Athletic apparel and accessories company Lululemon Athletica (NASDAQ:LULU) will release its Q1 financial results on Wednesday, June 5, 2024. The Wall Street analysts expect a moderation in its growth rate, reflecting competitive headwinds, macro challenges, and a lack of innovation.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

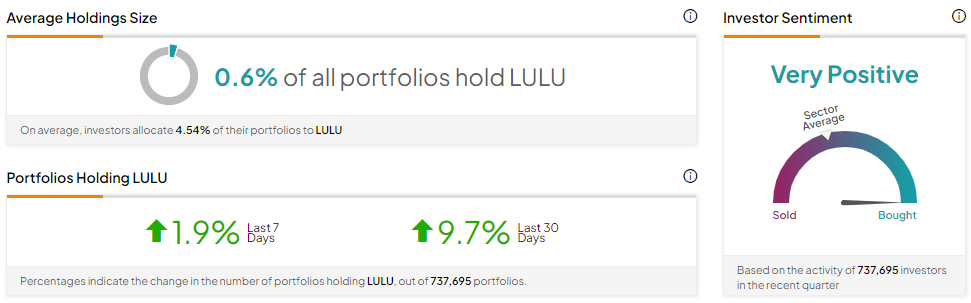

Lululemon stock is down over 40% given the challenges mentioned above. While LULU stock lost significant value, individual investors have a Very Positive view of the company ahead of earnings, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 9.7%.

With this background, let’s delve into analysts’ estimates for Q1.

LULU: Q1 Estimates

Analysts expect Lululemon to report sales of $2.20 billion in Q1, up 10% year-over-year. This represents a sequential slowdown in its top-line growth rate. For instance, Lululemon’s top line increased 16% year-over-year in the fourth quarter of 2023.

Goldman Sachs analyst Brooke Roach reiterated a Buy on Lululemon stock ahead of the Q1 print. However, the analyst lowered the sales and EPS estimates. Roach said that store traffic trends, promotions, and product innovation suggest a slow start to 2024. The analyst pointed out that promotional activity has increased at LULU to support volume growth. It’s worth noting that higher promotions could weigh on its margins and EPS.

Analysts expect Lululemon to report earnings of $2.40 per share, up about 5.3% year-over-year. This represents a significant slowdown in growth rate compared to Q4, where its EPS increased by about 20%. Nonetheless, TipRanks’ earnings page shows that LULU has consistently surpassed the Street’s EPS expectations over the past several quarters.

Options Traders See a Large Move

Using TipRanks’ Options tool, we can observe traders’ expectations for the stock’s movement following its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. While this may seem complex, the Options tool simplifies the process. This indicates that options traders expect a significant 10.34% movement in either direction.

Is Lululemon Stock a Buy or Sell?

Wall Street analysts are cautiously optimistic about LULU stock ahead of earnings. 17 out of 22 analysts covering LULU stock recommend a Buy. Four have a Hold, and one analyst has a Sell rating. Overall, Lululemon stock has a Moderate Buy consensus rating.

Analysts’ average price target on LULU stock is $434.62, implying an upside potential of 41.75% from current levels.