nvidia has seen strong demand for its Hopper and Blackwell lines of chips, the company’s top-end AI-capable products. These chips, the Blackwell line particularly, provide the capacity to match the current generation of accelerated computing and generative AI.

Strong sales of Nvidia’s current chips, building on the success of the company’s previous lines, have pushed the stock to an impressive 171% gain over the past 12 months.

And that brings us to the biggest recent news for Nvidia shareholders, or prospective shareholders: the recent stock split. In its fiscal 1Q25 financial report, Nvidia announced a 10-for-1 stock split, to bring the stratospheric price of the stock down and encourage sales. In the first week of June, when the split took effect, NVDA was trading for more than $1,100 per share; the shares are now trading for $126.

Behind the rise in share price, Nvidia has posted solid earnings results. In fiscal 1Q25, the company saw a top line of $26 billion, $1.45 billion better than the forecast and up a whopping 262% year-over-year. The company’s bottom line in the quarter came to $6.12 per share, by non-GAAP measures, beating the estimates by 54 cents per share. We should note that, adjusted for the split, Nvidia’s non-GAAP EPS comes to 61 cents. Nvidia’s leadership in the Data Center market powered these recent successes; the company’s DC segment brought in $22.6 billion of the quarter’s revenue, and expanded 427% year-over-year.

Market watchers expect to see Nvidia’s next set of quarterly results next month, and are looking for a top line of $28.43 billion, and non-GAAP earnings of 64 cents per share.

Nvidia’s success in data centers, and AI-capable chips, forms the foundation of Matt Ramsay’s bullish stance on the stock.

“One thing remains the same, fundamental strength at NVIDIA. In fact, our checks continue to point to upside in Datacenter as demand for Hopper/Blackwell-based AI systems continues to exceed supply. Elsewhere we expect inline results. Overall we see a product roadmap indicating a relentless pace of innovation across all aspects of the AI compute stack and reiterate NVIDIA as a Top Pick,” Ramsay opined.

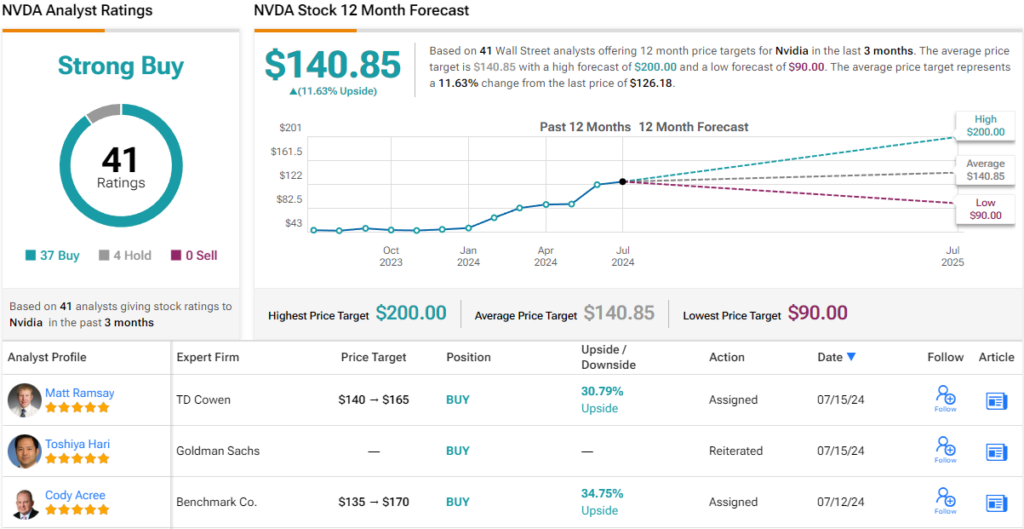

Ramsay goes on to give NVDA stock a Buy rating, and he complements that with a $165 price target that points toward a one-year gain for the stock of ~31%. (To watch Ramsay’s track record, click here)

Overall, Nvidia gets a Strong Buy consensus rating from Wall Street, based on 41 recent reviews that show a lopsided split of 37 Buys to just 4 Holds. Meanwhile, the average price target of $140.85 implies an upside of nearly 12% in the year ahead. (See NVDA stock forecast)

Advanced Micro Devices (AMD)

Next on our list is AMD, another leader in the semiconductor field. AMD is not in the same size league as Nvidia, but its market cap, standing near $295 billion, is respectable in its own right – and makes AMD the world’s sixth-largest chip company. Shares in AMD are up nearly 50% over the last 12 months.

