California-based Workday (WDAY) provides cloud-based software applications for finance and human resources management. It has a global footprint and counts more than half of the Fortune 500 companies as its customers.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, the company reported a 21.6% year-over-year jump in revenue to $1.38 billion and surpassed the consensus estimate of $1.36 billion. Adjusted EPS of $0.78 rose from $0.73 in the same quarter the previous year and beat the consensus estimate of $0.71.

With this in mind, we used TipRanks to take a look at the risk factors for Workday.

Risk Factors

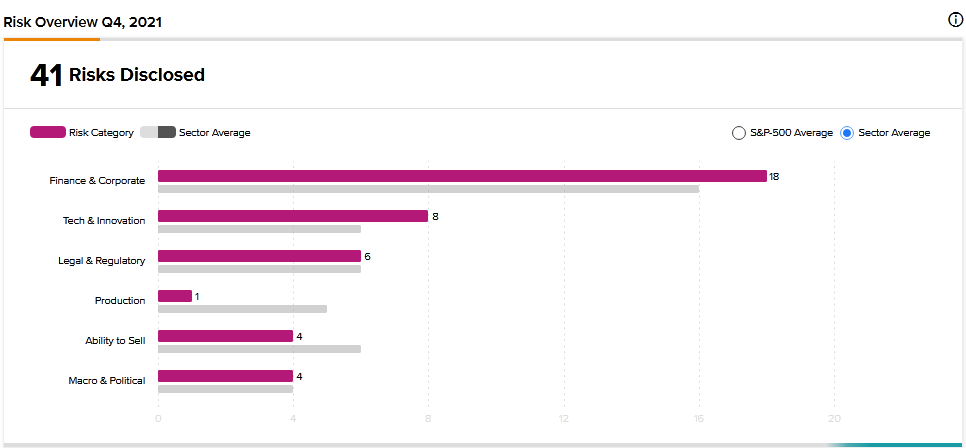

According to the new TipRanks Risk Factors tool, Workday’s top risk category is Finance and Corporate, with 18 of the total 41 risks identified for the stock. Tech and Innovation and Legal and Regulatory are the next two major risk categories with 8 and 6 risks, respectively. The company recently updated its profile with two new risk factors.

In a newly added Legal and Regulatory risk factor, Workday informs investors that it is subject to a variety of legal issues in the course of its business. It mentions regulatory probes, labor disputes, tax claims, and lawsuits related to intellectual property.

The company cautions that an adverse outcome from such issues could harm its business and financial condition. It explains that it could be required to change its business practices or stop offering certain products. Additionally, Workday could face significant monetary damage and reputational harm.

In a newly added Macro and Political risk factor, Workday tells investors that it is exposed to various climate-related risks. It explains that its facilities, including corporate headquarters and data centers, are located in regions prone to earthquakes and extreme weather conditions. Its operations also rely on third-party infrastructure, which could be damaged by natural disasters. Therefore, the company warns that it may be unable to operate normally if the infrastructure that it relies on gets damaged by climate-related events or other factors. Such an event could result in the loss of business and damage to the company’s reputation.

Workday tells investors in an updated Finance and Corporate risk factor that its co-founders David Duffield and Aneel Bhusri control the majority of the voting shares in the company. The problem with that is that the founders are entitled to vote in their own interests, which may not align with the interest of other shareholders.

Analysts’ Take

Wells Fargo analyst Michael Turrin recently reiterated a Buy rating on Workday stock and raised the price target to $340 from $325. Turrin’s new price target suggests 38.57% upside potential.

Consensus among analysts is a Strong Buy based on 19 Buys. The average Workday price target of $311.32 implies 26.88% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

SNC-Lavalin Posts Higher-Than-Expected Q4 Loss

High Tide Buys Crossroads Cannabis for C$2.5M

Crescent Point Energy Swings to Profit in Q4