The Kroger Company (KR) has agreed to settle the long pending opioid lawsuit with a $1.37 billion fine, without admitting to any wrongdoing or liability. Kroger and several other pharmacy companies were sued for selling pills without proper oversight, contributing to the opioid epidemic that killed over 564,000 people between 1999 to 2020.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As part of the agreement, the grocery store will pay equal installments of $1.2 billion over an 11-year period and $177 million over six years. The state of Nevada, which was one of the worst hit by the opioid crisis, will receive $26.7 million in installments beginning next year.

Details of Kroger’s Settlement of Opioid Claims

The lawsuit was filed by several states, counties, and Native American tribes that were affected by the epidemic. Of the settlement, $1.2 billion will go to states and local governments, $36 million to Native American tribes, and $177 million toward lawyer fees and expenses.

Moreover, Kroger agreed to injunctive relief that requires its pharmacies to observe, report, and share any questionable activity related to opioid prescriptions. The company recorded a one-time charge of $1.4 billion related to the lawsuit in the second quarter of Fiscal 2023. The extraordinary item had led to a loss of $1.54 per share in Q2 FY23.

Insights from TipRanks’ Bulls Say, Bears Say Tool

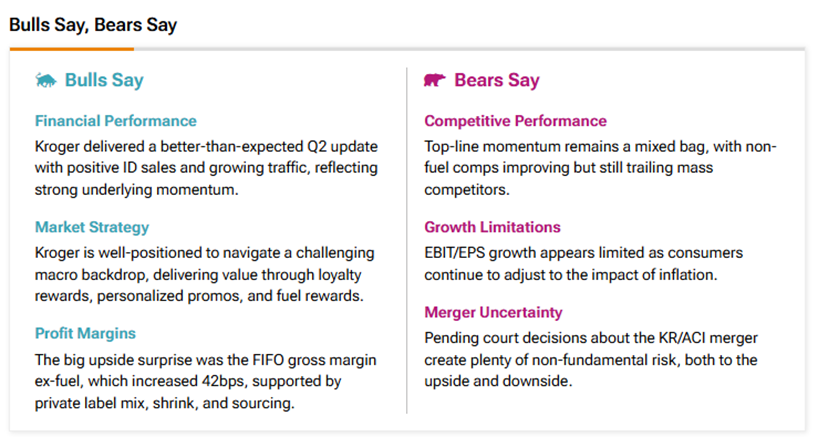

Kroger has been in the news for quite some time now owing to the opioid crisis and its much-awaited merger with peer Albertsons (ACI). According to TipRanks’ Bulls Say, Bears Say tool, analysts have varying views on Kroger.

Bulls are encouraged by Kroger’s solid Q2 FY24 print, increasing traffic in its stores, and improving FIFO (first-in, first-out) gross margin. Supporters also believe that Kroger has the ability to effectively navigate the ongoing macro challenges, aided by its loyalty rewards, promos, and fuel rewards.

On the other hand, bears are concerned about the top-line momentum, competition, limited bottom-line growth owing to ongoing inflation, and the pending court decision on the Kroger-Albertsons merger.

Is Kroger Stock a Good Buy Now?

Wall Street remains divided on Kroger stock, as can be seen from the differing views on the stock. On TipRanks, KR stock has a Moderate Buy consensus rating based on eight Buys versus five Hold ratings. The average Kroger Company price target of $60.27 implies 7.1% upside potential from current levels. Year-to-date, KR shares have gained 25.3%.