Johnson & Johnson (JNJ) is an American multinational healthcare products company. It makes pharmaceutical products, medical devices, and consumer packaged goods such as baby care, beauty, and women’s health products. Its pharmaceutical unit focuses on therapeutic areas such as oncology, immunology, cardiovascular, and vaccines, including the COVID-19 vaccine.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, the company reported a 10% rise in revenue to $24.8 billion but fell short of the consensus estimate of $25.3 billion. It posted adjusted EPS of $2.13, which rose from $1.86 in the same quarter the previous year and beat the consensus estimate of $2.12.

The company plans to distribute a quarterly dividend of $1.06 per share on March 8. JNJ stock currently offers a dividend yield of 2.55%, compared to the sector average of 1.37%.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Johnson & Johnson.

Risk Factors

According to the new TipRanks Risk Factors tool, Johnson & Johnson’s top risk category is Legal and Regulatory, with 7 of the total 22 risks identified for the stock. Production and Finance and Corporate are the next two major risk categories with 5 and 3 risks, respectively. The company has recently updated its profile with six new risk factors.

In November 2021, JNJ announced a plan to spin off its consumer health business into a standalone public company. It intends for it to be a tax-free transaction. Johnson aims to complete the transaction in 18 to 24 months. But it cautions that the transaction may not be completed on the expected terms or timeline. Moreover, there is no guarantee that the anticipated benefits of the transaction will be achieved. For example, the company mentions that the spinoff may not qualify for the tax-free treatment as anticipated.

The company informs investors that it has a significant number of patents linked to its products and manufacturing processes. It owns some of those patents while others are licensed. The patents are critical to the company’s business and operating results. JNJ explains that the validity of its patents is routinely challenged by competitors. Moreover, the company says that the global public policy has increasingly become unfavorable to intellectual property rights. Therefore, JNJ warns that it could lose a significant portion of its revenue if it is unable to defend its patents.

Johnson and Johnson says it is subject to data privacy and protection laws around the globe. It cautions that a breach of such requirements could expose it to fines, penalties, and lawsuits. It also warns that a breach could adversely impact its research activities and business operations. Moreover, the company may suffer reputational damage if it falls short of privacy and data protection requirements.

Analysts’ Take

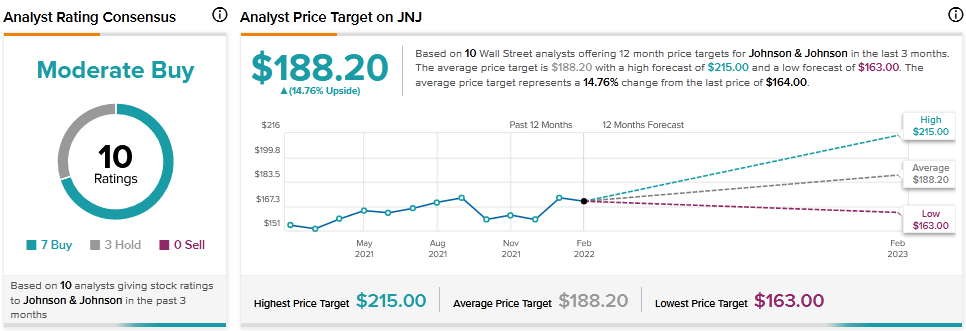

Societe Generale analyst Florent Cespedes recently reiterated a Hold rating on Johnson & Johnson stock and raised the price target to $177 from $173. Cespedes’ new price target suggests 7.93% upside potential.

Consensus among analysts is a Moderate Buy based on 7 Buys and 3 Holds. The average Johnson & Johnson price target of $188.20 implies 14.76% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Leidos Bags $11.5B Defense Enclave Services Contract; Shares Jump 3.6%

HP: Q1 Results Outperform, 2022 Guidance Upped

XPeng’s February Deliveries Rise 180% Y/Y; Shares Fall Pre-Market