Super Micro Computer’s (NASDAQ:SMCI) rapid shift from an AI darling to a market pariah demonstrates just how swiftly sentiment can change on Wall Street.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Over the two years leading up to March 2024, shares of the AI server maker skyrocketed by more than 2800% as they rode the AI wave. Just as intriguing, however, the stock has since retreated by 79%.

The losses have been particularly acute recently, as the company has had to deal with the fallout of auditor Ernst & Young quitting after the company failed to file its 10-K on time while it also faces delisting from the NASDAQ.

Of course, savvy investors will know that such a big drop often presents an opportunity for those willing to shoulder the risk. But is it worth the gamble here?

Nope, is the blunt answer from J.P. Morgan’s Samik Chatterjee, who thinks investors should bail out while they can.

“We are downgrading shares of Super Micro to an Underweight (i.e., Sell) rating from Neutral, due to several risk factors that introduce uncertainty around regulatory filings and business fundamentals,” stated Chatterjee, a 5-star analyst ranked among the top 3% of Wall Street stock experts. (To watch Chatterjee’s track record, click here)

So, what exactly are these “several risk factors”? Well, for one, the company has chosen not to offer additional details regarding the issues that caused the disagreement with the previous auditor (E&Y). Secondly, there have only been “limited commitments” from management regarding leadership changes to address investor concerns about the company’s discipline in financial reporting and “consistency of execution to the guidance outlined to the investment community.” At the same time, a lack of details around the timing of the appointment of a new auditor creates uncertainty about when the company will regain compliance with SEC filing requirements.

Less to do with any auditing issues, but more pertaining to the actual business, an “air pocket” in demand for Nvidia’s Hopper-based server systems, as customers wait for the next-generation Blackwell GPUs, suggests a higher probability of “aggressive pricing and margin pressure” in an industry that over the short term is “volume challenged.” Furthermore, the 5-star analyst highlights reduced visibility regarding the company’s ability to get back to the long-term gross margin range of 14%-17%, due to the “erosion of Super Micro’s leadership in AI server capabilities,” which is partly driven by the delay of the next-generation GPUs.

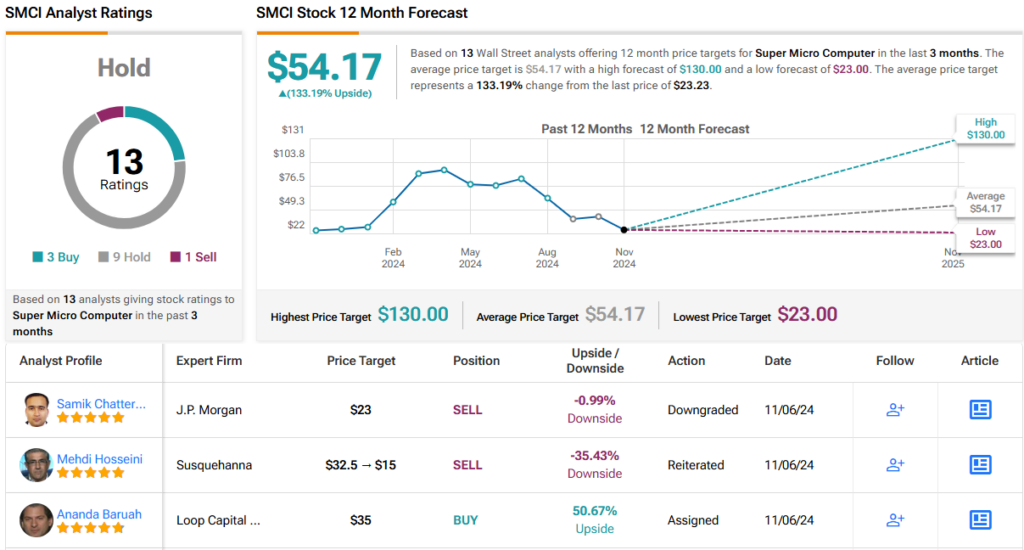

So, that’s the JPM view on SMCI’s prospects, but what does the rest of the Street think? Based on a total of 9 Holds, 3 Buys and 1 Sell, the stock claims a Hold consensus rating. However, some still appear highly optimistic given the $54.17 average price target suggests the shares will gain 133% over the next 12 months. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.