Super Micro Computers (NASDAQ:SMCI) soared by over 300% in the early months of 2024, but its meteoric rise has taken a sharp turn. Despite still being up 45% for the year, SMCI has plunged 65% from its mid-March peak.

Two recent bombshells have fueled its rapid decline. First, short-seller Hindenburg Research issued a report last month accusing SMCI of financial misconduct and shady sales practices. Despite the company’s firm denials, the revelations sent shockwaves through the market. Adding insult to injury, SMCI failed to file its 10-K report on time, stoking even more concern about what’s going on behind the scenes at the IT solutions provider.

So, could the drop in share price represent a window to jump on board? Investor Joseph Parrish advises caution, urging potential buyers to think carefully before hitting that ‘buy’ button.

Beyond the Hindenburg claims and the filing miss, an examination of SMCI’s business has not imbued Parrish with the confidence that massive growth is on the horizon. Unlike Nvidia, which seems to have cornered the lucrative GPU market, SMCI deals with data centers, where competition is fierce and the ability to differentiate oneself is not trivial.

“No company really has a ‘secret sauce’ when it comes to data centers, just different layers to their product to make a deal seem worth it,” writes Parrish, who also believes that competition from Dell and HP will compress margins.

In addition, notes the investor, SMCI’s profits have dropped from 17% to 11.3% over the past quarter, as investments required to expand its data center market are hitting the company’s bottom line.

While the company is not going anywhere, Parrish is dubious regarding SMCI’s ability to mimic its previous performance in early 2024.

“Super Micro isn’t about to go out of business, but there is a question on its lofty valuation of over $25 billion when free cash flow is currently negative and historically not often in the hundreds of millions,” the investor summed up.

Looking for “a much wider margin of safety,” Parrish is therefore rating SMCI a Hold (i.e. Neutral). (To watch Parrish’ track record, click here)

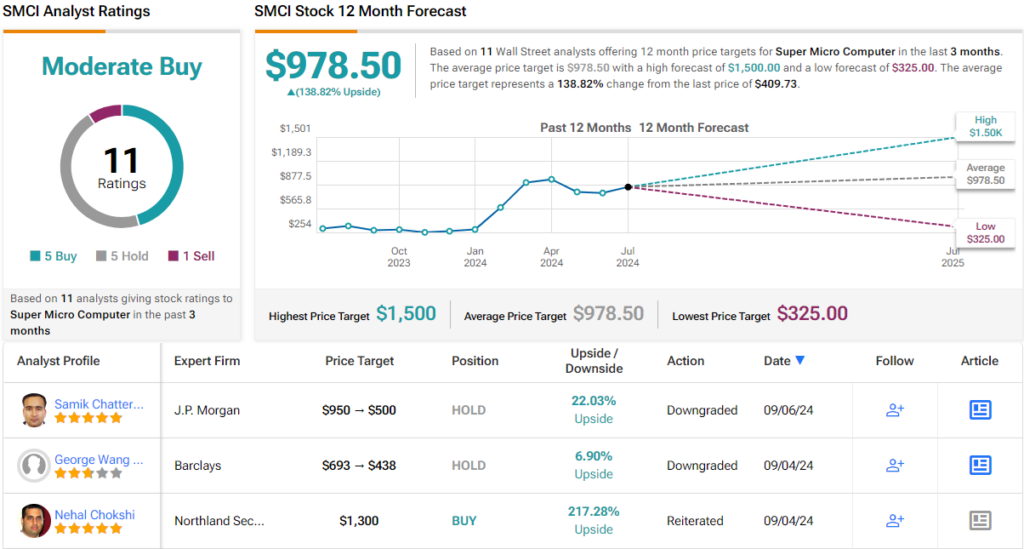

And what about Wall Street? Based on 5 Buys and Holds, each, plus 1 Sell, SMCI stock claims a Moderate Buy consensus rating. SMCI’s 12-month average price target of $978.50 would represent gains of over ~139%, indicating that Wall Street analysts still see plenty of upside potential for the stock in the year ahead. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.