Many analysts have reiterated their positions or re-rated CrowdStrike (CRWD) this week following the global computer outage caused by the company’s faulty update. While the price target remains high, it’s hard to look beyond near-term concerns and the very high multiples with which the company trades. It certainly looks overlooked in the near term, but medium-term growth expectations have been very strong. That’s why I’m neutral on the stock.

CrowdStrike and the Global Outage

The recent global IT outage that affected Microsoft’s (MSFT) Windows systems was caused by a faulty update from cybersecurity firm CrowdStrike. On July 19, 2024, CrowdStrike released an update for its Falcon Sensor product that contained a critical error. This update triggered a “logic error” in the software, resulting in system crashes and the infamous “blue screen of death” on millions of Windows devices worldwide.

The outage had far-reaching consequences, disrupting operations across various industries, including aviation, healthcare, banking, and IT services. Major companies and organizations experienced significant downtime, with airlines like Delta (DAL) canceling thousands of flights. The impact was felt all around the world.

CrowdStrike’s CEO, George Kurtz, confirmed that the issue was caused by a bug in the update and not a cyberattack. The company quickly identified the problem and began rolling out fixes, but the impact was already substantial. Nonetheless, it remains one of the biggest IT outages ever.

As a result of the outage, CrowdStrike’s stock price plummeted. On July 19, the company’s shares fell by approximately 14.1%, dropping from $343 to $294. The fallout continued into the following week, with the stock price declining further to $261 at the time of writing, representing a total drop of over 20% since the incident.

The outage also affected Microsoft, whose shares fell by less than 1% initially. However, the impact on Microsoft’s stock was less severe compared to CrowdStrike’s, likely due to Microsoft’s larger market capitalization and diversified business model. Likewise, Microsoft wasn’t responsible for the fault.

CrowdStrike’s Prospects

In the near term, there’s expected to be some further fallout from the outage. As Guggenheim noted, “The restoration of its reputation may take more time and will likely affect new business signings at least in the near term.” Analyst John DiFucci wrote in an investor note that Guggenheim was downgrading CrowdStrike to neutral, given that it has the highest revenue multiple in its coverage of the software industry.

Despite the outage, CrowdStrike’s long-term prospects likely remain intact. The cybersecurity market is projected to grow at a CAGR of 12.3% from 2023 to 2030, reaching $500.7 billion by 2030, according to Grand View Research. CrowdStrike is well-positioned to capitalize on this growth due to its innovative cloud-native platform and focus on artificial intelligence (AI) and machine learning.

It’s the leading single-platform cybersecurity solution on the market, and its Falcon platform reported a 33% year-over-year increase in annual recurring revenue (ARR) to $3.65 billion in Q1 2025. These are certainly encouraging numbers, and it goes some way to demonstrate the company’s ability to gain market share.

CrowdStrike also benefits from strategic partnerships with major cloud providers and tech giants like Nvidia (NVDA). Nvidia is collaborating with CrowdStrike to deliver AI computing services on CrowdStrike’s Falcon XDR platform.

Moreover, the company’s financial health is strong, ending the last quarter with $3.7 billion of cash versus $743 million of debt. This should give it some room to absorb any moderate slowdown in sales related to the Microsoft outages and to invest in future growth.

CrowdStrike After the Outage

CrowdStrike is still trading at very elevated multiples, as highlighted by DiFucci. The stock currently trades at 65.8x non-GAAP forward earnings and 16.1x forward sales. It’s a very expensive stock.

However, analysts are still forecasting strong growth throughout the medium and long run. In fact, analysts expect earnings growth to improve by 40.2% annually in the medium term. That’s very much sector topping.

In turn, this leads to a price-to-earnings-to-growth (PEG) ratio of 1.64x. Still, that’s not massively enticing (1.0x or lower is generally considered to be undervalued), especially with potentially slow near-term growth as the company navigates the fallout of the Microsoft outages.

Is CrowdStrike a Buy, According to Analysts?

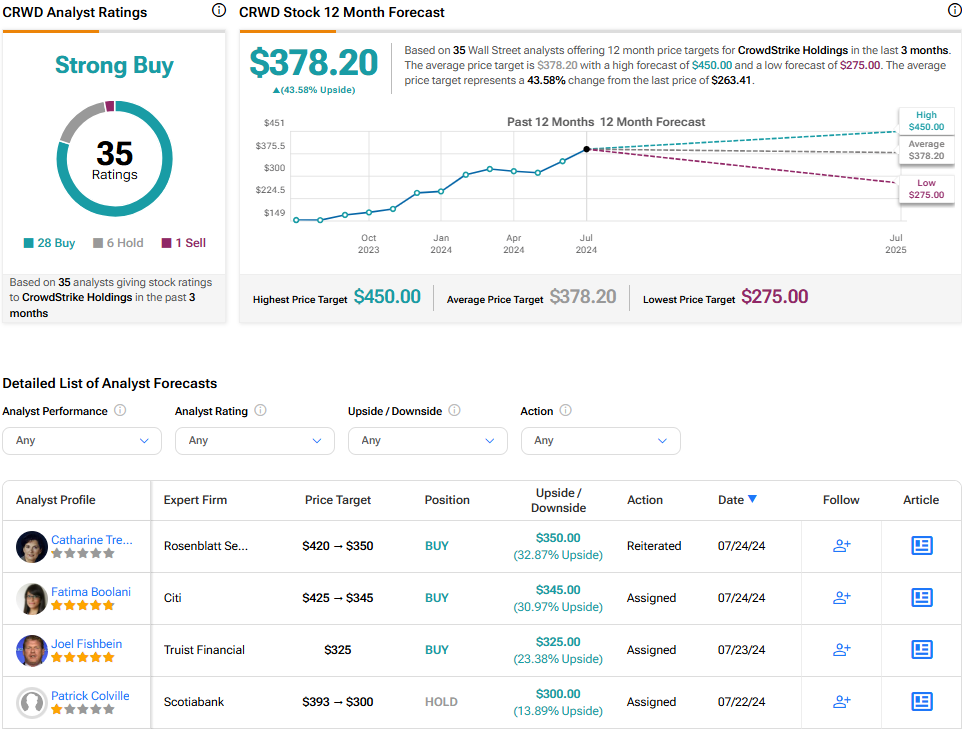

On TipRanks, CRWD comes in as a Strong Buy based on 28 Buys, six Holds, and one Sell rating assigned by analysts in the past three months. The average CrowdStrike stock price target is $378.20, implying 43.6% upside potential.

The Bottom Line on CrowdStrike

CrowdStrike is certainly an interesting proposition for investors. The stock remains up 72% over 12 months despite shedding value over the past week. Nevertheless, its valuation metrics still look rather stretched at 65.8x forward earnings and a PEG ratio of 1.64x. As such, it’s hard to get excited about the company’s prospects despite the very high price target.