Gap Inc (GAP) released its Q3 earnings report yesterday, and shares have been rising since then, along with analyst sentiment. The fashion retailer, which owns popular brands such as Banana Republic, Old Navy, and Athleta, reported its fourth consecutive growth quarter and raised its full-year outlook for net sales, gross margin, and operating income. This sets the company up to end 2024 on a high note, especially as the U.S. economy enters the holiday shopping season.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with Gap Stock?

Gap stock rose all day after a slight dip at the open today. Shares closed out trading up 12.84% for the day and 15% for the past week. Despite reporting consistent growth over the past two quarters, GAP stock has been fairly volatile. That is due mostly to unfavorable market conditions, though, which Gap has managed to overcome, rising 20% over the past six months.

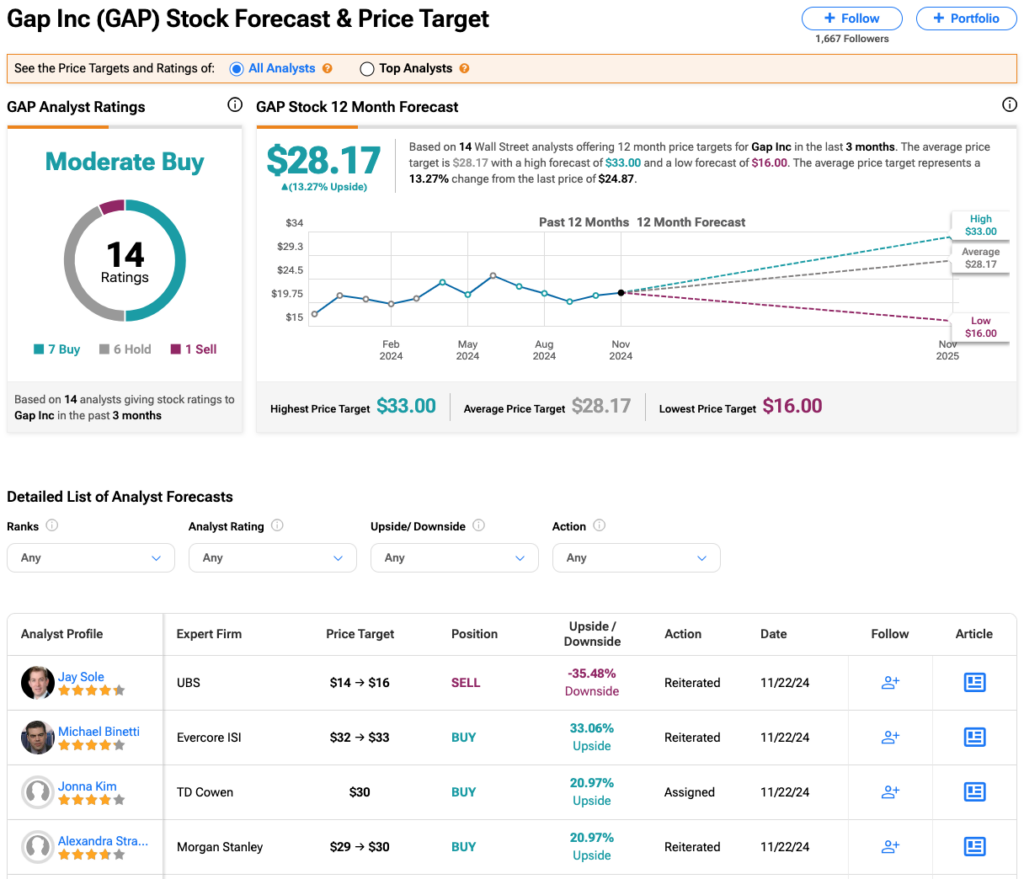

As the market reacts to Gap’s earnings, analysts have issued mostly positive takes on the stock. Michael Binetti of Evercore ISI increased his price target from $32 to $33 per share, implying 33% upside potential. Alexandra Straton of Morgan Stanley (MS) raised hers from $29 to $30, implying an upside potential of 21%. Both analysts maintain Buy ratings on GAP stock.

Other analysts rate it as a Hold but have also increased their price targets. Lorraine Hutchinson of BofA Securities raised hers from $25 to $28, and Matthew Boss of JPMorgan (JPM) increased his from $26 to $28, implying upside potential of 13%. And although UBS (UBS) analyst Jay Sole calls GAP a Sell, he increased his price target from $14 to $16.

Is GAP Stock a Buy, Sell, or Hold?

Overall, analysts have a Moderate Buy consensus rating on GAP stock based on seven Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 35% rally in its share price over the past year, the average GAP price target of $28.17 per share implies 13% upside potential.