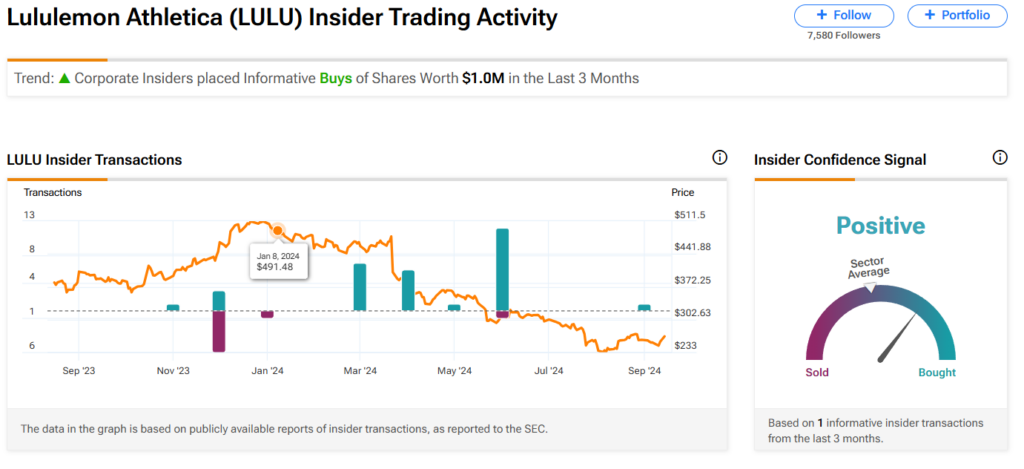

Lululemon Athletica (LULU) CEO Calvin McDonald is buying the dip in shares of the athletic apparel company that he runs. According to regulatory filings, McDonald just shelled out $1 million to purchase 4,000 shares of Lululemon stock at an average price of $260 each.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

McDonald’s latest insider stock purchase was made on Sept. 3 and brings his total holdings of company stock to 89,920 shares, worth $24 million, according to public filings made with the U.S. Securities and Exchange Commission (SEC). In addition to his role at Lululemon, McDonald also sits on the board of directors at the Walt Disney Company (DIS).

Buying the Dip in LULU Stock

McDonald’s purchase of Lululemon stock comes with the company’s share price down nearly 50% this year. The stock has fallen from an all-time high of $510 per share reached in December 2023. As a result, LULU stock is one of the worst-performing stocks in the benchmark S&P 500 index year-to-date. Only Walgreens Boots Alliance (WBA), Intel (INTC), and Dollar Tree (DLTR) have performed worse than Lululemon.

LULU stock has been trending downward as the company grapples with a host of problems that have hurt its financial results and forced it to lower its forward guidance. Issues impacting the company and its stock include slowing sales in the U.S., its biggest market, as well as a disastrous launch of new Breezethrough leggings. The Breezethrough product was launched in July of this year but was quickly pulled from Lululemon’s stores after customers complained about the legging’s unflattering fit.

Troubled Earnings from Lululemon

At the end of August, Lululemon, which is known for its yoga pants and other workout gear, issued mixed financial results for this year’s second quarter and lowered its forward guidance. Lululemon announced earnings per share (EPS) of $3.15, which beat consensus forecasts of $2.93. However, revenue of $2.37 billion fell short of analyst estimates that called for sales of $2.41 billion. It was the company’s first revenue miss in more than two years.

Management blamed the mixed results on North American sales that continue to slow. Comparable sales in the U.S. and Canada fell 3% during the quarter. Overall sales in the U.S. grew only 1%. Looking ahead, Lululemon said that it expects full-year revenue of $10.38 billion to $10.48 billion. That guidance is down from a previous estimate of $10.70 billion to $10.80 billion. Company executives also forecast earnings in a range of $13.95 to $14.15 a share for all of this year, down from a prior outlook of $14.27 to $14.47.

Is Lululemon’s Stock a Buy or Sell?

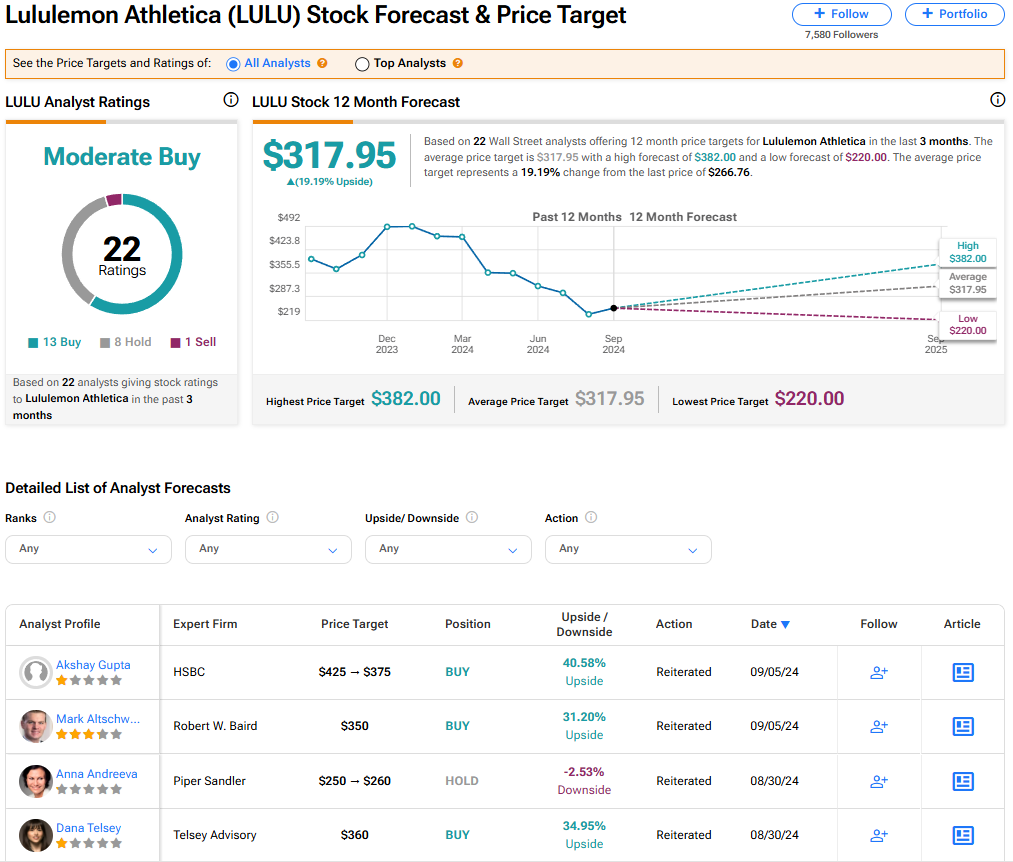

Wall Street analysts appear to share Lululemon CEO Calvin McDonald’s buy-the-dip sentiment. LULU stock currently has a Moderate Buy consensus rating among 22 analysts who track the company’s progress. The average price target on Lululemon stock of $317.95 implies nearly 20% upside from current levels.

Read more analyst ratings on LULU stock

Conclusion

Insider buying of company stock on the part of senior executives is often seen as a vote of confidence by analysts and investors. It also shows that management is committed to the company they are running and its future potential. Now appears to be an opportune time to buy LULU stock, with the share price effectively cut in half. The questions for investors are whether they think Lululemon’s share price has bottomed and if management can right the ship at the company.