Advanced Micro Devices (NASDAQ:AMD) is often seen as the one company that might be able to rein in runaway AI leader Nvidia. Its latest strategic move further indicates it wants to be considered a serious contender.

Last week, AMD revealed its agreement to acquire ZT Systems, a private company, in a deal valued at $4.9 billion, consisting of both cash and stock.

ZT Systems is a leading supplier of AI infrastructure systems to major hyperscalers worldwide. AMD emphasized that the addition of ZT’s 1,000 engineers will significantly bolster its silicon and software capabilities, particularly in systems-level design – a critical area as AI clusters and rack-scale solutions continue to expand in both size and complexity. AMD also highlighted its commitment to providing custom solutions tailored to the needs of hyperscale customers, rather than offering one-size-fits-all proprietary options. As part of this strategy, AMD plans to maintain its partnerships with OEM and ODM collaborators and intends to divest ZT’s manufacturing operations once the acquisition is finalized.

Stifel analyst Ruben Roy, ranked among the top 3% of Wall Street stock experts, shed light on AMD’s strategy, stating: “Given the increasing complexity of AI compute, we believe that the primary strategy underpinning the deal is AMD’s desire to have system/cluster designs in hand as silicon is brought up.”

“This makes even more sense to us given AMD’s recent update regarding expectations to accelerate the cadence of its GPU accelerator road-map. We believe that ZT Systems is amongst the largest white-box general-purpose server manufacturers in the world, which could, in our view, further enhance AMD’s CSP opportunities as head-node servers become increasingly important as cluster sizes increase,” Roy added.

The transaction is anticipated to conclude in the first half of next year, and AMD anticipates modest dilution in the first year following its close. However, by the end of 2025, the company expects the transaction to become accretive on a run-rate basis. Revenue is expected to be derived via services and support, along with increased GPU sales, which will compensate for the initial modest dilution.

Roy believes the substantial investment involved in the deal is worthwhile in the long term. “While the eventual purchase price for 1,000 engineers may appear expensive, we believe that AMD is likely positioning itself more competitively as system design complexities continue to accelerate in lock-step with time-to-market demands,” the 5-star analyst summed up.

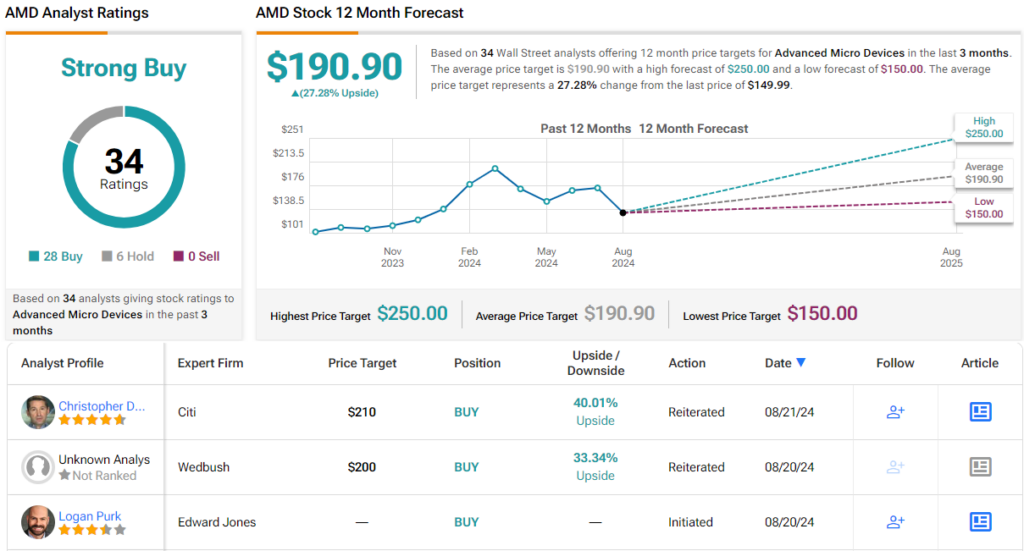

All in all, Roy rates AMD shares a Buy, while his $200 price target implies a potential upside of 32% from current levels. (To watch Roy’s track record, click here)

AMD gets plenty of support from elsewhere on the Street. With an additional 23 Buy recommendations and 6 Holds, the stock claims a Strong Buy consensus rating. The forecast calls for one-year returns of 22%, considering the average price target stands at $189.48. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.