The share price of the FTSE 250-listed carmaker Aston Martin Global Holdings PLC (GB:AML) was hit hard today after the company posted losses in its Q3 2023 earnings report. The company’s adjusted operating loss decreased to £48.4 million from £55.5 million in the same quarter last year, falling short of the forecast of £37.5 million. The company affirmed its full-year guidance but reduced the volume outlook due to initial delays in the DB12 ramp-up during the third quarter.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s shares declined by almost 12% today at the time of writing, reaching the top spot among the fallers on the FTSE 250 index.

Aston Martin is a manufacturer of high-end sports cars with a legacy spanning more than 100 years. The company is known for its design and automotive excellence and includes models like Vantage, DB11, DBS, DBX, and Valkyrie, among others.

Betting High on DB12

The company’s DB12 model has generated remarkable demand. A noteworthy 55% of the initial DB12 customers are first-time customers of the company, expanding its base to new audiences. For the full year, Aston Martin anticipates DB12 volumes to reach 6,700 units, a decrease from the prior estimate of around 7,000 units. The company stated that production was impacted due to supply-related issues and delays in incorporating the new platform. Nonetheless, the company has resolved these issues and expects solid demand and orders for DB12.

In the medium term, the company is confident about achieving its financial targets of £2 billion in revenue and around £500 million in adjusted EBITDA by 2024/25.

Aston Martin Stock Price Target?

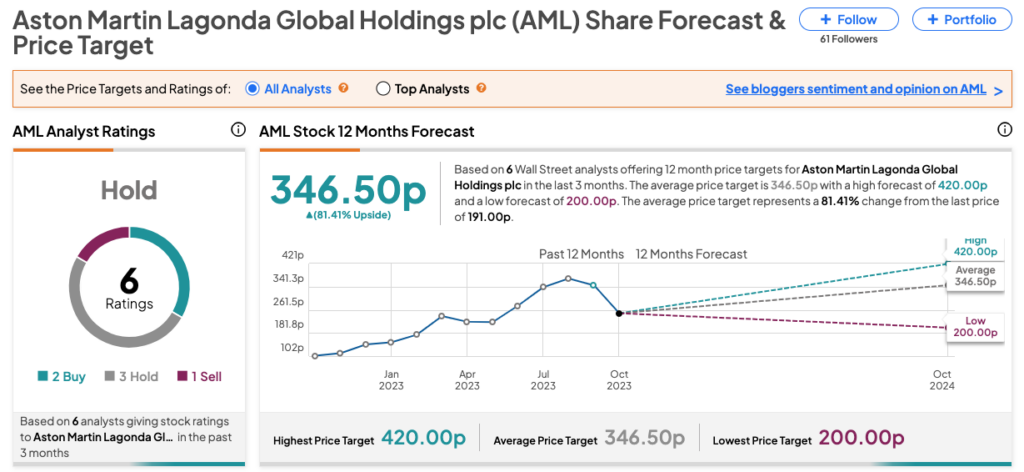

On TipRanks, AML stock has received a Hold rating based on two Buy, three Hold, and one Sell recommendations. The Aston Martin share price target is 346.5p, which implies a huge upside potential of 81% from the current level.