Financial services provider Citigroup (NYSE:C) is scheduled to release its second quarter 2024 results on July 12, before the market opens. The rising deposit costs due to higher interest rates, along with slowing loan growth, may have impacted Citi’s Q2 performance. However, a pick-up in investment banking activity may have bolstered Citi’s non-interest income during the quarter.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

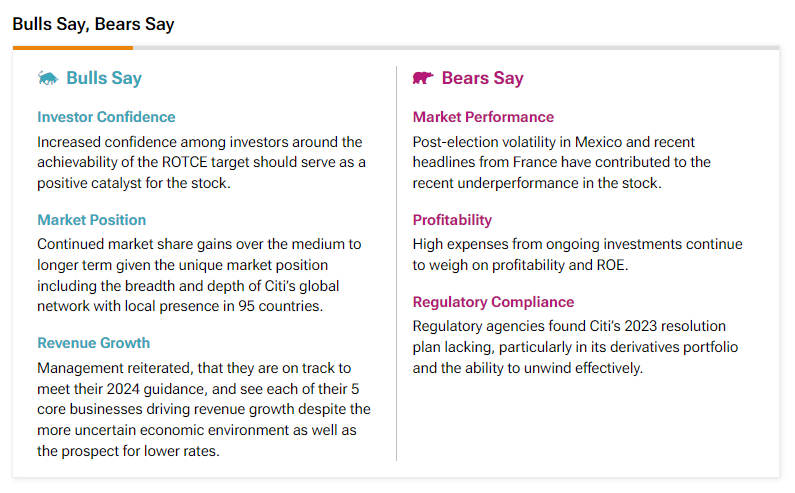

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bearish on Citigroup stock expect the company’s ongoing investments to continue to pressure its profits.

Citi – Q2 Expectations

Wall Street expects Citigroup to report sales of $20.07 billion in Q2, down 47.4% year-over-year. However, the company is expected to post earnings of $1.39 per share, reflecting an increase of 4.5% from the year-ago quarter.

Interestingly, C has an encouraging earnings surprise history. The company exceeded earnings estimates in 14 out of the previous 15 quarters.

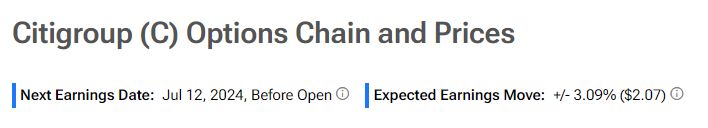

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you. Indeed, it currently says that options traders are expecting a 3.09% move in either direction.

Is Citigroup a Buy or Sell Stock?

Turning to Wall Street, analysts have a Moderate Buy consensus rating based on 10 Buys and eight Holds assigned in the past three months. After a 31% rally in its share price over the past six months, the analysts’ average price target on Citi stock of $69.19 implies a limited upside potential of 3.3%.