NIO (NIO) stock is sliding and has been for over a month. Shares in the electric vehicle (EV) company have been all over the place in 2024 with the 52-week high being almost 200% higher than the 52-week low. While that might sound appealing to traders, there are plenty of warning signs for long-term investors. I’m bearish on NIO because of its cash burn, profit forecast (or lack thereof), and the waning utility of its battery-swapping program.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

NIO’s Uncertain Outlook

One of the big reasons why I am bearish on NIO stock is that it has failed to live up to expectations. NIO certainly isn’t a household name, but it’s a stock many investors became familiar with during the pandemic as capital surged into the electric vehicle segment. NIO proved particularly popular with its unique battery-swapping program and the company was seen as a potential competitor to Tesla (TSLA) — that’s partially because investors were keen on its program that swaps fully charged batteries for depleted ones rather than spending hours charging a rundown battery.

However, NIO failed to live up to the hype, and this was compounded by China’s extended Covid-19 restrictions that caused supply chain issues. Fast-forward to 2024 and NIO’s outlook remains uncertain, as the company faces challenges in the competitive Chinese EV market and struggles to maintain consistent growth.

In Q3 2024, NIO delivered 61,855 vehicles, representing an 11.6% year-over-year increase. While that might sound like decent volume growth, it’s far below what many investors had hoped for. Moreover, NIO’s gross margins have been damaged by an intensely competitive marketplace.

NIO’s Earnings Forecast

Another reason to be bearish on NIO is the company’s lack of profitability. For the upcoming quarter, analysts have forecasted normalized and GAAP earnings per share (EPS) of -$0.27, reflecting ongoing challenges in achieving profitability. Revenue is estimated at $2.69 billion and this would be just $20 million more than in Q3 of 2023.

Even more concerning than the near-term loss is the fact that most analysts don’t see NIO turning a profit any time soon. Analysts typically only provide a forecast for the next three years, and the consensus through to 2026 is continued losses. NIO isn’t forecast to turn a profit until 2027, and there’s only one analyst providing an earnings forecast for that year — down from 15 in 2026.

The current forecast suggests a loss of $1.29 per share in 2024, a loss of $0.92 in 2025, and a smaller $0.63 loss in 2026. That’s concerning because the company currently has total cash of $1.65 per share and a net cash position of $432 million. It’s hard to see how the firm will be able to navigate its way toward profitability without further capital raises, share dilution, or borrowing.

NIO and Battery Swapping

As mentioned before, NIO is unique in that it allows customers to exchange empty batteries rather than recharge them, but I’m not sure this is the big plus it was once deemed to be, which makes me further bearish on the company’s outlook. This has been a key differentiator for the company, and the benefit is that swapping batteries takes just a few minutes while charging them can take hours.

NIO has heavily invested in expanding its network of swapping stations, viewing it not only as a service but as a potential revenue generator. These stations provide a unique customer experience, reduce wait times for recharging, and allow NIO to build a loyal customer base with access to fast, convenient battery swaps. However, with advancements in fast-charging technology, the relevance of battery swapping is diminishing. While my Tesla Model Y probably takes an hour to charge fully at a supercharger, charging speeds have improved in recent years with many electric vehicles now capable of gaining an 80% charge in as little as 20 minutes using ultra-fast chargers.

For instance, the Li (LI) Mega, a high-end EV, supports 500 kW charging, offering a 10-minute charge to 80%. As charging infrastructure becomes more widespread and faster, consumers may prioritize charging convenience over the need for battery swapping. Personally, I’m wondering whether battery-swapping will become obsolete if charging technology continues improving. For me, this strategic concern adds to the unappealing earnings forecast.

Is NIO Stock a Buy?

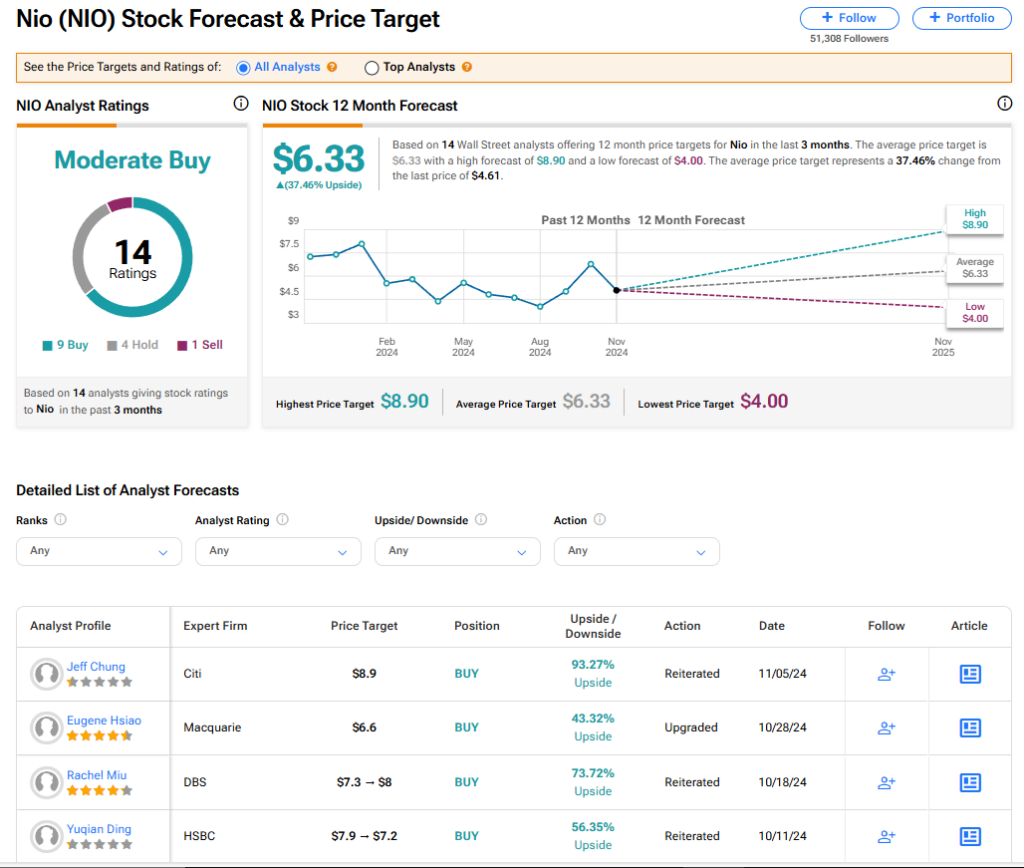

NIO is a Moderate Buy based on nine Buys, four Holds, and one Sell rating assigned by analysts in the past three months. The average NIO stock price target of $6.33 implies 24% upside potential from current levels.

Read more analyst ratings on NIO stock

The Bottom Line on NIO Stock

NIO stock has surged on several occasions throughout 2024, and I wouldn’t be surprised to see something similar happen again. However, this would probably be driven by technical indicators rather than the company’s fundamentals. As mentioned, I find NIO’s prospects to be increasingly weak, with medium-term forecasts indicating that the business may need to seek additional capital in order to guide it through to profitability. Despite supportive trends in the broader EV sector, NIO appears set to continue posting losses for the foreseeable future. For me, it’s simply an investment that carries too much risk.