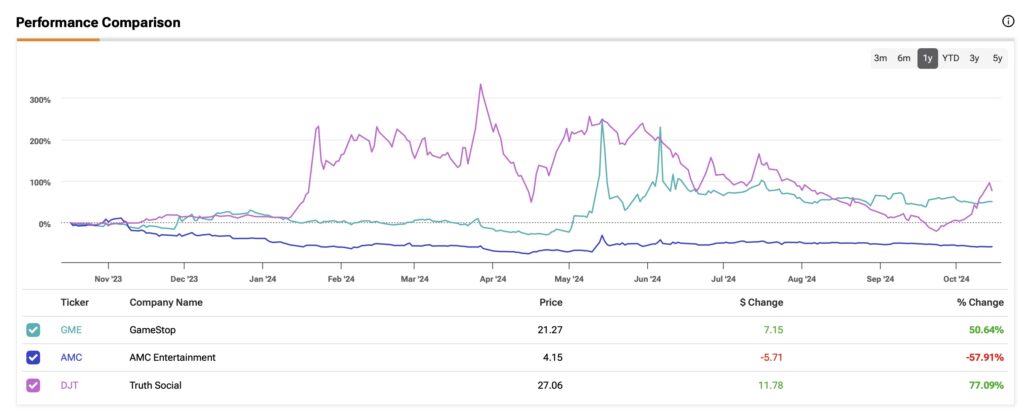

In this article, I will use the TipRanks Stock Comparison Tool to help me analyze leading meme stocks GameStop (GME), AMC Entertainment (AMC), and Trump Media Technology Group (DJT). A closer look leads me to a neutral outlook for both GameStop and Trump Media, and a bearish outlook for AMC. However, if I had to select one to invest in based on fundamentals, GameStop stands out as the best option.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let’s take a deeper look.

A Closer Look at GameStop (GME)

I have a neutral outlook on GameStop, the most iconic meme stock, which was at the center of a massive short squeeze in 2021, causing some bearish hedge funds to lose billions. However, the story didn’t end there. Recently, several unconventional events have shaped GameStop’s year, driving the stock to a 22% year-to-date gain inline with the S&P 500 (SPY).

GameStop shares surged 400% from their yearly low in April to a peak in mid-May, driven by another meme rally. This time, the rally was sparked by Roaring Kitty, a mysterious trader and YouTuber who played a key role in the 2021 GameStop short squeeze. Roaring Kitty disclosed a multimillion-dollar bet on GameStop shares, reigniting excitement and ‘fear of missing out’ (FOMO) among retail investors and traders on social media.

The renewed hype around GameStop allowed management to strengthen the company’s balance sheet. Facing declining sales, and challenged to achieve breakeven profitability, GameStop capitalized on the situation by selling a significant amount of new shares.

In May, it sold 45 million shares, raising $933 million, followed by another sale of 75 million shares in June that generated $2.1 billion. With these proceeds and its prior cash reserves, GameStop now has approximately $4.2 billion on its balance sheet and virtually no debt.

Is GameStop a Buy, Hold, or Sell?

I rate GameStop as a Hold. While its history of short squeezes and extreme volatility makes it too risky to short, the company’s strong balance sheet offers strategic flexibility. Under the leadership of CEO and largest shareholder Ryan Cohen, GameStop could explore ventures beyond its decaying core business. Although this flexibility could lead to new growth opportunities, no clear strategy has emerged yet to justify a more bullish outlook.

Since Ryan Cohen made his initial investment in GameStop in 2020, he has not sold a single share, despite the significant appreciation of his initial stake. In fact, last year, Cohen increased his stake, along with a few other directors, by an additional 10 million shares. This could be seen as a strong sign of commitment from the management team to create value for GameStop shareholders.

Most Wall Street analysts avoid covering the stock, except for Michael Pachter from Wedbush, who has a Sell recommendation and a target price of $10. This results in a Moderate Sell consensus on TipRanks, and Pachter’s price target implies potential downside of 53%.

A Closer Look at AMC Entertainment (AMC)

I hold a bearish view on AMC Entertainment, the second most notable meme stock. Unlike GameStop, the movie theater chain has a highly leveraged balance sheet and is at risk of filing for Chapter 11. Since August last year, AMC shares have fallen more than 90% as CEO Adam Aron has aggressively diluted equity to capitalize on the stock’s popularity. Over the past five years, AMC’s share count has increased by approximately 610%, from 51 million in 2020 to 310.4 million (post-reverse stock split), and the company raised about $3.8 billion in doing so.

Despite some progress in reducing debt and renegotiating maturities, AMC still carries around $8.6 billion in long-term debt, including the value of capital leases. Liquidity remains a concern, as reflected by a quick ratio of 0.56. This suggests potential challenges in meeting short-term obligations, especially in light of its negative free cash flows.

Is AMC a Buy, Hold, or Sell?

I have a bearish view on AMC. Although the stock is sensitive to meme rallies, it has fewer catalysts compared to GameStop. AMC faces significant debt and domestic box office revenues have yet to recover to pre-pandemic levels due to COVID-19 disruptions and industry strikes. Despite a large devaluation, AMC still trades at a premium to its peers, with a forward EV/EBITDA ratio of 32x.

One risk to consider is the 15.8% short interest in AMC, which could lead to short squeezes in the event of a rally.

AMC is rated a Moderate Sell on Wall Street, with three analysts recommending Hold and three recommending a Sell. The average AMC price target is $4.80, which implies a potential upside of about 15%.

Reviewing Trump Media & Technology Group (DJT)

I have a neutral outlook on Trump Media & Technology Group (TMTG), and classify it as a meme stock due to its peripheral influences, and intense volatility since it went public as a SPAC in 2021. DJT stock’s valuation appears disconnected from fundamentals, with the primary asset, Truth Social, generating less than $5 million in annual revenues against an enterprise value of $5 billion. DJT stock invariably depends on Donald Trump, its largest shareholder. An election victory could potentially spur a significant surge in market value, while any large stock sale from Trump could sink the share price.

While I find the risk-reward profile questionable and would typically adopt a bearish stance, it’s important to note that any short bet could backfire in light of Donald Trump’s, often unpredictable, moves. Furthermore, unlike AMC, DJT has a strong balance sheet, with $344 million in cash and no debt. There are no liquidity questions pertaining to this stock, at least for now.

Is DJT a Buy, Hold, or Sell?

I rate DJT as a Hold. While there is a significant short-term catalyst on the horizon—the American elections in November—polls signal a tight race, and that makes any bet on DJT highly speculative.

Since last month, DJT stock has surged nearly 80%. One of its major shareholders sold 7.5 million shares in late September, but the market was relieved that Trump himself did not sell stock as the share lockup expiry date passed. Trump has also experienced climbing poll numbers, according to leading bookmakers. TMTG shares have attracted a great deal of interest in the market, and that is likely to intensify as the November 5 election date approaches.

There are no brokerage analysts or firms offering coverage of the DJT stock, and thus no Wall Street price target to speak of.

Conclusion

Despite declining sales in its core business, GameStop’s strong balance sheet and debt-free status make it the best choice for investors looking at meme stocks. However, sustained shareholder gains remain dependent on management’s ability to deliver a successful reinvention of GameStop’s business. I have a neutral view on GME stock.

Meanwhile, AMC is burdened by significant debt, prompting my bearish rating.

Trump Media & Technology Group has generated minimal revenue and trades at uber-inflated valuations. DJT is the stock with a notable near-term catalyst—the upcoming presidential election— but it feels safest to have a neutral view.

Ultimately, I’m not a confident investor in any of these three meme stocks.