Biotech stock Novavax, Inc. (NASDAQ: NVAX) has posted a wider-than-expected loss for the fourth quarter of 2021. Also, the company reported disappointing revenues for the quarter.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company fell 7% in the extended trading session on Monday.

Results in Detail

Novavax recorded a loss of $11.18 per share, significantly higher than the Street’s estimated loss of $0.55 per share. The company reported a loss of $2.70 per share in the prior-year quarter.

Total revenue generated in the quarter stood at $222.2 million, down 20.6% year-over-year, and missed the consensus estimate of $442.77 million by a wide margin.

Remarkably, royalties and other revenue increased significantly to $127.2 million, primarily due to protein-based COVID-19 vaccine (NVX-CoV2373) sales to South Korea and Indonesia.

General and administrative expenses grew 37.7% to $84 million, while research and development (R&D) expenses more than doubled to $963 million on the back of the development and manufacturing of NVX-CoV2373.

For 2021, Novavax reported a loss of $23.44 per share, compared with the loss of $7.27 per share reported in 2020. Total revenue came in at $1.15 billion, significantly up from $475.6 million in 2020.

As of December 31, 2021, Novavax had $1.5 billion in cash, cash equivalents, marketable securities, and restricted cash, compared with $0.8 billion as of December 31, 2020.

Outlook

Providing vaccine updates, Novavax CEO Stanley C. Erck said, “NVX-CoV2373 has now received regulatory authorizations globally, representing the potential to reach more than six billion lives. We are now delivering our vaccine around the world, with immunizations already happening in the European Union, Asia and Australia to meet the continued need to achieve high vaccination rates through primary immunization, boosting and protection of pediatric age groups.”

“We also remain focused on expanding access to our vaccine through additional regulatory filings and ongoing research to add to our robust body of clinical data. We are confident in NVX-CoV2373’s potential as a vital vaccine option due to its reassuring safety profile and demonstrated efficacy against variants with the benefits of refrigerator-stable storage,” Erck added.

For 2022, the company expects revenue in the range of $4 billion to $5 billion.

Other Developments

In a separate release, Novavax announced that its pivotal Phase 3 clinical trial that was conducted in the United Kingdom demonstrated high efficacy for NVX-CoV2373 over a period of six months. Additionally, the data showed vaccine efficacy of 82.5% in protection against all COVID-19 infections.

Analysts’ Recommendations

Consensus among analysts is a Strong Buy based on 5 Buys versus 1 Hold. The average Novavax price target of $215 implies 157.89% upside potential. However, shares have lost 65.3% over the past year.

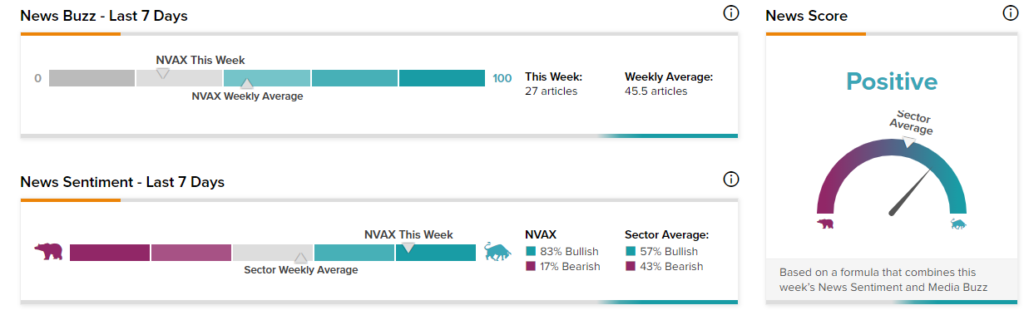

News Sentiment

News Sentiment for Novavax is currently Positive, based on 27 articles over the past seven days. 83% of the articles on NVAX have a Bullish sentiment, compared to a sector average of 57%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Biohaven & Pfizer Bags CHMP Positive Recommendation for Rimegepant

Zendesk Terminates Merger Deal with Momentive

Zscaler Plunges 15% Despite Q2 Beat