It’s getting harder to support electric vehicle maker Lucid Group (LCID), with its stock down 33% in the last 12 months. The share price has fallen 60% since the company went public via a special purpose acquisition company (SPAC) in 2021. And, at $3.81 per share, Lucid is now trading as a penny stock, defined as any security that changes hands at less than $5. With the company facing a long road to profitability and an increasingly competitive market, an investment in the automaker might be dead money. For these reasons, I am bearish on LCID stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Lucid Failed to Deliver on Early Promise

Ultimately, my negative outlook on Lucid is due to the company’s failure to deliver on its early potential. The U.S.-based electric vehicle maker was founded in 2007, and was touted as a potential “Tesla (TSLA) killer” early on. It received lots of attention from investors and the financial media, and was praised for its cutting-edge technology. The company’s fully electric vehicles boast impressive range and performance. However, despite innovative technology, sleek designs, and impressive battery range, the company has failed to deliver on its promise and is mostly known today for its production shortfalls.

In 2021, Lucid projected 49,000 vehicle deliveries for 2023, but in reality, it only managed to deliver 6,001 electric cars — a big miss on its ambitious target. Product launches have also faced delays, with the Lucid Gravity SUV, initially slated for late 2023, now pushed back to 2025. Unsurprisingly, Lucid has struggled financially. It has reported significant losses and has been forced to cut prices to stimulate demand.

Unlike competitors such as Tesla or BYD (BYDDF), Lucid has failed to establish an attractive price point for its vehicles or a strong brand. Consequently, it has not captured meaningful market share in the EV sector. All of these factors have increased investor skepticism and led to a declining share price.

Lucid’s Long Road to Profitability

Another reason for my bearish outlook on LCID stock is that the company continues to burn through cash at an alarming rate, raising concerns about its viability. And, the company’s initial projections for breakeven earnings by 2024 now appear to have been too optimistic. Consensus opinion suggests that Lucid won’t reach its breakeven point before 2027. In fact, the one analyst who provides forward earnings estimates on Lucid through 2030 doesn’t foresee profitability within the next six years.

In addition, recent production data from Lucid is not encouraging. In Q2 of this year, Lucid produced 2,110 vehicles, putting it on track for annual production of approximately 9,000 vehicles. This is far behind competitors such as Tesla, which now produces more than one million fully electric vehicles per year. Lucid needs to scale its production quickly if it ever hopes to achieve profitability.

Poor Market Share and Valuation

Another reason to be pessimistic about Lucid and its prospects is the fact that the company currently makes only one model of electric vehicle, called the “Air,” that is priced between $69,900 and $249,000. The Air faces tough competition not only from Tesla but also from legacy automakers with well-established brands, lower prices, and better reputations for quality. Lucid management has said they plan to produce lower-cost models. However, that looks to be years away, potentially putting Lucid behind the curve in the global electric vehicle market.

If there’s a silver lining to be found with Lucid, it is that the company’s cash on hand remains strong at $1.5 billion. However, the company’s cash is somewhat overshadowed by the high valuation of the stock. Despite the steady decline in its share price, LCID stock continues to trade at a high multiple of 13.6 times TTM sales, representing a premium to smaller peers such as Vinfast (VFS) at 6.7 times, Nio (NIO) at 1.2 times, and even fellow U.S. electric vehicle maker Rivian (RIVN) at 2.6 times.

Is Lucid Stock a Buy According to Analysts?

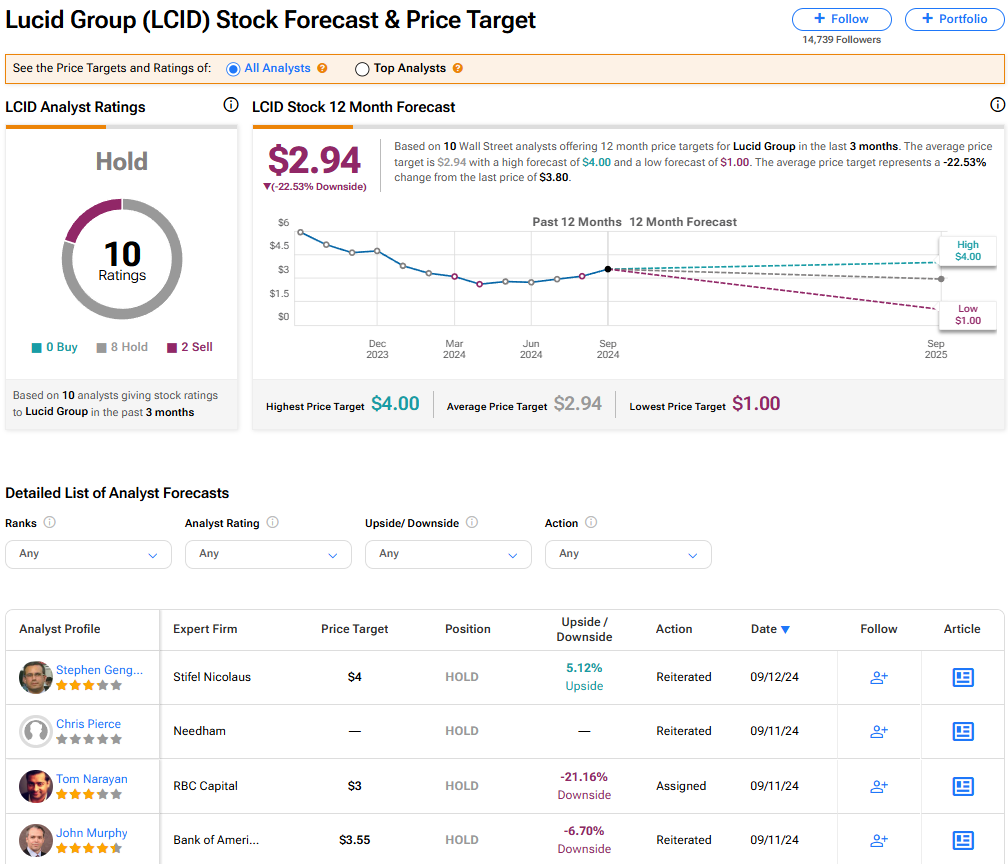

On TipRanks, LCID stock is rated a Hold among 10 Wall Street analysts. There are currently eight Hold and two Sell ratings assigned by analysts in the past three months. There are no Buy ratings on the stock. The average Lucid stock price target of $2.94 implies further downside risk of 22.5%.

The stock received five new ratings the week of Sept. 9, all of them Hold ratings. These new Hold ratings reflect the company’s technological advantage, notably its range and efficiency, as noted by Needham analyst Chris Pierce, who also highlighted LCID stock’s problematic valuation.

Read more analyst ratings on LCID stock

Conclusion: Steer Clear of Lucid Stock

Lucid stock is down more than 30% over the past 12 months, and judging by analysts’ price targets, it doesn’t appear to have hit bottom yet. Yes, the company’s technology is impressive, but the execution has been terrible, and the stock’s valuation is unappealing. With profitability nowhere in sight, investors would be wise to steer clear of LCID stock. Right now, it appears that any investment in this automaker would indeed be dead money.