Shares of Danish pharmaceutical company Novo Nordisk (NVO) are getting a 1.63% boost on Tuesday alongside a proposal from President Joe Biden. The President suggested adding weight loss drugs to Medicare and Medicaid as obesity treatments. Currently, Medicare and Medicaid only approve weight loss drugs as diabetes treatments.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Such a proposal could greatly expand the use of weight loss drugs in the U.S. That would benefit Novo Nordisk as it is the maker of Ozempic, one of the leading weight loss drugs on the market. The company called the proposal an “important step forward for patients.”

Novo Nordisk May Run Into Administration Trouble

While President Biden suggested such a proposal could go into effect in 2026, there’s one issue that could prevent that. Biden is the outgoing President of the U.S., with President-elect Donald Trump taking over in January.

Trump has already started naming picks for members of his administration. Among them is Robert F. Kennedy Jr., who is poised to head the U.S. Department of Health and Human Services. RFK Jr. is vocal about pushing Americans to lose weight but favors healthy eating and an active lifestyle over prescription medicines. He’s gone so far as to claim that Novo Nordisk is counting on selling Ozempic to Americans because “we are so stupid and so addicted to drugs.”

With Trump’s team coming into office, Biden’s proposal would have to get the new administration’s approval before going into effect. Considering RFK Jr.’s stances on weight loss and medicine, it seems unlikely that Ozempic will be added to Medicare and Medicaid as a weight loss treatment.

Is NVO Stock a Buy, Sell, or Hold?

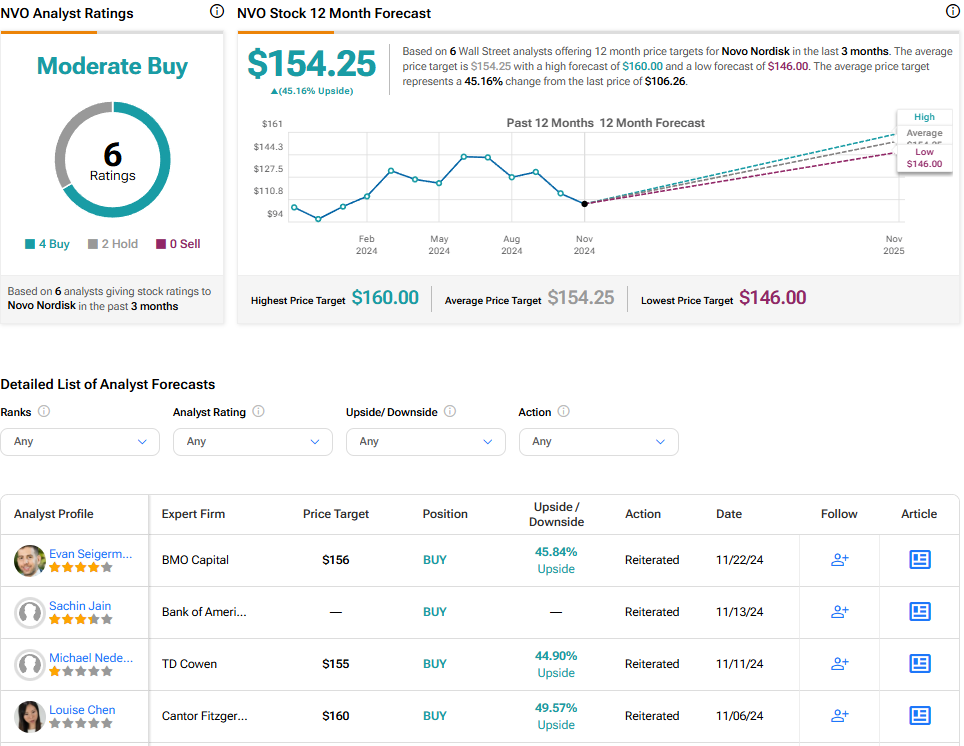

Turning to Wall Street, the analysts’ consensus rating for Novo Nordisk is Moderate Buy based on four Buy and two Hold ratings over the last three months. That comes with an average price target of $154.25, a high of $160, and a low of $146. This represents a potential upside of 45.16% for NVO shares.