Amazon (AMZN) is making efforts to streamline its grocery delivery operations. According to the Wall Street Journal, the company aims to merge the fulfillment networks of its grocery stores, Whole Foods Market, and Amazon Fresh into a single platform. This initiative will help strengthen Amazon’s position in the competitive grocery market.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Importantly, AMZN seeks to create a one-stop shop for customers, allowing them to order groceries and other household items without the need to visit multiple stores. It is worth highlighting that the company has already started using 26 Amazon Fresh fulfillment centers to handle delivery orders for Whole Foods products and other household goods.

Additionally, the company plans to set up a micro fulfillment center within a Whole Foods store in Pennsylvania. This center will offer both Amazon Fresh and Whole Foods products, allowing for efficient order fulfillment and quicker delivery times.

AMZN Challenges Traditional Grocery Giants

By integrating the fulfillment networks, AMZN intends to enhance its online presence and better compete with traditional grocery retailers like Walmart (WMT), Target (TGT), and Kroger (KR). Amazon’s expansion into the grocery business has faced challenges due to the dominance of established retailers with vast store networks.

For instance, Walmart has about 4,600 stores across the U.S. and has rapidly expanded online grocery delivery and pickup services. Interestingly, WMT’s stores now serve as both shopping destinations and fulfillment centers, enabling the company to capture a wider customer base.

As Amazon continues to revamp its grocery strategy, it remains to be seen whether these initiatives will attract more shoppers and capture a larger share of the competitive grocery market.

Is AMZN a Good Stock to Buy?

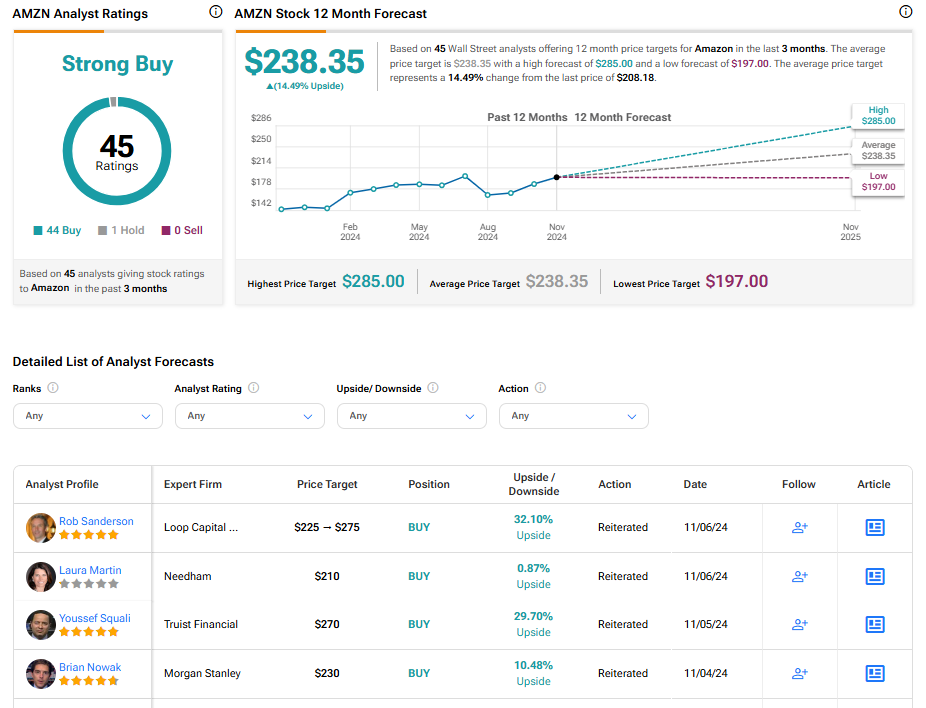

Turning to Wall Street, AMZN stock has a Strong Buy consensus rating based on 44 Buys and one Hold assigned in the last three months. At $238.35, the average Amazon price target implies a 14.49% upside potential. Shares of the company have gained 37% year-to-date.