AMD has built a solid reputation on the quality of its high-capacity processor chips. The company works at the design and engineering of its chips, as well as the marketing and distribution; like many of the major chip firms, AMD is ‘fabless,’ and has farmed out production of its designs to dedicated chip foundries. AMD is known as a provider of high-end products for the data center industry and generative AI developers, and has engineered its latest chipsets to meet the needs of end users in the high-performance computing and AI industries.

These new AMD chips include the latest iterations of the company’s MI300/400 chipsets, as well as the Ryzen AI chips, EPYC processors, and Instinct accelerators. AMD has found a great deal of success with its top-end chip lines, and they are used by computer makers such as Lenovo and Dell, as well as high-performance computing specialists like Supermicro.

AMD last reported earnings for 1Q24, and we saw a sound top line of $5.5 billion. This represented a modest 2.2% year-over-year gain while beating the forecast estimates by $20 million. At its bottom line, AMD reported a non-GAAP EPS figure of 62 cents, a penny better than had been anticipated. The company’s data center and client segments both showed 80%-plus gains in Q1, based on strong sales of the MI300 accelerator series. AMD has been benefiting from high demand across multiple industries for AI-capable chipsets.

Looking ahead, analysts are predicting that AMD will see 68 cents per share at the bottom line, based on revenues of $5.72 billion.

When we check in again with top analyst Ramsay, we find him upbeat on AMD, tapping the company as a strong candidate for long-term growth.

“Over the last 9 months, sentiment has moved (up and down) much more than fundamentals at AMD as Datacenter upside was until now masked by downside in other segments. However, we believe the fundamental setup into 2H24 and 2025 is strong, driven by some upside to core server, strong growth of MI300/325 ahead of the MI350/400 product cycles, and favorable PC seasonality near-term,” Ramsay commented.

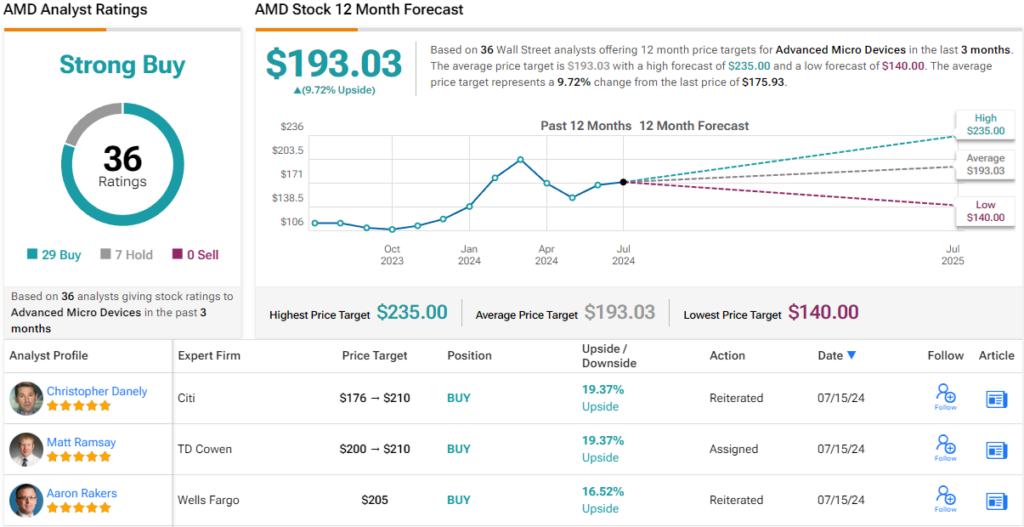

Quantifying his bullish stance, the analyst puts a $210 price target on AMD shares, suggesting that the stock will gain 19% in the next 12 months – and providing sound backing for his Buy rating.

All in all, AMD has earned a Strong Buy consensus rating from Wall Street’s analysts, visible in the 29 Buy ratings against 7 Holds. The stock’s trading price of $175.89 and average target price of $193.03 together imply a gain of ~10% on the one-year horizon. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.