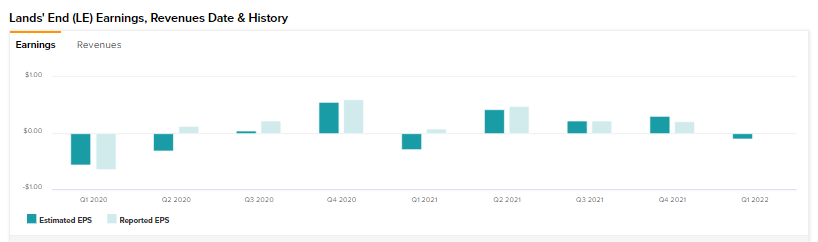

American lifestyle brand Land’s End, Inc. (LE) posted a better than expected bottom line for the first quarter. While revenue dropped 5.5% year-over-year to $303.7 million, net loss per share came in. This came in narrower than estimates by $0.03. Shares of the company gained nearly 13% on the opening bell in response.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The drop in revenue was primarily attributable to a 15.7% decline in global eCommerce net revenue. Its net revenue from Outfitters and third parties, on the other hand increased by 32.6% and 83.3%, respectively, due to robust demand.

LE’s gross margin was also reduced to 42.5% from 46% a year ago. Although selling, general and administrative (SG&A) expenses were lower by $9.8 million, LE incurred a net loss of $2.4 million. In comparison, it had generated a net income of $2.6 million a year ago.

Management Weighs In

CEO of Land’s End, Jerome Griffith, commented, “Despite revenue pressure from global supply chain issues and the impact of inflation on the consumer, we achieved our profit expectations. We continued to successfully execute on our strategic initiatives and are encouraged by the performance of our Outfitters business, which increased 33%, and by our expanding Third Party business, which increased 83%.”

For the rest of the year, LE expects supply chain delays and higher inflation to impact its business. Fiscal 2022 net revenue is expected to be between $1.62 billion and $1.68 billion. Diluted earnings per share (EPS) are expected to be between $0.60 and $0.88. Furthermore, LE expects gross margin improvement in the second half of 2022 as “higher supply chain costs are lapped.”

Analyst’s Take

At the time of writing, Craig Hallum’s Alex Fuhrman decreased the stock’s rating to Hold while assigning the stock a price target of $15, which implies a potential upside of 25.84%. That’s after a 43.4% slide in the share price so far in 2022.

Hedge Funds Remain Positive

Despite this price underperformance, TipRanks data shows hedge fund confidence signal in Land’s End remains very positive based on the activities of three funds in the recent quarter. Hedge funds have increased their holdings in LE by 379,100 shares in the last quarter.

Closing Note

Although LE saw a drop in revenue, the lower than anticipated net loss per share has buoyed investor sentiment. Additionally, the expected margin improvement in H2 2022 should keep the long-term growth story of the company intact.

Read Disclosure