The China-based Meituan, earlier known as Meituan-Dianpin (HK:3690), reported its Q3 results yesterday, hinting towards slower revenue growth in its food delivery business in the quarter ahead. The company attributed its reduced forecasts to subdued consumer spending in its primary market. It also indicated that deliveries are expected to decrease compared to the same period last year. The milder winter weather was cited as a factor, as it tends to prompt people to dine outside rather than opting for food delivery.

Additionally, Meituan noted a projected decline in earnings from its non-food delivery service, attributing it to heightened consumer cautiousness regarding spending. In response to the expected slowdown, the company intends to boost its marketing expenditure in the upcoming months to grow its demand.

Post-results, the shares were hit hard, reaching their lowest level in the last three years. The shares are trading down by 12.18% today at the time of writing. Year-to-date, the stock has lost over 48% of its value in trading.

Meituan is an investment holding company that operates a leading e-commerce platform to facilitate trade between consumers and merchants. The company operates the largest food delivery platform in China.

Q3 Earnings Snapshot

In Q3, revenues witnessed a substantial growth of 22.1%, reaching ¥76.5 billion compared to ¥62.6 billion in the same period of 2022. Furthermore, adjusted EBITDA and adjusted net profit grew to ¥6.2 billion and ¥5.7 billion for this quarter, representing a year-over-year increase of 28.9% and 62.4%, respectively.

In its core local commerce segment, revenue demonstrated a notable year-over-year increase of 24.5%, reaching ¥57.7 billion. Operating profit also experienced growth, rising by 8.3% year over year to ¥10.1 billion. The robust expansion of food delivery operating profit was somewhat mitigated by the decline in in-store, hotel, and travel operating profit compared to the same period last year.

Along with the results, the board also declared a share buyback worth $1 billion. However, the execution of this buyback would be contingent on the company’s cash position, taking into account its plans to invest in new initiatives and explore overseas investments.

Is Meituan a Buy or Sell?

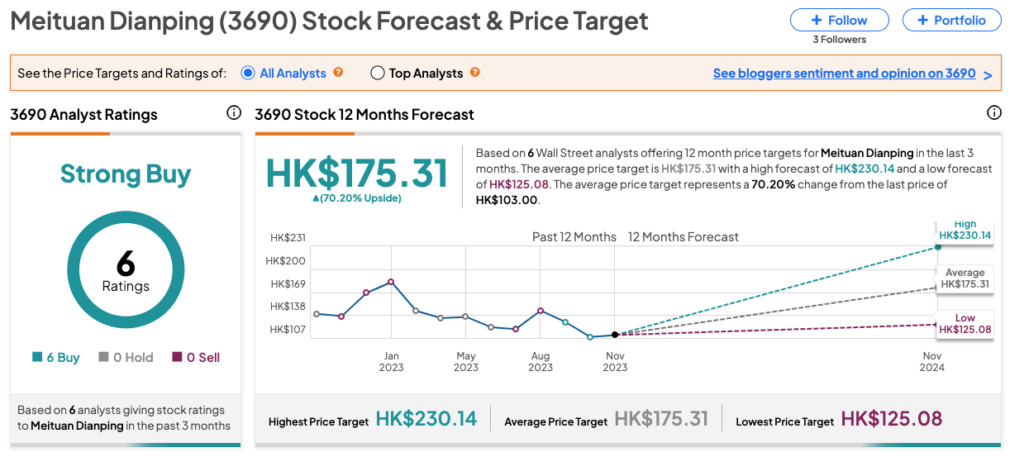

According to TipRanks’ rating consensus, 3690 stock has received a Strong Buy rating, backed by all Buy recommendations from six analysts. The Meituan share price forecast is HK$175.31, which implies a huge upside of 70% on the current trading level.