So, it is further bad news for chip stock Intel (INTC) today. Just when the “Coffee Debacle” had been put to rest, we now discover that the Arrow Lake launch “didn’t go as planned.” Worse, Intel also faces a major new competitor in a field it had practically run for years. All of this combined added up to bad news for Intel shareholders, who sent shares down nearly 4.5% in Monday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A report from The Verge revealed that the Core Ultra 9 200S line of chips is not running up to snuff, based on reviews. In fact, in several cases, they are losing ground to many chips from Advanced Micro Devices (AMD), one of Intel’s primary competitors. Intel knew this would be the case, and there are plans to shore up these chips’ performance soon.

There have been some efficiency gains, the report noted. However, a “comprehensive update” set to come out in the next few weeks should address the issue more thoroughly. Intel noted that a fix on this front is as simple as a “…flash the BIOS and update Windows kinda situation.”

Sounds Like Doom

And then, things got worse. A report from Techradar suggested that none other than Nvidia (NVDA) is about to make a pivot and may be looking to jump into PC processors, the market that Intel basically made 20 years ago.

The Nvidia chips, the report noted, would likely be ARM-based, and might be available by sometime in 2026. We should know more about these chips sometime in 2025, which will be facilitated by Qualcomm (QCOM) losing its exclusive deal with Arm to make processors for Windows applications. Such a move would pressure Intel in a market in which it was formerly dominant and leave it in a bad position going forward.

Is Intel a Buy, Hold, or Sell?

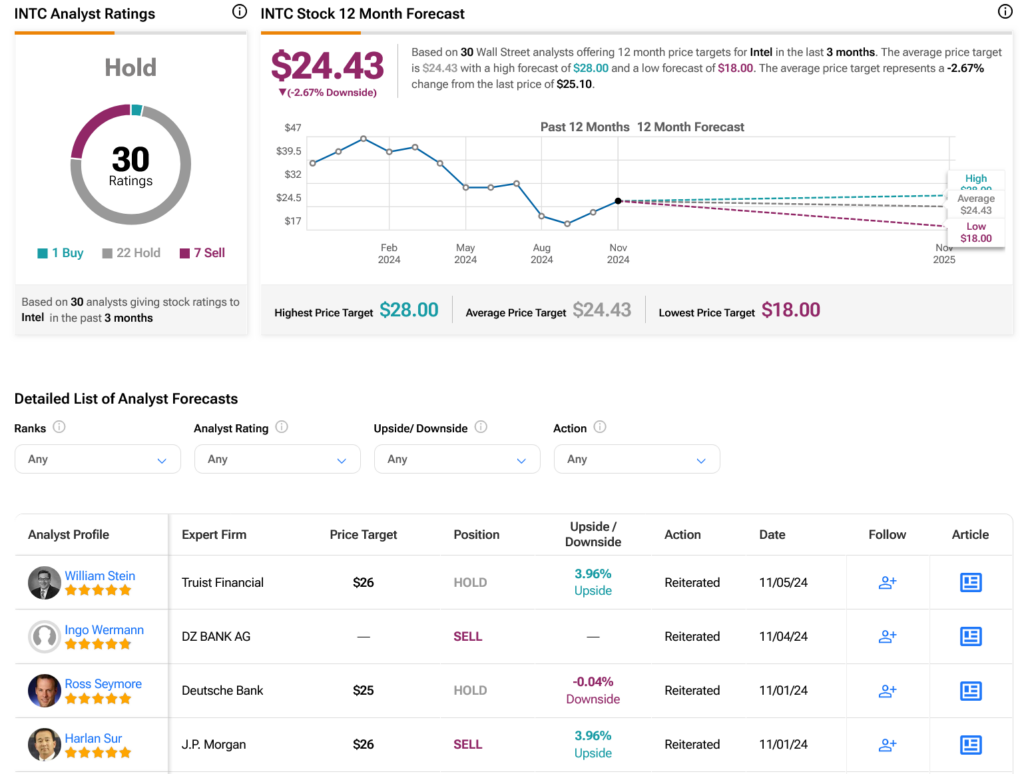

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 22 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 33.7% loss in its share price over the past year, the average INTC price target of $24.43 per share implies 2.67% downside risk.