Citi (C) has raised its price target on Urban Outfitters (URBN) stock and set a “30-day positive catalyst watch” for the clothing retailer. Analyst Paul Lejuez increased his price target on the company from $39 to $42, implying a 12% upside potential. While Lejuez maintains a Hold rating on URBN, he expects the stock to continue rising over the coming month, as indicated by the 30-day target he set for a positive catalyst.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with Urban Outfitters Stock Today?

So far, this target upgrade hasn’t done much for Urban Outfitters stock. Shares closed out trading yesterday down 2% and continued slipping today in premarket trading. This follows a difficult week and a highly volatile three months, during which time URBN stock has fallen 9%. But Lejuez’s new take suggests that the company could be headed for a turnaround as the holiday shopping season approaches.

One key catalyst is quickly approaching. As Lejuez notes, Urban Outfitters is scheduled to report Q3 earnings on November 26. He expects it to beat Wall Street estimates with a “stronger than consensus gross margin.” In a recent note to clients, the analyst stated that he sees the company’s favorable risk/reward ratio heading into the earnings period as grounds for opening a 30-day positive catalyst watch.

At the end of the previous quarter, TipRanks’ Casey Dylan reported that Urban had shown promising growth. Although its sales had slowed, the company reported a net income increase of 17% from the previous year. If Q3 earnings show that this growth is ongoing, URBN stock could be well-positioned to end the year on a high note, particularly as the holiday shopping season will likely lead to a sales bump.

Wall Street Is Sidelined on Urban Outfitters

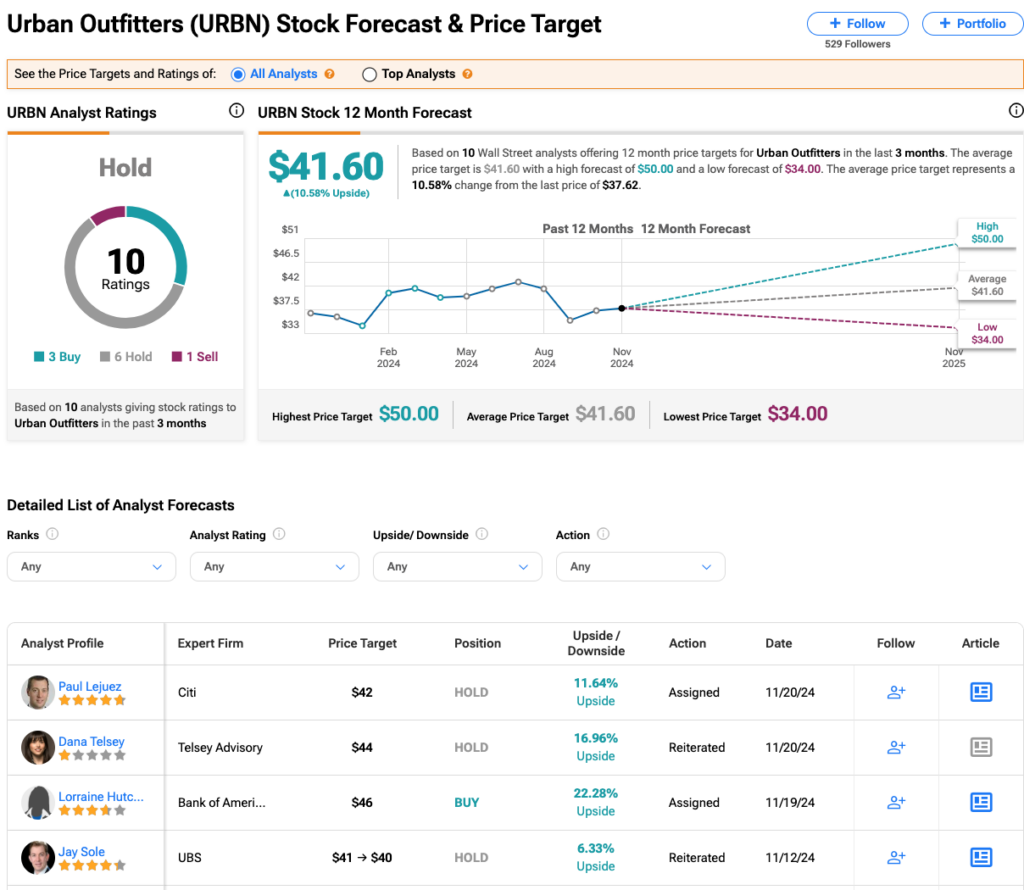

Overall, Wall Street regards Urban Outfitters with caution. Analysts have a Hold consensus rating on URBN stock based on three Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 4% rally in its share price over the past year, the average URBN price target of $41.60 per share implies 11% upside potential.