Intel (INTC) has been through a lot since posting its second-quarter earnings report, which sent the stock on a volatile ride, acting like it’s having a spasm. The stock’s Beta of 1.93 can tell us something about the rollercoaster ride the company, its employees, and its shareholders have been experiencing lately. It can be emotionally draining for everyone involved and even affect its tactics. For instance, Intel’s efforts to cut costs by every means necessary have led to some questionable decisions, some of which might look impulsive. Just look at the whole “coffee and the rental cars debacle.”

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Alongside its coffee reduction, INTC also plans to shut down some of its past acquisitions, such as Granulate, a cloud optimization company that it bought for $650 million in 2022. This ongoing saga doesn’t look like it will end soon, and the company will face takeover or merger attempts soon.

In the meantime, INTC posted mixed-bag, although generally positive, results in its latest earnings report, which took place on October 31st. The company reported revenue of $13.3 billion, down 6% from the same quarter last year. The gross margin took a hit, dropping to 15% from 42.5% in Q3 2023. This decline was mainly due to restructuring and impairment charges totaling $15.9 billion. However, the company did give an optimistic outlook for the fourth quarter, expecting revenue to fall between $13.3 billion and $14.3 billion, with a non-GAAP EPS of $0.12. Nevertheless, the company aspires to enhance its foundry initiative and elevate its future margins.

As before, we’ll try to recap some of Intel’s latest developments into three talking points, as if it were a TV show from the ’80s. So. “Previously on INTC… ”

- Delayed CHIPS Act: Intel has been awaiting the financial boost promised by the CHIPS Act, which aimed to support its U.S. semiconductor manufacturers. The anticipated funds have yet to arrive despite the company splashing around $30 billion into its fabrication operations. This delay has forced Intel into aggressive cost-cutting measures. CEO Pat Gelsinger has voiced his frustration, stressing the urgency of receiving these critical funds.

- Market Challenges: Big competitors like Nvidia (NVDA) and AMD (AMD) are challenging Intel’s dominance in the data center market. Once a leader, Intel finds itself lagging, particularly as AMD’s EPYC processors gain popularity over Intel’s Xeon processors due to their lower price. Despite suggestions to increase production of its Granite Rapids processors, Intel has yet to take action, meaning they’re losing ground in the chipset sector.

- Strategic Moves: Amid these challenges, Intel has caught the eye of potential investors and buyers. Reports indicate that Silver Lake and Bain Capital are preparing bids for Intel’s minority stake in Altera, which could help recoup some of its past investments. Additionally, there are discussions in Washington about further government assistance, possibly even a bailout, due to Intel’s strategic importance to the U.S. supply chain. Potential mergers with companies like AMD or Marvell Technology (MRVL) are also on the table, which could allow Intel to focus more on its core manufacturing business.

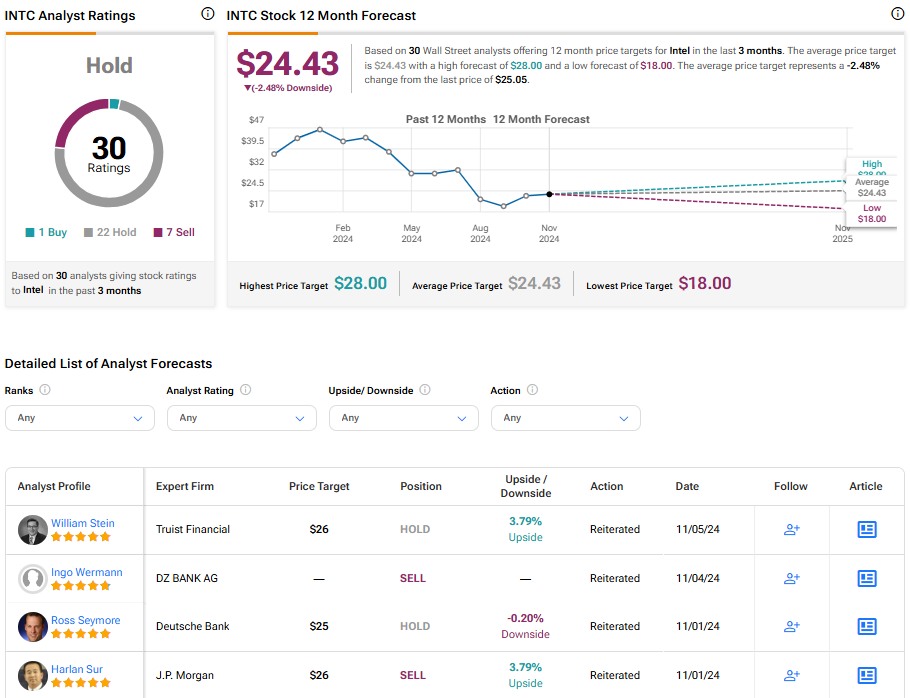

INTC’s Price Target on Wall Street

On Wall Street, INTC stock is a Hold, with one analyst declaring it a Buy, 22 a Hold, and 7 Sell. The average price target for INTC stock is $24.43, signaling a downside of -2.48%.

To be Continue

The ongoing saga of Intel is set to continue. Still, there are positive signs for recovery, as the company is cutting operational costs and even shutting down a whole operation like Granolate to save money. Recently, it posted growing revenue, and the immediate possibility of huge cash inflow, thanks to the CHIPS Act or from outside investors, is very much a real prospect. It seems that the company’s fortunes could go either way, but be sure we’ll be here to keep you posted.