Over the past year, JPMorgan Chase (JPM) stock has risen 56% (see chart below), propelling the company to the top spot among publicly traded banks with a market capitalization of $634.4 billion. Its nearest competitor, Bank of America (BAC), trails far behind with a market cap of $331.1 billion. And yet, despite this surge, I believe that JPMorgan’s valuation has not reached extreme levels, even as we transition to a lower interest rate environment. With its valuation at a reasonable level, I remain bullish on JPM stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

JPMorgan’s Operating Environment

To begin, allow me to explain the main reason I am bullish on JPMorgan’s stock. This would be the positive operating environment in which the bank finds itself in. Over the past year, interest rates reached multi-decade highs, bolstering the bank’s net interest income, which is a key revenue driver for its operations. However, he Federal Reserve is now easing its rate-hiking campaign. The Fed has begun cutting rates, yet these cuts are expected to proceed slowly as concerns about inflation persist.

JPMorgan’s CEO Jamie Dimon has also been vocal about uncertainty in the economy, particularly when it comes to inflation, geopolitics, and regulatory changes. Despite the reduction in interest rates, JPMorgan Chase continues to benefit from a high-rate environment, allowing the bank to generate substantial income from its lending activities.

Strong Fundamentals at JPMorgan

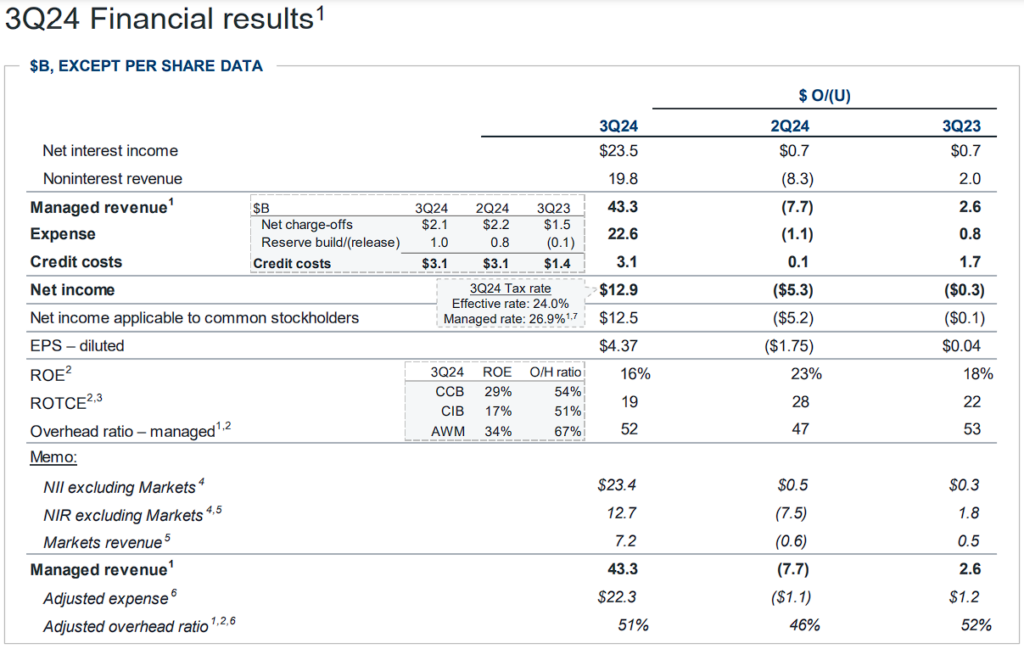

Another reason to remain bullish on JPM stock is the bank’s strong fundamentals. JPMorgan’s third-quarter financial results showed how the company has sustained strong results despite some softening in the broader economy. The bank’s net interest income remained a key driver, growing 3% to $23.5 billion despite a recent 50-basis point interest rate cut from the Fed. This was mainly backed by higher balances in card services and wholesale deposits, though deposit margin compression did weigh on the banking and wealth management business. Non-interest revenue grew by an impressive 17% thanks to higher investment banking fees, asset management fees, and lower securities losses than last year.

It’s worth mentioning that the bank’s consumer business also showed strength, particularly in the credit card segment, where revolving balances grew, contributing to net interest income growth. Card services revenue grew by 11%, reflecting higher consumer spending and account acquisitions. These are very strong considering underlying macro-economic uncertainties. Despite some setbacks like declining deposit balances, influenced by margin compression and the overall shift in consumer behavior, JPMorgan Chase continues to print cash.

JPM Stock Valuation Remains Reasonable

A reasonable valuation is yet one more reason to be bullish on JPMorgan stock. I believe that, despite the 56% gain in the share price over the past year, the valuation still appears fair. Today, the stock is trading at 12.2 times this year’s consensus earnings per share (EPS) estimate of $18.10. This multiple is in line with many other banks, meaning that JPMorgan’s stock is not priced at a premium to the rest of the market despite its dominant position in the banking industry.

