Cameco Corp (TSE: CCO), one of the world’s largest uranium producers, raised its dividend after reporting its revenue and profit fell in the fourth quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue & Earnings

Revenue for Q4 2021 came in at C$465 million, a decrease of 15.5% from the revenue of C$550 million reported in Q4 2020.

The company reported a profit of C$11 million (C$0.03 per diluted share), compared to a loss of C$61 million (C$0.15 per share) in Q3 2020.

On an adjusted basis, the company lost C$54 million (C$0.14 per share), compared with a profit of C$80 million (C$0.20 per diluted share) reported in the fourth quarter of 2020.

CEO Commentary

Cameco president and CEO Tim Gitzel said, “Our results reflect the very deliberate execution of our strategy of full-cycle value capture. We have been undertaking work to ensure we have operational flexibility, we are aligning our production decisions with the market fundamentals and our

contracting portfolio, and we have been financially disciplined. Since 2016, with our planned and unplanned production cuts, inventory reduction and market purchases, we have removed more than 190 million pounds of uranium from the market, which we believe has contributed to the security of supply concerns in our industry.”

The uranium miner says it will now pay an annual dividend of C$0.12 per share, up 50% from C$0.08 per share.

In its outlook for this year, Cameco says it expects revenue for 2022 between C$1.5 billion and C$1.65 billion. Capital expenditures for the year are estimated to be between C$150 million and C$175 million.

Wall Street’s Take

Last month, CIBC analyst Bryce Adams initiated coverage of CCO with a Buy rating and C$37 price target. This implies 30.6% upside potential.

Adams said he expects nuclear energy to be essential in reducing the world’s dependence on fossil fuels and sees Cameco as offering investors the opportunity to invest in “Tier 1 assets, with premium jurisdictional exposure, a significant reserve base, a strong balance sheet, and a reasonable valuation.”

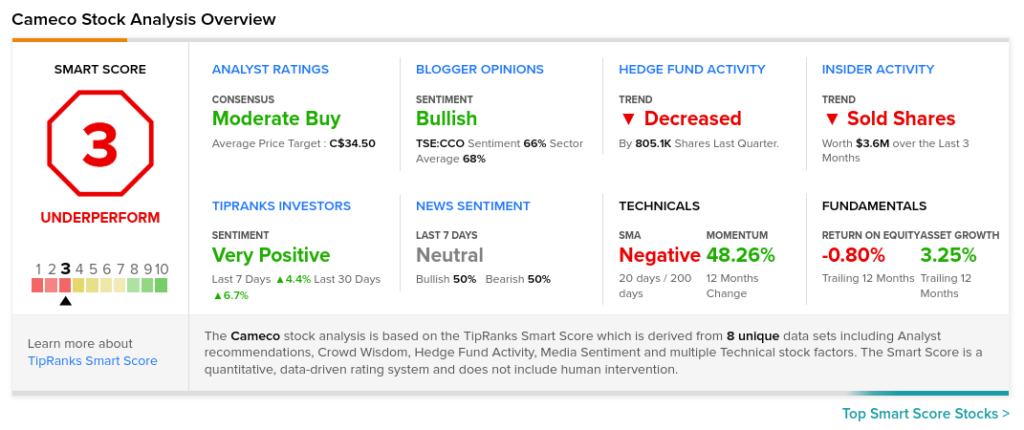

Overall, CCO scores a Moderate Buy consensus rating among analysts based on one Buy and one Hold. The average Cameco price target of C$34.50 implies 21.6% upside potential to current levels.

TipRanks’ Smart Score

CCO scores a 3 out of 10 on the TipRanks Smart Score rating system, indicating that the stock is likely to underperform the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Cenovus Energy Q4 Loss Widens, Shares Plunge

Suncor Energy Swings to Profit in Q4