Supermarket chain Kroger (KR) has initiated a legal battle with the Federal Trade Commission (FTC) over the $24.6 billion acquisition of Albertsons (ACI). The court trial began on Monday, August 26, in Portland, Oregon, and is expected to last until September 13. Following the news, KR stock gained about 2% in yesterday’s regular trading session.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It is worth mentioning that the FTC filed a lawsuit in February 2023 to block the merger. The regulator argued that the deal would reduce competition in the grocery industry and lead to higher prices for consumers. Additionally, the FTC stated that the merger would make it harder for unions to negotiate better labor contracts.

Importantly, eight U.S. states joined the FTC’s efforts, while Colorado and Washington filed separate lawsuits to block the deal.

Kroger’s Defense Against the FTC’s Claim

Kroger argued that the FTC is ignoring the significant changes in the grocery industry. The company believes that traditional supermarkets must consolidate to compete with the increasing dominance of big-box stores and online giants like Walmart (WMT), Amazon (AMZN), and Costco (COST).

Kroger also contended that its plan to divest nearly 600 stores to C&S Wholesale Grocers, a wholesale grocery supply company, would create a strong competitor in the supermarket space. However, the FTC remains skeptical that C&S Wholesale can effectively compete with Kroger after the merger.

Is Kroger a Good Stock to Buy?

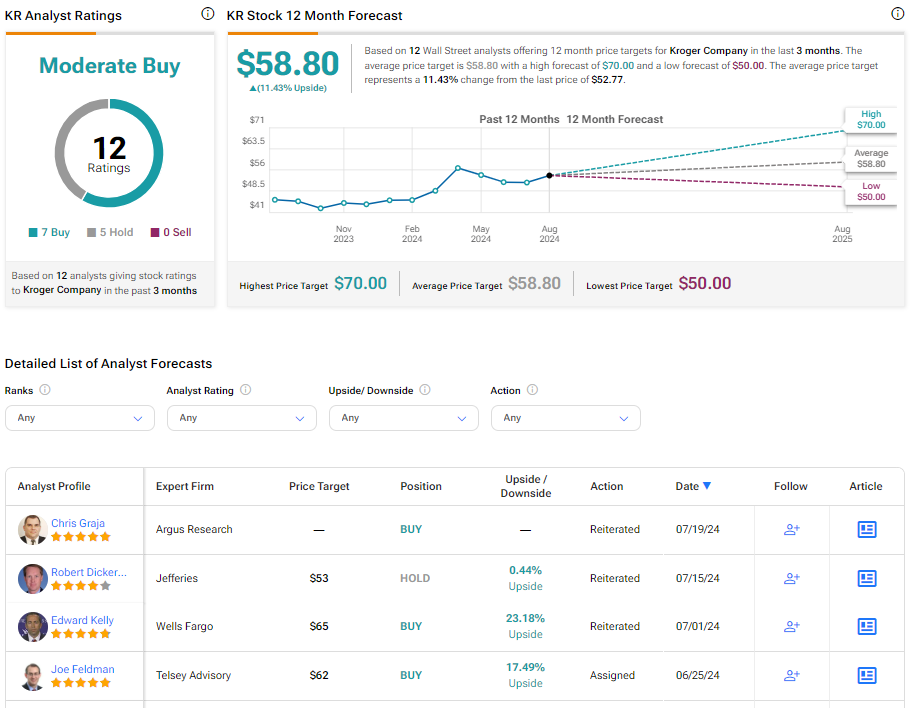

On TipRanks, KR has a Moderate Buy consensus rating based on seven Buy and five Hold ratings assigned by analysts in the past three months. The analysts’ average price target on Kroger stock of $58.80 implies 11.43% upside potential. Shares of the company have gained 10.4% in the past six months.