Super Micro Computer, Inc. (SMCI), a high-performance server and storage solutions manufacturer headquartered in California, surprised investors on Nov. 18 by announcing that it has appointed BDO USA as its auditor. Super Micro stock surged more than 30% higher with this news, and it’s time to turn bullish as the company tries to meet compliance requirements to stay listed on the Nasdaq. Super Micro’s proposal submitted to the Nasdaq reveals the company is trying to meet the updated annual and quarterly report submission deadlines.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I am bullish on the prospects for Super Micro as I believe delisting fears are masking the company’s investment appeal at a cheap valuation.

Super Micro’s Fundamentals Remain Strong

My bullish stance on Super Micro stems from the company’s strong financial performance and promising partnerships. Despite losing over 75% of its market value in the last six months, Super Micro has continued progressing with its key partnerships. For example, on Oct. 15, Nvidia Corporation (NVDA) announced Super Micro’s launch of a new JBOF powered by Nvidia’s BlueField data processing unit. In addition to Nvidia, Advanced Micro Devices (AMD) and Intel Corporation (INTC) continue to work closely with Super Micro, a testament to the company’s strong relationships with leading global chipmakers.

In addition to maintaining strong partnerships with key customers and business partners despite failing to meet Nasdaq reporting requirements, Super Micro has grown exponentially. According to the preliminary Q1 2025 earnings report, revenue ranged from $5.9 billion to $6 billion for the quarter ended Sep. 30, a notable increase from just $2.12 billion in revenue reported for the corresponding quarter last year.

Macroeconomic Tailwinds Support Growth

The macroeconomic environment paints a promising outlook for Super Micro. The company has emerged as one of the biggest winners of the growing data center market, with large-scale companies investing aggressively in boosting their data center capacity. In the fourth quarter of Fiscal 2024, which ended on June 30, more than 70% of Super Micro revenues came from AI and rack-scale systems, registering a year-over-year growth of more than 200%. According to McKinsey, the demand for global data center capacity will grow at an impressive CAGR of between 19% and 22% to an annual demand of 171 to 219 gigawatts by 2030. The exponentially growing generative AI workload is expected to be the major driver behind this growth.

This stellar growth in data center capacity demand will create a strong demand for AI chips in the next few years, paving the way for Super Micro’s high-performance server business – where the company builds the necessary infrastructure to connect AI chips – to thrive. According to BoFA analyst Vivek Arya, a five-star analyst according to Tipranks’ ratings, the AI chip market will reach $200 billion in 2027, up from just $44 billion in 2023. Super Micro, aided by its partnerships with leading AI chipmakers worldwide, stands to benefit from this projected growth.

Diversification Will Help Super Micro Grow

In addition to the strengthening financial performance and the favorable macroeconomic outlook, I am impressed by Super Micro’s diversification efforts. The company’s diversification strategy is multi-pronged. From a product diversification perspective, Super Micro is investing heavily in liquid cooling solutions, enabling the company to produce more than 3,000 racks per month by the end of this year compared to around 1,000 racks per month today. From an end-market perspective, Super Micro is expanding into new markets such as 5G, telecommunications, IoT, and edge computing.

Super Micro’s diversification efforts also include geographic expansion. The company is expanding its manufacturing footprint globally to mitigate the disruption risks that may arise from reliance on a single supply-chain hub. As part of this strategy, Super Micro has already expanded its manufacturing presence to the Netherlands, Malaysia, and Taiwan and built a new factory in California.

Is Super Micro a Buy, According to Wall Street Analysts?

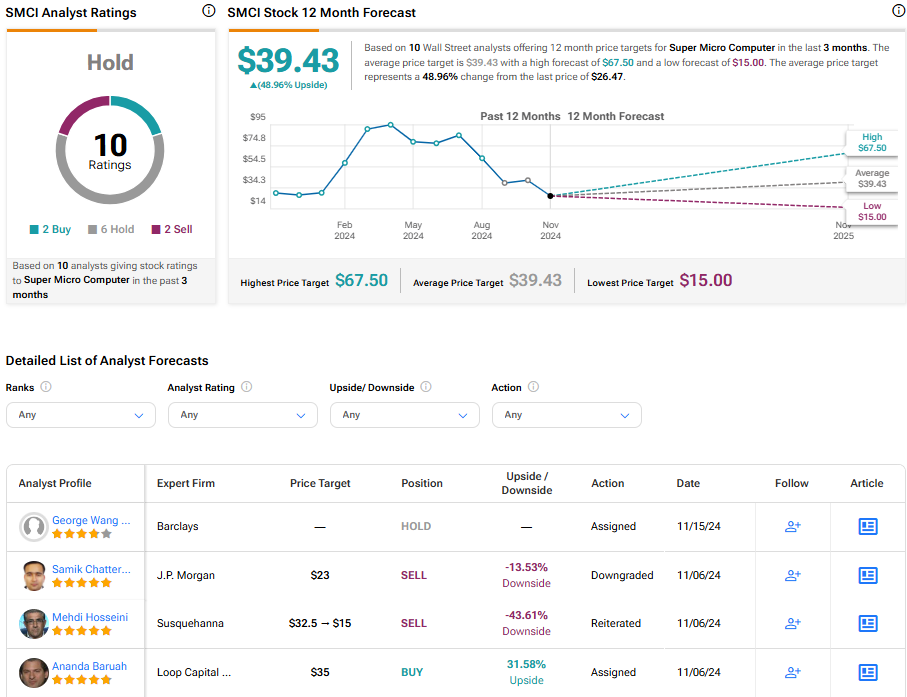

Wall Street reacted positively to Super Micro’s appointment of BDO as an independent auditor. Northland analyst Nehal Chokshi, also a five-star analyst according to Tipranks’ ratings, commented that this is the first step to restoring investor trust in the company’s financials. However, the analyst notes that investors need to exercise caution today as the company still has a long way to go before fully recovering from the regulatory debacle. Earlier this month, Mizuho Securities suspended the coverage of Super Micro due to the lack of audited financial statements. At the same time, JPMorgan (JPM) analyst Samik Chatterjee, another top analyst, scoring five-star ratings from Tipranks, slashed his price target from $50 to $22 on similar concerns.

Although Super Micro has not been a favorite among analysts lately, if Nasdaq accepts the proposal submitted by the company a couple of days ago, a notable change in analyst sentiment is likely. Based on the ratings of 10 Wall Street analysts, the average Super Micro price target is $39.43, which implies an upside of 48.96% from the current market price.

I believe Super Micro is cheaply valued in light of expected growth. The company currently trades at a forward P/E of just 7.42, but analysts expect revenue to grow by 67% year-over-year and 20% year-over-year in Fiscal 2025 and 2026, respectively. The current valuation does not reflect the stellar growth ahead of the company as investors’ judgment has been clouded by Super Micro’s recent failure to comply with filing requirements.

Takeaway

If approved, Super Micro’s proposal to the Nasdaq will provide the company with a much-needed grace period to meet quarterly and annual report filing requirements. This proposal, coupled with the appointment of a new auditor, is a step in the right direction as the company tries to restore investor confidence. Super Micro enjoys a long runway to grow, and addressing regulatory concerns will likely help the company gain momentum in the market, potentially leading to a notable expansion in valuation multiples.