Strong box office returns this summer are proving little help to AMC Entertainment (AMC), which took on vast amounts of debt to stay afloat during the Covid-19 pandemic.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The North American box office is posting its best returns in years. In fact, third-quarter ticket sales were the highest seen since the pandemic struck in 2020. However, the report also noted one very serious problem for AMC theaters: the massive debt load under which it operates.

The report notes that AMC did not start the pandemic in a good position. AMC was trying to reverse the gradual death of the theater by bringing in premium seating and buying up other chains to expand its footprint. AMC thus took on roughly $5 billion in debt, and that was before theaters were closed by a government mandate.

With Hollywood mostly shutdown too, that made new content next to impossible to get, and it was a double whammy to a struggling industry. Today, AMC is still struggling under a long-term debt load of just over $4 billion.

Bigger Titles

This year has not been great for movies. The disaster that was Joker: Folie a Deux and the marginal run of Venom: The Last Dance has drawn attention to a likely winner to come: Disney’s (DIS) Moana 2. The combination of that, Wicked, and Mufasa: The Lion King, will likely help drive a $9 billion annual box office, and give AMC a needed boost.

Some analysts are even suggesting that Moana 2 might do better than Inside Out 2, which is a possibility, albeit a remote one. Even if it does not surpass that high bar, it is still likely to be a major draw, and a serious profit vector for both AMC and Walt Disney Co. (DIS).

Is AMC Stock a Buy or Sell?

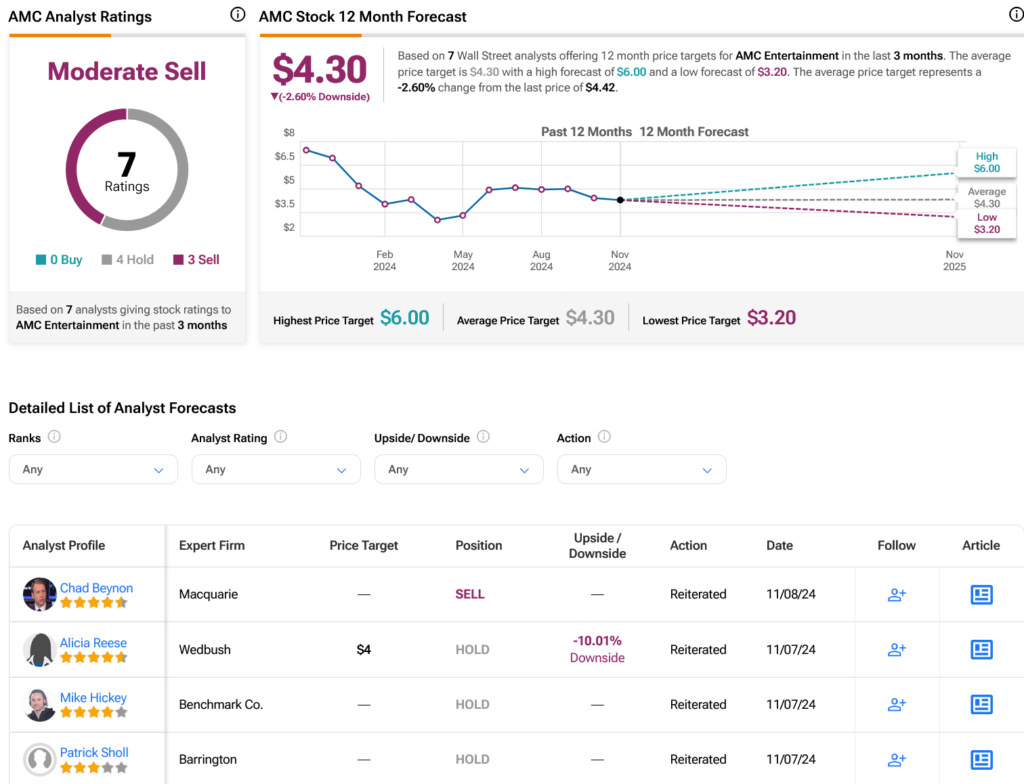

Turning to Wall Street, analysts have a Moderate Sell consensus rating on AMC stock based on four Holds and three Sells assigned in the past three months, as indicated by the graphic below. After an 37.92% loss in its share price over the past year, the average AMC price target of $4.30 per share implies 2.6% downside risk.