Needham analyst Quinn Bolton views Super Micro Computer (SMCI) as a major beneficiary of liquid cooling infrastructure systems. The five-star analyst was impressed by SMCI’s presentations at the 2024 Open Compute Summit last week and shared his thoughts in a research note on October 21.

Bolton has a Buy view on SMCI stock with a price target of $60, implying 32.3% upside potential from current levels. Super Micro Computer designs and manufactures servers and data center equipment such as cooling systems.

Below are the three brief takeaways from Bolton:

Higher Cooling Requirements as Server Racks Get Denser – Bolton noted that the common view across the conference was that there would be an exponential increase in the number of server racks required in data center infrastructure. These racks are set to get denser from 120kw racks to 250kw racks and eventually 400kw to 500kw racks over the next few years. Accordingly, there will be a higher need for direct liquid cooling (DLC) technology to cool these racks.

Ease of Installation and Compatibility will be the Decisive Factor – The analyst also spoke with a few Taiwanese ODM (original design manufacturers) suppliers about the continuous use of traditional air-cooling infrastructure for data center customers. The ODMs believe that customers will continue using the air cooling infra until they reach a certain power threshold. Moreover, the data centers need to reconfigure their layout to install the liquid cooling systems. This simply implies that a certain number of customers will still continue to use air cooling systems for their data centers owing to ease of installation and compatibility.

SMCI Offers Both Technologies, Making it a Vital Player – Importantly, Bolton noted that SMCI offers both DLC and immersion/air cooling technology, meaning that the AI major is ready to shift gears full-time toward DLC once the immersion cooling becomes obsolete. At the same time, it will continue to cater to the requirements of smaller players who depend on air cooling infrastructure. SMCI has already shipped more than 100,000 GPUs (graphics processing units) with DLC, Bolton noted. SMCI is well positioned to leverage the changing trend in cooling technology, the analyst concluded.

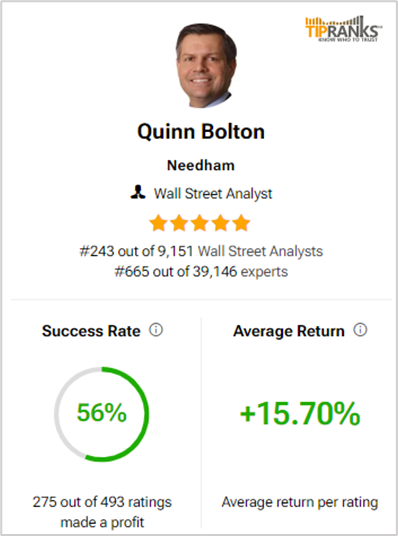

Bolton Boasts a Superb Track Record

Quinn Bolton ranks #243 out of the 9,151 analysts ranked on TipRanks’ Star Ranking system. The five-star analyst boasts a success rate of 56% alongside an average return per rating of 15.70% in the past year.

Is SMCI a Good Buy Now?

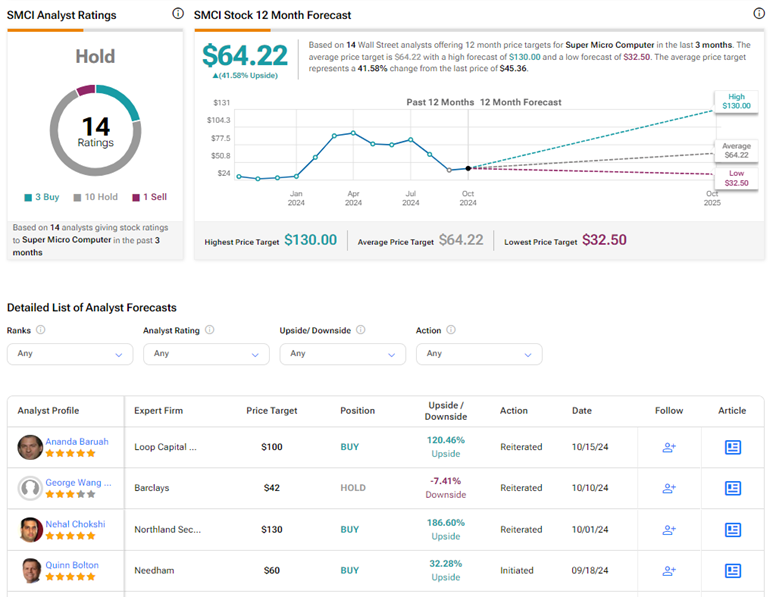

Unfortunately, SMCI shares have been losing steam lately, particularly after missing Q4 FY24 earnings estimates. Analysts have grown skeptical as the Q1 FY25 results approach on October 29 and prefer to remain on the sidelines for now.

On TipRanks, SMCI stock has a Hold consensus rating based on three Buys, ten Holds, and one Sell rating. Also, the average Super Micro Computer price target of $64.22 implies 41.6% upside potential from current levels. Year-to-date, SMCI stock has gained 56.5%.