Shares of Amgen (AMGN) plunged in trading, even as the biopharmaceutical company reported promising results from a mid-stage trial of its experimental weight loss drug, MariTide. These findings come as the company seeks to capture a share of the booming obesity drug market.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

In the trial, patients with obesity lost an average of 20% of their body weight after a year, while those with both obesity and Type 2 diabetes saw an average weight loss of 17%. Notably, no plateau in weight loss was observed, suggesting potential for further reductions beyond the initial 52 weeks.

AMGN’s MariTide’s Phase-2 Trial Involved 592 Patients

MariTide’s once-monthly—or even less frequent—dosing could give it a competitive edge over popular weekly injections like Novo Nordisk’s (NVO) Wegovy and Eli Lilly’s (LLY) Zepbound. The first phase of the trial involved 592 patients who tested various regimens and dosing levels, including 140, 280, and 420 milligrams. For example, some groups underwent a rapid four-week dosage escalation, while others followed a slower 12-week escalation.

Additionally, one group tested the highest dose of the drug administered every other month, with plans to explore quarterly dosing in ongoing studies. Furthermore, while 11% of patients discontinued treatment due to adverse effects, fewer than 8% did so specifically because of gastrointestinal issues.

Amgen Expands Trial to Test Long-Term Durability

In addition, the company invited patients to participate in the trial’s second part to determine the drug’s durability and potential for continued weight loss. Amgen Chief Scientific Officer Jay Bradner commented that AMGN was “interested to see how quickly people who lost weight rebound when they come off the medicine.”

AMGN Shares Fall despite Encouraging Results

Despite the encouraging data, Amgen shares plunged in trading as Wall Street had anticipated weight loss outcomes closer to 25%. Deutsche Bank analyst James Shin even described the results as “underwhelming,” citing a 20% weight loss in Cohort A and 17% in Cohort B at 52 weeks. He also noted that it’s unclear if these figures are placebo-adjusted, and they fall short of Wall Street’s 25% benchmark.

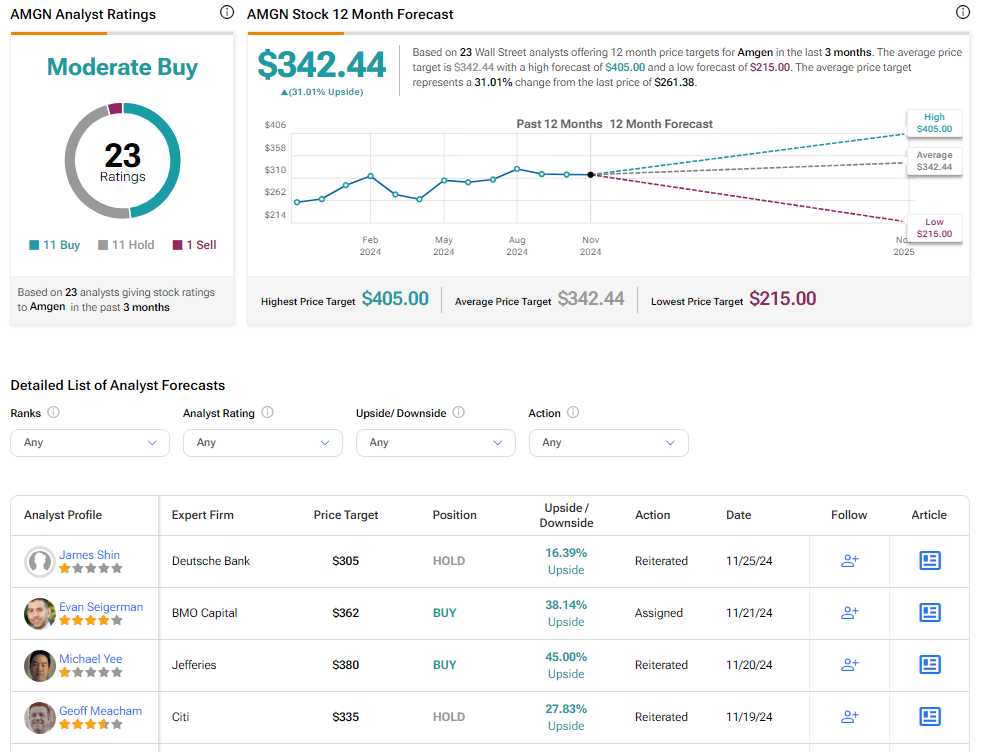

Shin maintains a Hold rating on AMGN with a price target of $305, which suggests an upside potential of 16.4% from current levels.

Is AMGN Stock a Good Buy?

Analysts remain cautiously optimistic about AMGN stock, assigning it a Moderate Buy consensus rating based on 11 Buy ratings, 11 Hold ratings, and one Sell. AMGN has increased by more than 2%, and the average AMGN price target of $342.44 implies an upside potential of 31% from current levels.