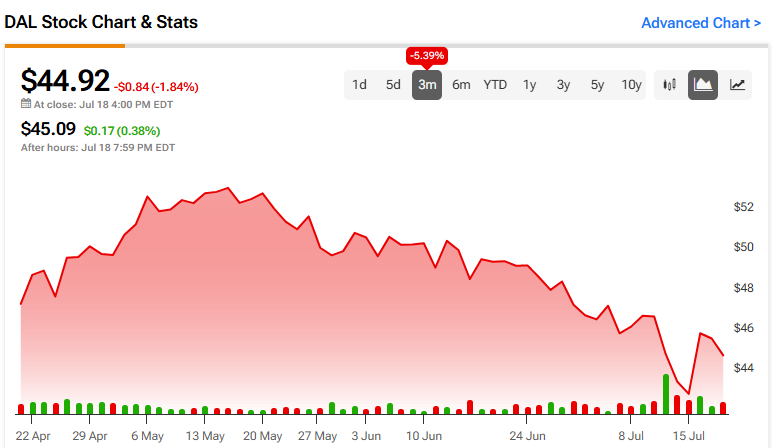

U.S. legacy carrier Delta Air Lines (DAL) reported its Q2 earnings results on July 11, which disappointed market expectations with lower unit revenue numbers and a less optimistic outlook for Q3. Despite this, I remain cautiously bullish on Delta due to its strong balance sheet and diverse business model, making it one of the safer bets in this volatile airline industry.

While Delta’s Q2 results were below expectations, this is not entirely without fault. However, after the recent pullback, I believe that DAL shares now trade at even more attractive valuation multiples. As the industry’s oversupply normalizes and Delta improves its cost management, buying DAL at current prices could prove beneficial for investors, with analysts predicting a potential surge of 40%.

Delta’s Q2 Earnings and the Market’s Reaction

If you look at the market’s reaction after Delta Air Lines released its Q2 results, the nearly 8% drop in its stock price might give the impression that the Atlanta-based airline had a terrible quarter.

But when you dig into the actual numbers, calling it a bad quarter for Delta doesn’t seem fair. Delta reported adjusted EPS of $2.36, which was right on target with expectations. Additionally, Delta generated $2.7 billion in free cash flow, which facilitated $2.1 billion in debt repayment. Gross leverage improved to 2.8x in the first six months of the year, keeping Delta’s liquidity strong and maintaining a robust balance sheet.

Analysts were expecting Delta to report $15.5 billion in operating revenues, but it actually reported $16.7 billion, a record for the company. However, despite a 7% increase in revenue, there was an 8% increase in capacity (available seat miles), and that’s precisely what caused the main issue.

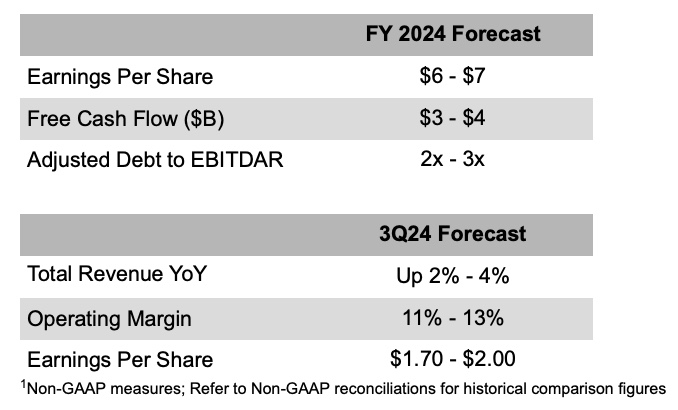

The growth in capacity led to weak unit revenue numbers. The guidance for the second quarter was for unit revenue to stay flat or drop by up to 2%, but it fell by 2.6%. Additionally, the earnings forecast for the third quarter came in weaker than expected, with management guiding between $1.70 to $2.00 per share compared to $2.03 last year and an expectation of $2.05 for Q3.

According to Delta Air Lines CEO Ed Bastian, the problem wasn’t a lack of demand but rather oversupply. He stated, “The industry added more capacity this summer, with an 8% increase, particularly in the domestic market. Real demand growth for the summer, between June and August, is closer to 4%. This oversupply has resulted in heavy discounting, especially at the lower end, leading to fare and yield weakness in the quarter.”

In addition to Delta management’s optimism that domestic revenues will start growing again by September as the industry adjusts, another positive point is that Delta’s mix of premium services, from international to business travel, should help limit the impact compared to its competitors.

This issue of too many available seats is also influenced by seasonal factors and the challenges faced by competitors, especially low-cost airlines. During the summer, these airlines increase their number of flights, but in the fall, when fewer people travel, the industry scales back on the extra seats, acting more cautiously.

Was There an Overreaction, After All?

Even though Delta Air Lines’ Q2 results weren’t bad overall, there were still noticeable weaknesses and challenges due to their strategy of adding more flights while earning less per seat. This doesn’t justify an ultra-bearish reaction, in my opinion, but it hasn’t strengthened the bullish thesis much, either.

While operating revenues increased by 7% year-over-year, operating expenses rose by 10%, a higher rate than revenues and capacity growth. This suggests difficulties in controlling costs. On top of that, fuel costs jumped by another 12% year-over-year, driven by commodity price swings and the oversupply of seats.

The most likely reason for the ultra-bearish reaction was that revenue growth came at the expense of efficiency. Delta didn’t manage to cut costs effectively while expanding capacity, which certainly didn’t please investors.

Looking ahead to Q3, management expects capacity to grow by 5% to 6% and revenue growth of 2% to 4%, predicting that unit revenue will improve each month. Further, the operating margin is projected to be between 11% and 13%, down from the 13.6% reported in Q2.

While these numbers aren’t terrible, Delta’s Q3 guidance was lighter than expected. The market may have anticipated stronger demand from summer travel, which saw record numbers but also a surplus of seats. This perception suggests that the lower end of the market is saturated, resulting in limited pricing power.

The positive news is that Delta’s valuation multiples appear derisked following the recent decline. DAL’s forward P/E ratio stands at 7.2x, nearly 30% below its average over the last half-decade.

Is DAL Stock a Buy, According to Analysts?

Based on the overwhelmingly bullish consensus on DAL stock, Wall Street indicates that the Q2 earnings blemishes are unlikely to be a significant concern. All 11 analysts covering the stock have a buy recommendation, leading to a Strong Buy consensus rating. DAL stock’s average price target is also striking, at $63.07 per share, implying a substantial 40% upside potential.

Key Takeaway

Delta Air Lines didn’t have a terrible Q2, but it faced significant challenges, especially with an oversupply of seats that overshadowed what was anticipated to be strong demand.

The increase in capacity resulted in higher costs, which I believe could have been managed more effectively. On the bright side, Delta’s management seems quite confident in the company’s ability to address these headwinds in the upcoming quarters.

Despite the unpredictable nature of the airline industry, Delta remains one of the least risky choices in the sector due to its robust balance sheet and diverse business model. Additionally, the recent pullback in DAL shares has derisked its valuation multiples, making it an attractive investment opportunity with 40% upside, according to analysts.