The American coffee giant Starbucks (SBUX) is struggling to brew favorable returns for investors, making the stock appear like dead money for the next few years. Preliminary results have disappointed investors, signaling a tough road ahead for the company and reinforcing my bearish outlook on the stock. Worse, the challenges seem specific to Starbucks rather than the broader industry.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Over the past five years, Starbucks has risen just 17%, trailing far behind the S&P 500’s 90% gain. In the past year, the stock is up only 4%, with most of the gains driven by the transition to new leadership. While the new CEO Brian Niccol’s revival strategy has provided some momentum to the shares, analysts caution that the company’s challenges won’t be resolved solely through a leadership change. Overall, a meaningful turnaround seems unlikely, making it doubtful that investors will see substantial returns anytime soon.

Starbucks’ Preliminary Results Raise Concerns

One of my main concerns about Starbucks is its disappointing financial performance quarter after quarter. Most recently, the company released its preliminary report for Q4 and the full fiscal year 2024, marking its third consecutive quarter of declining revenue and net income. Starbucks began its preliminary report by citing a “challenged customer experience.”

In Q4, the coffee chain reported a 7% decline in global comparable store sales compared to the previous year, along with a 3% year-over-year decline in consolidated net revenues. This indicates that Starbucks’ new store openings couldn’t compensate for declining same-store sales. Additionally, GAAP earnings dropped by 25% year-over-year to $0.80 per share in Q4, indicating narrower profit margins. Meanwhile, fourth-quarter revenues of $9.1 billion fell short of the consensus estimate of $9.37 billion.

The company’s results were mainly affected by weaker revenue in North America during the quarter, with comparable transactions declining by 10% year-over-year. As Starbucks’ largest market, this trend raises concerns about long-term growth. Although we’ll get complete details when the company releases its earnings on October 30th, the initial information was unimpressive.

Starbucks Suspends 2025 Guidance

Another worrying sign for investors is the company’s suspended guidance for FY25. Starbucks attributed its suspended guidance to the CEO transition and the current state of the business. Moreover, the company’s CFO, Rachel Ruggeri, stated that “Despite our increased investments, we were unable to reverse the trend of declining traffic.” Ruggeri further added that the company is creating a strategy to revitalize its business, but it will require time. This raises concerns for long-term investors, as the entire bullish outlook appears to rely heavily on Niccol’s performance.

To compensate for the suspended guidance, the coffee giant has declared an increase in its dividend from $0.57 per share to $0.61 per share, marking a 7.0% year-over-year rise. Starbucks characterized this dividend increase as a demonstration of its confidence in long-term growth, but it failed to offer any significant boost to investors.

Starbucks has consistently raised its quarterly dividend by $0.04 per share annually for several years, making the latest increase feel less significant. Last year, Starbucks hiked its dividend from $0.53 to $0.57 per share. The dividend hike does little to alleviate concerns about a coffee giant that has stalled.

Rising Coffee Brands Snack on Market Share

In addition to its falling sales, Starbucks is losing its market share to new and rising coffee brands and chains. Investors in Starbucks should keep an eye on Dutch Bros (BROS), a rapidly growing U.S.-based coffee chain with a market capitalization of $5 billion. Dutch Bros reported a remarkable 30% year-over-year revenue growth in Q2 2024. The company also opened 36 new locations during the quarter, bringing its total to over 900 shops.

Starbucks isn’t going to get dethroned anytime soon, as it wrapped up 2023 with more than 38,000 stores globally. However, the rising popularity of Dutch Bros poses a threat, as it could draw customers away from Starbucks, impacting revenue growth and profit margins. Additionally, the rise of fast-growing fast-food brands like Chipotle Mexican Grill (CMG) and CAVA Group (CAVA) could add further pressure on Starbucks.

At the same time, Starbucks holds a significant lead in the coffee industry. Nonetheless, such dominance isn’t always beneficial for long-term investors. A large market share can hinder a company’s ability to achieve substantial revenue and net income growth. Given Starbucks’ recent challenges and the rise of new competitors, I have a bearish outlook on the stock.

Is SBUX Stock a Buy, According to Analysts?

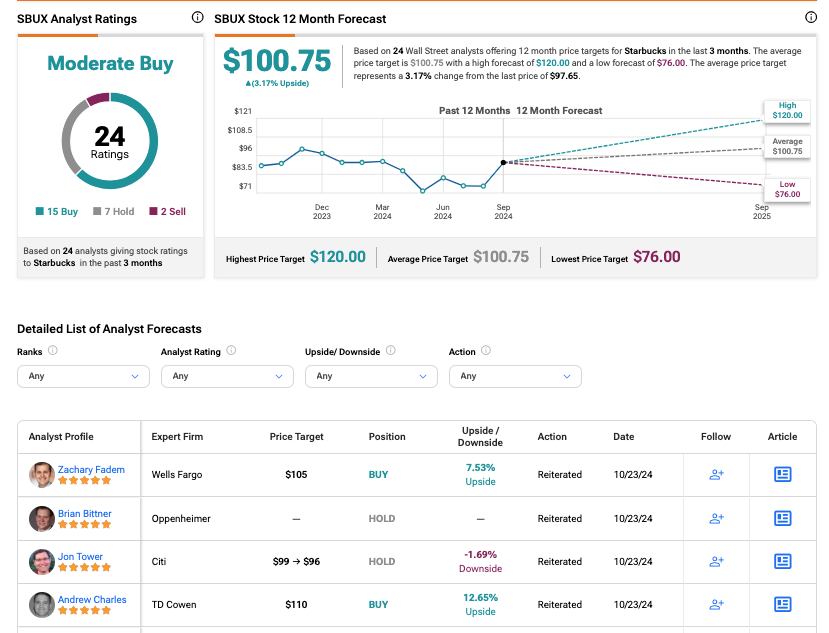

Currently, SBUX stock is rated as a Moderate Buy on TipRanks based on 15 Buys, seven Holds, and two Sells assigned by analysts in the past three months. The average Starbucks share price target is $100.75, suggesting a modest upside of 3.17% from current levels. While the highest price target of $120 per share suggests a potential upside of 22%, the lowest price target of $76 per share indicates a possible decline of 22%.

See more SBUX analyst ratings.

The Bottom Line on SBUX Stock

Preliminary results show a significant decline in Starbucks sales, and the suspension of guidance adds to the uncertainty for the coffee chain. Although the dividend increase is a sign of confidence in future performance, the company is still maintaining the same growth rate it has experienced for several years.

While Niccol might steer the company back on track, rivals are growing at a faster pace. Dutch Bros is a notable challenger, and it doesn’t need to match Starbucks’ size to make it a bumpy ride for SBUX investors. Although Starbucks is unlikely to disappear, this competition may hinder the stock’s long-term returns.