TipRanks’ Stock Screener tool for the U.K. market helps filter stocks based on several parameters like market capitalization, analyst consensus rating, upside potential, sector, and dividend yield. Using this tool, we selected two U.K. stocks – Greggs plc (GB:GRG) and Shell plc (GB:SHEL), which could offer an upside potential of over 20%, as per analysts.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let us discuss these stocks in detail.

Greggs (GB:GRG)

British bakery chain Greggs is navigating well through the ongoing macro pressures, as reflected in its recent trading update for Q4 and the full year. The company’s year-end performance benefited from strong performance in the Christmas season. Overall, Greggs’s sales grew 19.6% to £1.81 billion in 2023.

Greggs continues to optimize its store network by opening new stores and relocating shops to ensure enhanced presence in successful catchments. It opened 220 new stores while closing/relocating 75 shops, ending 2023 with 2,473 stores. Greggs plans to open between 140 and 160 net new stores in 2024.

Moreover, the company is investing in its supply chain to support its aggressive growth plans. It is also boosting its business through its partnerships with Just Eat and Uber Eats.

While wage inflation and higher costs could weigh on the bottom line, management is confident about continued progress in 2024.

Is Greggs a Good Stock to Buy?

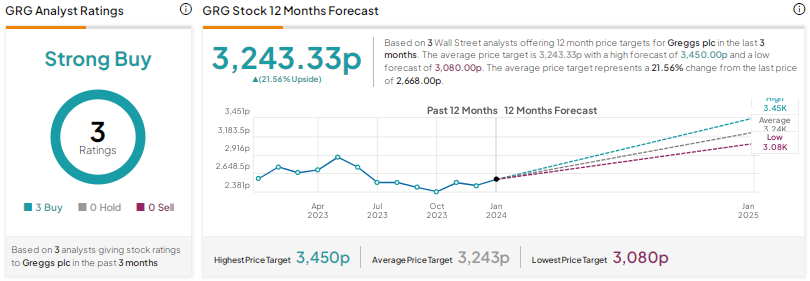

On January 22, Jefferies analyst Andrew Wade reiterated a Buy rating on GRG stock with a price target of 3,450p (29.3% upside potential).

Greggs stock earns a Strong Buy consensus rating based on three unanimous Buys. The Greggs share price target of 3,243.33p implies 21.6% upside potential. GRG stock offers a dividend yield of 2.3%. Shares have essentially been flat over the past year.

Shell (GB:SHEL)

Shares of the British oil and gas giant Shell took a hit earlier this month when the company announced that its Q4 earnings would be impacted by impairment charges in the range of $2.5 billion to $4.5 billion. The impairments are due to macro headwinds and portfolio decisions, mainly related to the Singapore refining and chemicals hub that the energy major intends to sell.

Meanwhile, Shell’s CEO Wael Sawan is taking initiatives to drive efficiency and reduce costs to improve its profitability and competitiveness compared to its U.S. rivals. The company is targeting cost savings of $3 billion by the end of 2025 and recently cut down its headcount further as part of this goal.

Shell is facing near-term headwinds like volatility in oil prices and pressure from a group of investors who are urging the company to take more aggressive actions to reduce greenhouse gas emissions. That said, several analysts remain optimistic about the company’s long-term potential and ability to enhance its shareholder returns through dividends and share buybacks.

Is Shell a Good Stock to Buy?

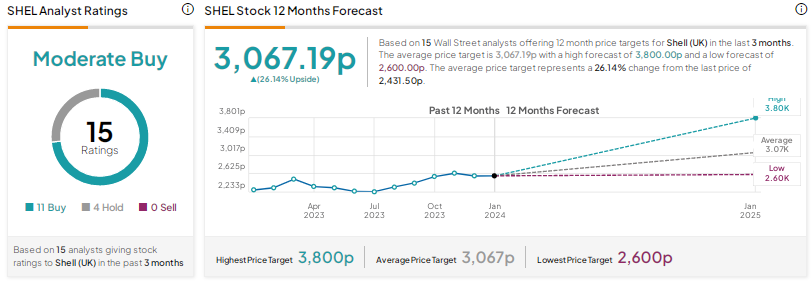

On Tuesday, Barclays analyst Lydia Rainforth reiterated a Buy rating on the stock with a price target of 3,800p (56.3% upside potential).

With 11 Buys and four Holds, Shell stock has a Moderate Buy consensus rating. The Shell share price target of 3,067.19p implies 26.1% upside potential. Shares have risen by just 2.5% over the past year. SHEL offers an attractive dividend yield of 4.2%.

Conclusion

Both Greggs and Shell are dominant players in their respective sectors and well-positioned to sail through the ongoing macro uncertainty. As per TipRanks’ Smart Score System, GRG and SHEL stocks have a smart score of nine, which implies that they could outperform the broader market over the long term.