Last month’s surge in MicroStrategy (MSTR) shares created headaches for Matt Tuttle, who runs the T-Rex 2X Long MSTR Daily Target ETF (MSTU). According to Bloomberg, the fund, which is designed to offer twice the return of MicroStrategy’s volatile stock, hit limits with its prime brokers, who could not provide enough swap exposure due to the stock’s wild swings. With just $20 million of the $100 million exposure needed, Tuttle turned to buying call options to keep the fund running.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

When commenting on the unique challenges related to MicroStrategy, Tuttle said, “If this was Procter & Gamble, I’d get all the swap exposure I want.” In addition, a rival fund, the Defiance Daily Target 2X Long MSTR ETF (MSTX), faced similar issues. It also started using options to maintain its leverage targets. The main issue with MSTR stock appears to be its wild price swings. Indeed, the stock dropped 22% yesterday after short-seller Citron Research targeted the stock, only to rally 12% at the time of writing.

This kind of volatility forces market-makers and prime brokers to re-evaluate risk limits and raise margin requirements, which leads to the issues mentioned above. Nevertheless, both funds have thrived despite these hurdles thanks to MSTR’s massive year-to-date rally. In fact, the combined assets for the two ETFs are now worth nearly $4 billion.

Why Are Leveraged ETFs Popular?

Single-stock leveraged ETFs like the ones mentioned are popular because they draw in retail investors who are chasing quick profits despite warnings about their risks. This is especially true for those who are bullish on Bitcoin.

The cryptocurrency itself is very volatile, and MicroStrategy is already viewed as a leveraged bet on Bitcoin. When you combine those two factors together and then add even more leverage through an ETF that doesn’t impact margin requirements, it is easy to see why aggressive investors would find these products attractive.

Is MSTR a Good Stock to Buy?

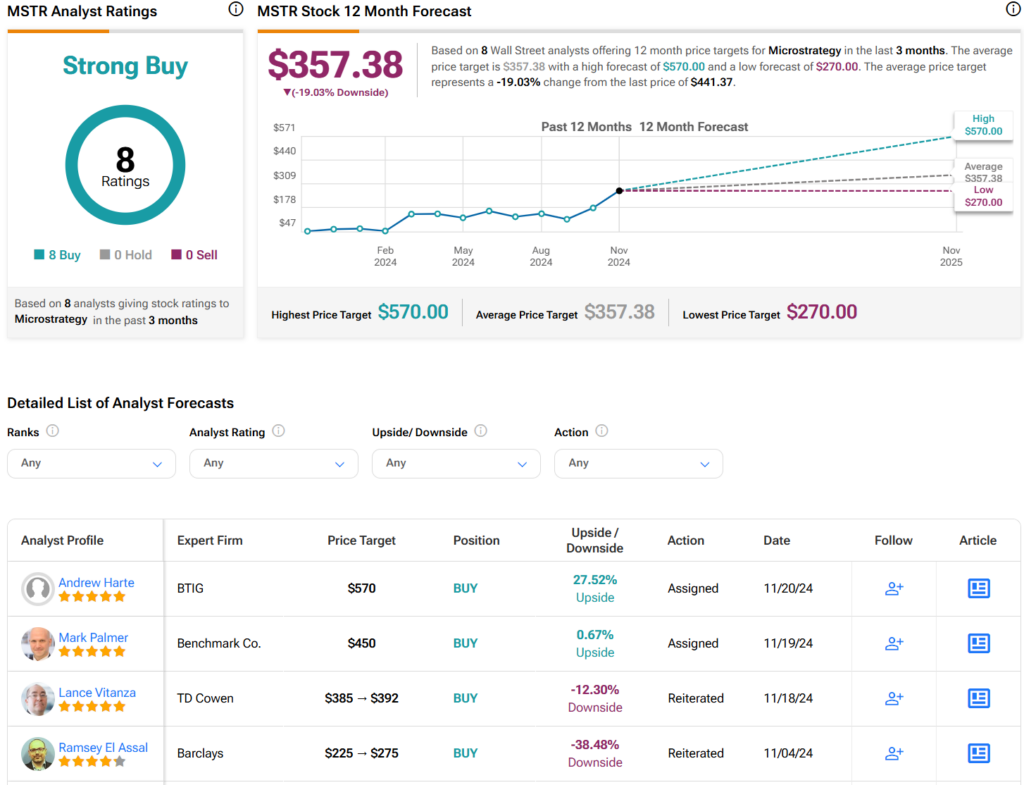

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on eight Buys assigned in the past three months, as indicated by the graphic below. However, after a 604% surge in its share price on a year-to-date basis, the average MSTR price target of $357.38 per share implies 19% downside risk.