As JPMorgan enters 2025, it is likely to see some pressure on its earnings as assets rotate to lower interest rates. However, the current valuation suggests the market has already factored in some of these risks. Even if earnings dip slightly next year, the current price-to-earnings (P/E) ratio doesn’t imply that JPM is overvalued. The fact that the company continues to buy back stock further reinforces this view. The $5.34 billion in stock repurchased in Q3 of this year is the most stock the company has bought back over the past 12 quarters.

Is JPM Stock a Buy?

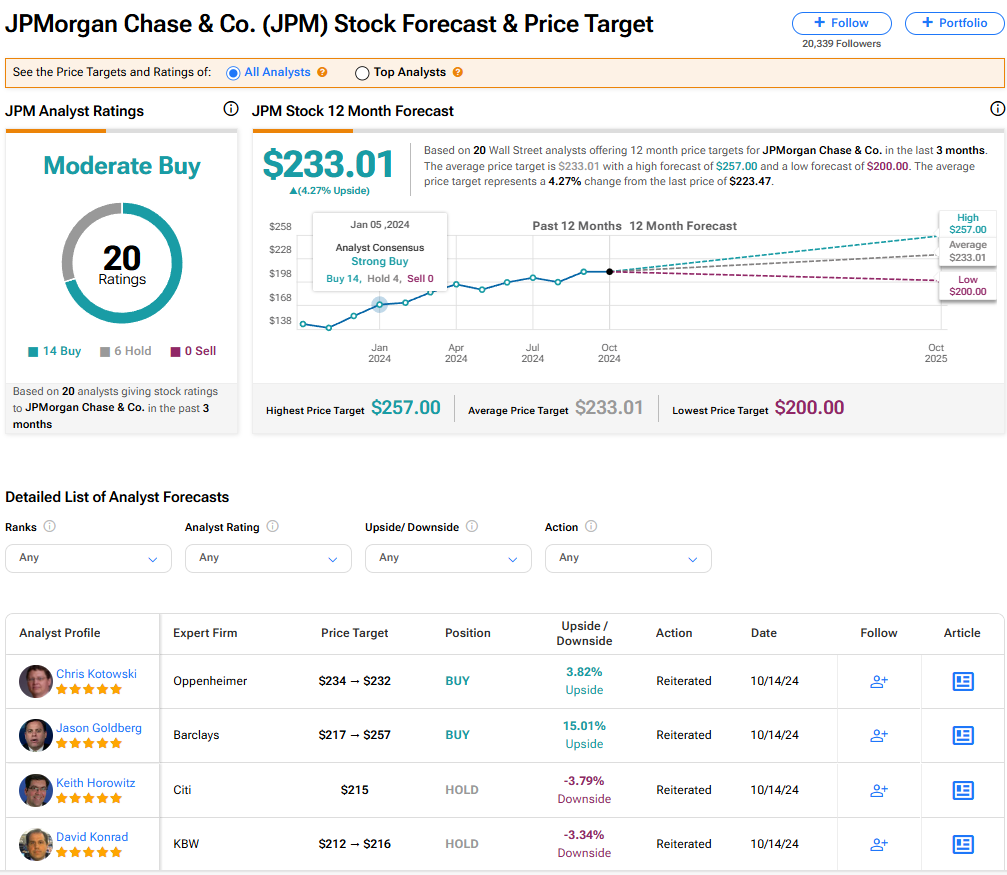

Looking at Wall Street’s view on the stock, JPMorgan maintains a Moderate Buy consensus rating based on 14 Buy and six Hold recommendations assigned in the past three months. There are no Sell ratings on the stock. At $233.01, the average JPM stock forecast suggests 4.27% upside potential.

Read more analyst ratings on JPM stock

If you’re uncertain about which analyst to follow regarding JPM stock, Chris Kotowski from Oppenheimer is your best bet. Over the past year, Mr. Kotowski has been both the most accurate and profitable analyst covering the stock. He has delivered an average return of 30.72% per rating and a 100% success rate.

Conclusion

Despite a rather tremendous 51% rally in JPM stock over the past year, its valuation remains reasonable at 12.2 times consensus earnings. The bank continues to benefit from high interest rates and solid market fundamentals, evidenced in its strong net interest income and growth in consumer spending and investment banking fees. Considering that interest rates are likely to decline slowly in coming months, some pressure on earnings is expected. Still, current valuations suggest that this scenario is already priced into the stock. For these reasons, I am bullish on JPMorgan and see the bank as an attractive investment.