Delta Air Lines (DAL) has shown a strong recovery following the major tech outage with CrowdStrike (CRWD). Despite the disruption, I’m still bullish on Delta’s future, bolstered by its solid earnings growth potential and a modest dividend. Moreover, under the Trump administration, the airline might benefit from lower fuel prices, enhancing existing growth forecasts and reinforcing my optimistic outlook on the stock.

Delta’s Valuation Metrics Reinforce My Positive Outlook

Delta stock isn’t as cheap as it was in the summer following the CrowdStrike (CRWD) outage, which caused hundreds of millions in damages. Delta is suing CrowdStrike for $500 million, plus an unspecified amount for profit loss and reputational damage. However, the share price has somewhat recovered since then and still looks like good value, in my opinion.

Currently, Delta stock is trading at 9.4x forward earnings, putting it at a substantial 53% discount to the industrials sector overall. This 9.4x represents a modest premium to United Airlines (UAL), though other peers trade at varied valuations due to differing cash positions and other factors.

According to analysts, Delta’s earnings are expected to grow by around 8.6% annually over the medium term—lower than the industrials average but in line with many of its sector peers. This brings Delta’s price-to-earnings-to-growth (PEG) ratio to 1.1, which I find attractive, especially combined with the 1.1% forward dividend.

Regarding recent performance, Delta has posted four years of continuous quarterly revenue beats, which is encouraging. However, it narrowly missed earnings estimates in the past two quarters. While this would usually raise concerns, Q3 earnings were difficult to forecast due to the CrowdStrike outage.

Falling Fuel Prices Could Provide a Boost

Given Delta’s heavy reliance on fuel, I see potential fuel cost reductions as a key factor that aligns with my bullish perspective. Delta’s recent quarterly fuel expense totalled $2.8 billion, or 21.2% of its $13.2 billion operating expenses. This substantial share of costs makes Delta’s profitability sensitive to fluctuations in fuel prices — more so than its European peers who have fuel hedging operations.

As such, falling fuel prices could significantly benefit Delta by reducing its operating costs and potentially contributing to improving margins. While it can be challenging to forecast where oil prices will go, we should note that geopolitical risk, relating to things like Russia’s war in Ukraine and Israel’s proxy war with Iran, are keeping prices artificially higher.

These factors have broadly contributed to keeping Brent crude oil prices above $70 per barrel, despite declining global demand. If these geopolitical tensions ease, it could lead to further reductions in fuel costs, potentially improving Delta’s financial performance and operational flexibility.

Moreover, president-elect Donald Trump has vowed to bring oil prices down and to bring an end to war in Ukraine, or at least give Kyiv an ultimatum. He’s previously said he would cut energy costs by 50% and spur increased domestic oil production. Oil prices fell on Wednesday November 6 as news of his electoral victory broke.

Delta’s Strategic Expansion Enhances Long-Term Growth Potential

I believe Delta’s earnings growth potential remains solid. So, how will Delta grow earnings? Well, improving margins—thanks in part to cheaper fuel—is one way. Additionally, the company is strategically expanding its transatlantic network for summer 2025, with plans to offer approximately 700 weekly flights to 33 European destinations. The expansion program includes seven new routes, including the airline’s first non-stop service to Catania — incidentally one of the worst airports I’ve been to — in Sicily.

Among the new services, Delta will launch a four-times-weekly flight between its hub in Atlanta and Naples, enhancing its Italian network. Clearly Delta sees Italy — Europe’s third most popular destinations for Americans — as a major growth market with five destinations from the U.S. The airline is also increasing flights to key hubs such as New York-JFK and Los Angeles, providing travelers with more options and flexibility.

Challenges with Boeing Orders Pose Minor Setbacks

While I’m confident in Delta’s overall strategy, delays in Boeing’s (BA) 737 Max deliveries could present some short-term challenges. It was reported in March that the delivery of 10 737 Max aircraft could be pushed back as far as 2027. Given the turbulence that has taken place at Boeing over the past eight months, these orders could be potentially delayed further. Thankfully, Delta operates a diverse fleet that includes both Boeing and Airbus aircraft—unlike Ryanair (RYAAY), which relies exclusively on Boeing—though Airbus (EADSF) is currently facing some production challenges as well.

Is Delta Stock a Buy, According to Analysts?

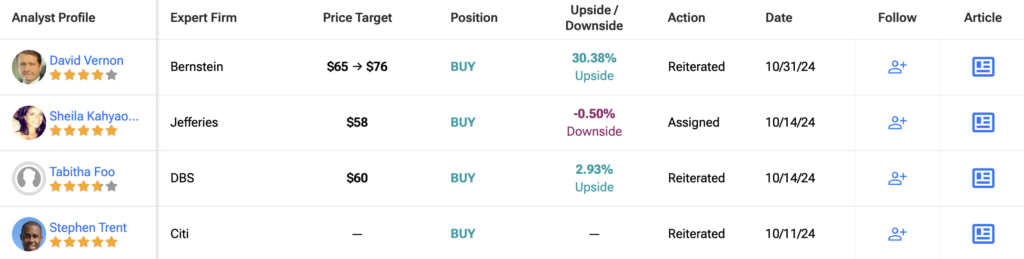

On TipRanks, DAL comes in as a Strong Buy based on 16 Buys, zero Holds, and zero Sell ratings assigned by analysts in the past three months. The average DAL stock price target is $63.89, implying an about 9.6% upside potential.

The Bottom Line on Delta Stock

The average share price target for Delta indicates that the stock could push higher. I believe this is also reflected by the PEG ratio of 1.1, which, although above one, is complemented by a modest dividend. Personally, with a Trump presidency on the horizon, I’d suggest the stock will benefit from lower fuel prices, which should impact the bottom line. It’s also encouraging to see Delta commit to new routes, notably those to Italy, which has seen a surge in tourism post-Covid.