CAVA Group (NYSE:CAVA) stock has rallied over 111% year-to-date. The upside is driven by optimism among investors about the company’s growth potential. Despite the significant jump in CAVA stock, individual investors have a Very Positive view of the company. This reflects investors’ optimism about CAVA’s future growth potential.

According to TipRanks data, the number of portfolios holding the stock increased by 15.6% in the last 30 days. Overall, among the 742,108 portfolios monitored by TipRanks, 0.4% have invested in CAVA stock.

Learn more about TipRanks’ powerful Investor Sentiment tool here.

Cava is a fast-casual Mediterranean restaurant chain known for its customizable bowls, salads, and pita wraps. For a thorough assessment of the stock, go to TipRanks’ Stock Analysis page.

Not Just Investors

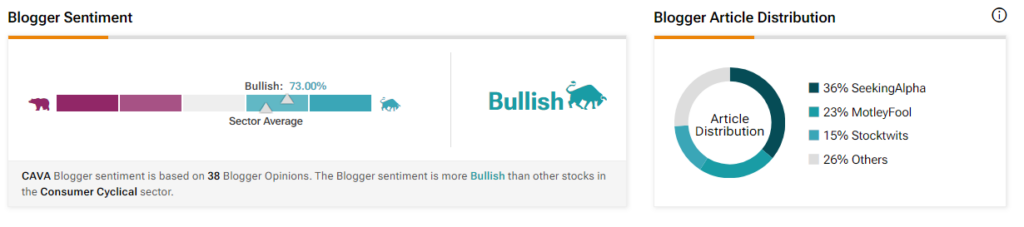

It is worth highlighting that, apart from the investors, hedge fund managers and bloggers are also bullish on the company. Based on the Blogger Opinion tool, we can see that out of the 38 bloggers tracked by TipRanks, 73% of them are optimistic, which is higher than the sector average, as pictured below.

Furthermore, the Hedge Fund signal remains Positive for CAVA stock. TipRanks data shows that hedge fund managers, including Gotham Asset Management’s Joel Greenblatt, bought 60,100 shares of the company in the last quarter.

Is CAVA Stock a Buy?

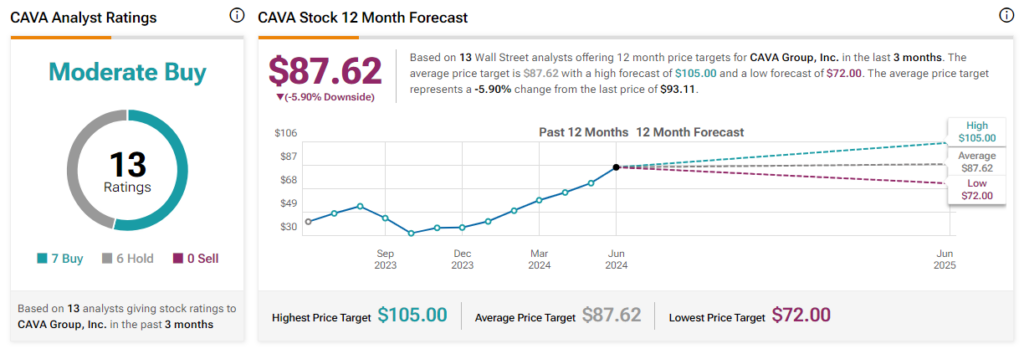

Wall Street is cautiously optimistic about CAVA’s prospects. CAVA sports a Moderate Buy consensus rating based on seven Buy and six Hold recommendations. The analysts’ average price target on CAVA stock is $87.62, implying 5.9% downside potential from current levels.