Shares of Morgan Stanley (MS) are up 7% and near an all-time high after the U.S. investment bank reported third-quarter financial results that far exceeded consensus forecasts.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Heading into the market’s close, MS stock was trading right around $120 per share, near its all-time high of $121.45. The 7% post-earnings rally brings Morgan Stanley’s gain for the year to 32%. The bank’s stock has steadily risen since early August along with shares of the U.S. financial services sector.

However, the catalyst for the latest move higher in MS stock was the investment bank’s Q3 financial results, which showed strong growth across several business segments and trounced the forecasts of analysts on Wall Street.

A Recovery in Wall Street Deals

The New York-based bank reported strong financial results for Q3, driven by growth in its wealth management division and stock trading. Wealth management revenue came in at $7.27 billion, up 14% from a year earlier. Institutional securities, which includes stock trading, reported revenue of $6.82 billion, up 20% from a year ago.

Management at Morgan Stanley said the investment bank also got a boost from investment banking as deals on Wall Street continue to recover. Morgan Stanley’s investment banking revenue rose 56% in Q3. The bank said that it expects mergers and acquisitions (M&A) and initial public offerings (IPOs) to continue rising in coming months as lower interest rates encourage deal making.

Is MS Stock a Buy?

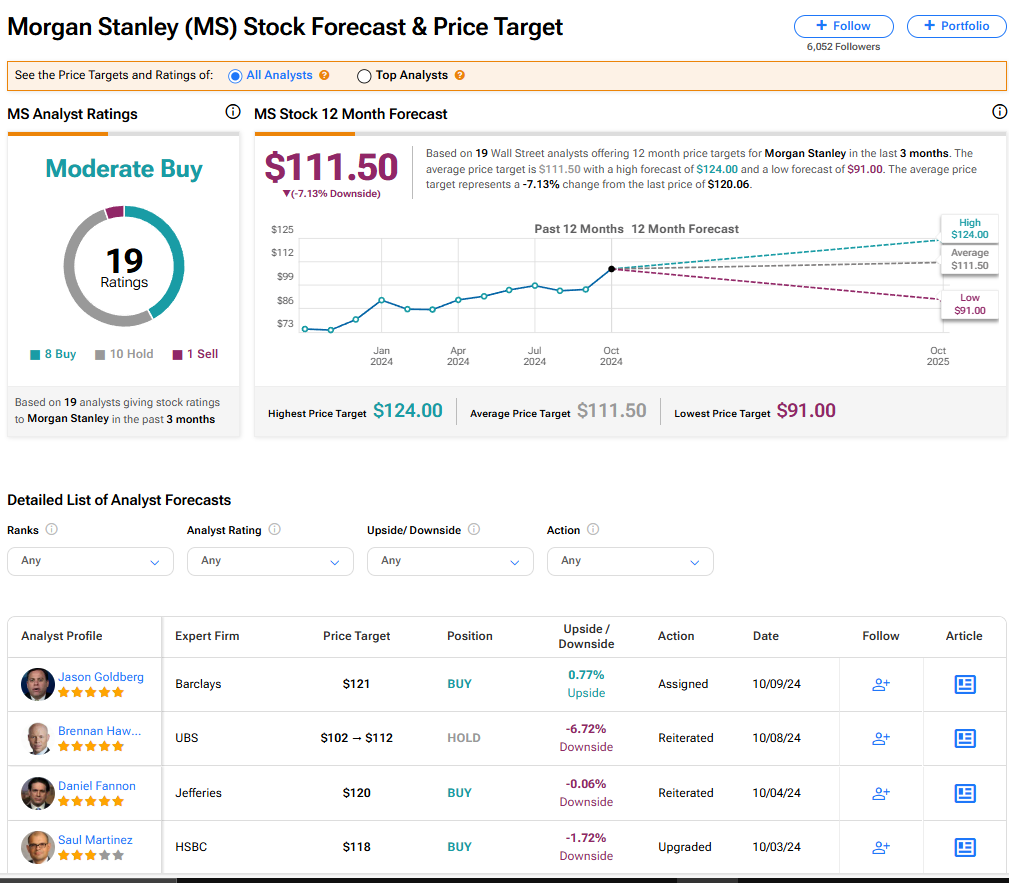

Morgan Stanley stock has a consensus Moderate Buy rating among 19 Wall Street analysts. That rating is based on eight Buy, 10 Hold, and one Sell recommendations issued in the last three months. The average MS price target of $111.50 implies 7.13% downside risk from current levels.