Bitcoin (BTC-USD) miner Marathon Digital (MARA) disclosed plans to raise $250 million through a private offering of convertible senior notes. The company intends to use the proceeds to increase its bitcoin holdings. However, MARA stock declined over 11% on Monday, reflecting investors’ concerns about the dilution effect of this issuance on existing shareholders’ value.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The convertible notes, which will mature in 2031, will be offered to institutional investors. The buyers will have the option to convert their holdings into cash, Marathon’s common stock, or a combination of both.

It’s worth noting that last month, Marathon Digital acquired $100 million worth of bitcoin, bringing the company’s total holding to over 20,800 bitcoins, valued at about $1.28 billion.

Rising Trend in Bitcoin Holdings

This move aligns with a growing industry trend, as other companies like MicroStrategy (MSTR) and Tesla (TSLA) have also been increasing their holdings of the cryptocurrency.

Interestingly, MARA and other mining companies have ramped up their bitcoin accumulation efforts after the crypto industry’s downturn in 2022. Furthermore, the halving event in April, which reduced the reward for mining new bitcoin, has led miners to focus more on accumulating bitcoin rather than selling it.

Is MARA a Good Stock to Buy?

The company aims to enhance its financial position by capitalizing on the potential gains from cryptocurrency. However, weaker-than-expected Q2 results have kept analysts sidelined on the stock.

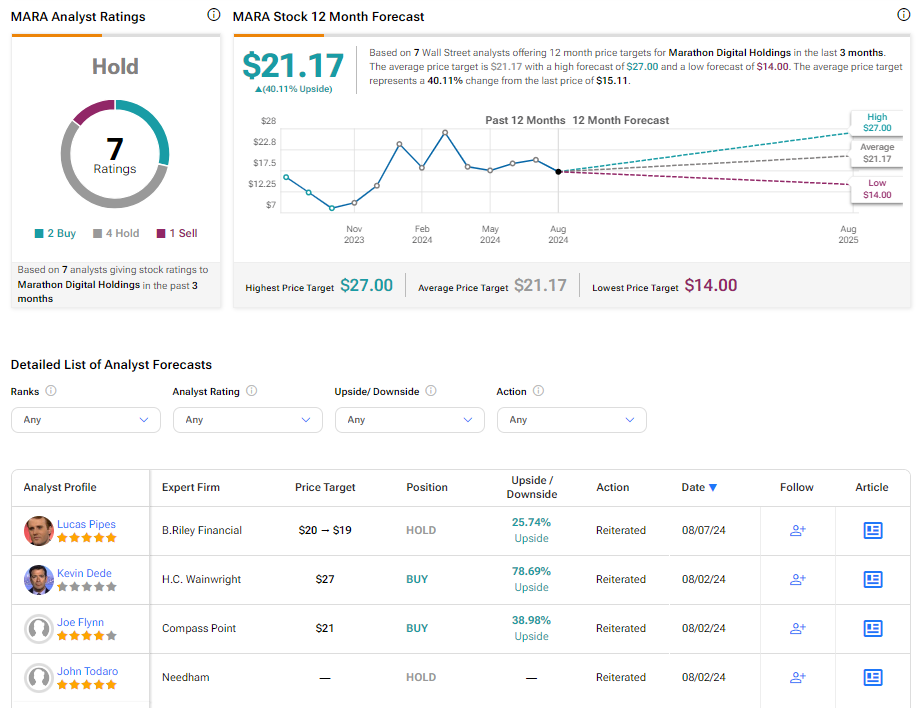

On TipRanks, MARA has a Hold consensus rating based on two Buys, four Holds, and one Sell rating assigned by analysts in the past three months. The analysts’ average price target on Marathon Digital stock of $21.17 implies 40.1% upside potential.