DoorDash Inc. (NYSE: DASH), an on-demand delivery service platform, reported stronger-than-expected fourth-quarter revenue and guided for a robust order book for fiscal 2022. This was driven by solid customer retention coupled with new customer growth that continued to order through its platform from both restaurant and non-restaurant verticals.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Following the news, shares surged 27.8% during the extended trading session, after closing the day down 6.8% at $94.89 on February 16. However, the company’s bottom line came in short of expectations.

Yet, the company delivered record numbers across all of its key metrics, with monthly active users (MAUs) growing 22% year-over-year to over 25 million. DoorDash also recorded high quarterly records for Total Orders and Marketplace Gross Order Value (GOV), and its DoorPass members surpassed 10 million.

Mixed Results

DoorDash’s Q4 revenue rose 34% year-over-year to $1.3 billion, exceeding analysts’ estimates of $1.28 billion. The strong growth was generated by a 35% growth in Total Orders to $369 million and a 36% jump in Marketplace GOV to $11.2 billion.

However, quarterly diluted net loss stood at $0.45 per share, much worse than Street estimates of $0.27 per share.

On the contrary, for FY21, DoorDash revenue leaped 69% to $4.89 billion and diluted net loss improved to $1.39 per share from FY20 net loss of $7.39 per share.

Official Comments

Delighted with the results, Co-Founder, CEO, and Board Chair, Tony Xu, and CFO, Prabir Adarkar, said, “We ended 2021 with even more opportunity than when we began. The addition of new verticals, new services, and new geographies provides more surfaces to execute against and greater room to drive long term growth that benefits all our stakeholders. “

They added, “We expect the pending close of the Wolt acquisition to add to this, bringing extraordinary talent and world-class operations that will expand our ability to enhance local commerce on a global scale.”

Q1 and FY22 Outlook

Based on the current business momentum and order demand, DoorDash forecasts or Q1 Marketplace GOV to be between $11.4 billion and $11.8 billion, marginally higher than the Q4 number.

Similarly, FY22 Marketplace GOV is projected to fall in the range of $48 billion to $50 billion.

Analysts’ View

Ahead of DASH’s quarterly print, Evercore ISI analyst Mark Mahaney reiterated a Buy rating on the stock with a price target of $256, implying a whopping 169.8% upside potential to current levels.

According to Mahaney, DoorDash’s conservative guidance for Q4FY21 will bode well for the company as it is a seasonally strong quarter. Moreover, the analyst is optimistic about the company’s performance derived from the quarterly results of its peers Uber (UBER) and Just Eat Takeaway.com.

Overall, the DASH stock has a Moderate Buy consensus rating based on 6 Buys and 5 Holds. The average DoorDash price target of $195.5 implies 106.03% upside potential to current levels. However, DASH shares have lost 49.3% over the past year.

Stock Investors

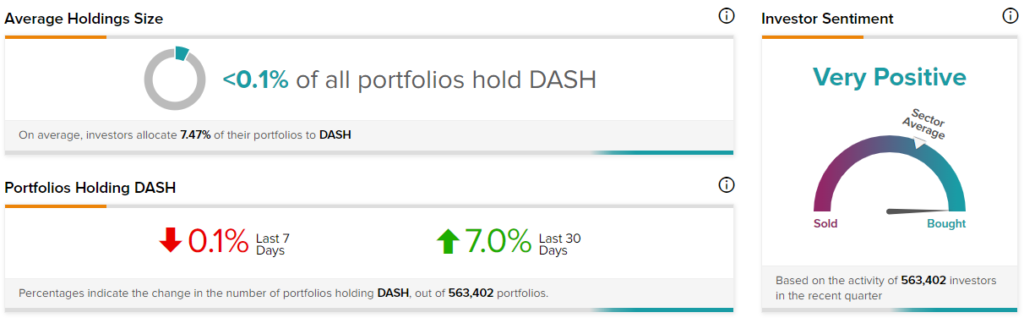

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on DoorDash, with 7% of portfolios tracked by TipRanks increasing their exposure to DASH stock over the past 30 days, at the time of writing.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

U.S. Regulators Probe Wall Street Firms for Block Trades – Report

Upstart Gains 23% on Phenomenal Q4 Results and Beat

ZoomInfo Drops 12% Despite Beating Q4 Expectations