According to regulatory filings, electric vehicle (EV) maker Tesla’s (TSLA) corporate insiders are planning to sell its common stock worth $300 million in the coming months. Three of Tesla’s board members, namely chairwoman Robyn Denholm, CEO Elon Musk’s brother Kimbal Musk, and Kathleen Wilson-Thompson, have all applied for Rule 10b5-1 trading arrangement to sell shares with expiration dates in the first half of 2025. These sales will result from the expiration of stock options and are subject to certain conditions.

Such plans come under the Informative Buy/Sell trades of corporate insiders. These trades are made public so as to keep the other investors aware of insiders’ planned stock sales, which could also affect the company’s stock price. The plans execute automatically based on preset conditions, including volume, price, and timing.

More on the Planned Stock Sale by TSLA Insiders

Tesla reported the planned share sale in its latest 10-Q filing. Denholm is set to sell up to 674,345 of TSLA shares on or before June 18, 2025. Musk’s brother has signed to sell up to 152,088 of TSLA stock with, an expiration date of May 30, 2025. Meanwhile, Wilson-Thompson is planning to sell up to 300,000 shares by February 28, 2025.

Altogether, the three board members are set to sell 1,126,433 common shares of the EV king. At the current Tesla share price of $262.51, this results in a total sale consideration of $295.70 million.

A Closer Look at Tesla’s Insider Transactions

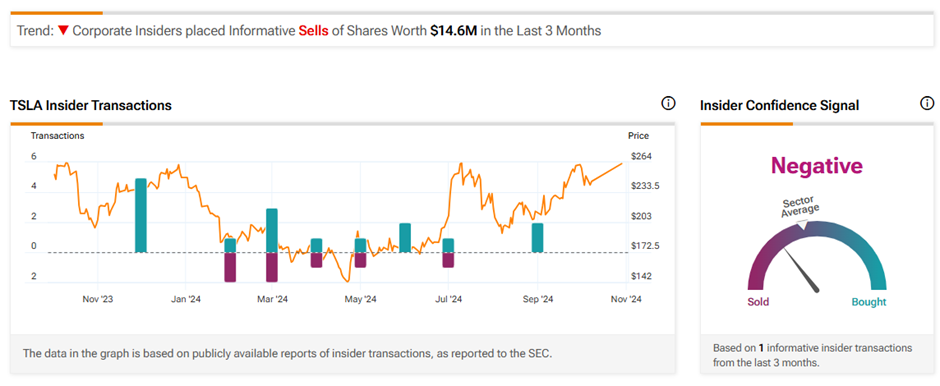

TSLA stock currently has a Negative Insider Confidence Signal on TipRanks, based on Informative Sell transactions worth $14.6 million undertaken in the last three months.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Tesla Stock a Buy?

Wall Street remains skeptical about Tesla stock despite the healthy earnings beat reported for Q3 FY24. On TipRanks, TSLA stock has a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sell ratings. Also, the average Tesla price target of $207.83 implies 20.8% downside potential from current levels. Year-to-date, TSLA shares have gained 5.6%.