It is almost refreshing to reveal good news about aerospace company Boeing (BA) that does not come with a caveat or some kind of other clause or trap that takes the edge off the good. Despite the purity of the good news, Boeing shares still struggled and were down fractionally in Tuesday afternoon’s trading. The report came from Defense News, which noted that Boeing landed a contract for 15 more KC-46A Pegasus refueling tankers worth a hefty $2.6 billion.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This should go quite some way toward patching up Boeing’s cash crunch, which it recently tried to repair by turning to its investors for some extra funding with a stock sale. That worked out well, but it is not a move Boeing will be able to repeat any time soon.

Thus, measures like this should prove particularly helpful going forward. Boeing’s experience building such aircraft is now well-known; this is the 11th lot of tankers ordered and will bring Boeing up to 168 such tankers in play worldwide. The United States has 89 of them, which have been delivered since 2019, and four went to the Japanese Self-Defense Force. Israel also bought four themselves not so long ago.

A New Stop for Those Chinese Boeings?

Yesterday, a report from Aviation A2Z filled us in about China Southern Airlines’ plan to sell off a load of 10 Boeing 787-8 aircraft, which represented all of the airline’s Boeing 787-8 fleet. Now, Aviation A2Z answered its own question about what to do with those aircraft by making a suggestion: Air India should step in.

This might sound like a bridge too far at first, particularly given recent tensions between India and China. But, the report notes, this would also be a good move for Air India. First, it has the cash on hand to meet China Southern’s terms of no partial sales. Further, since these are only 11-year-old aircraft, on average, they could be available at “significantly reduced prices.” Plus, the move “…align(s) with Air India’s growth trajectory” and essentially suggests that this offer is in the right place at the right time.

Is Boeing a Good Stock to Buy Right Now?

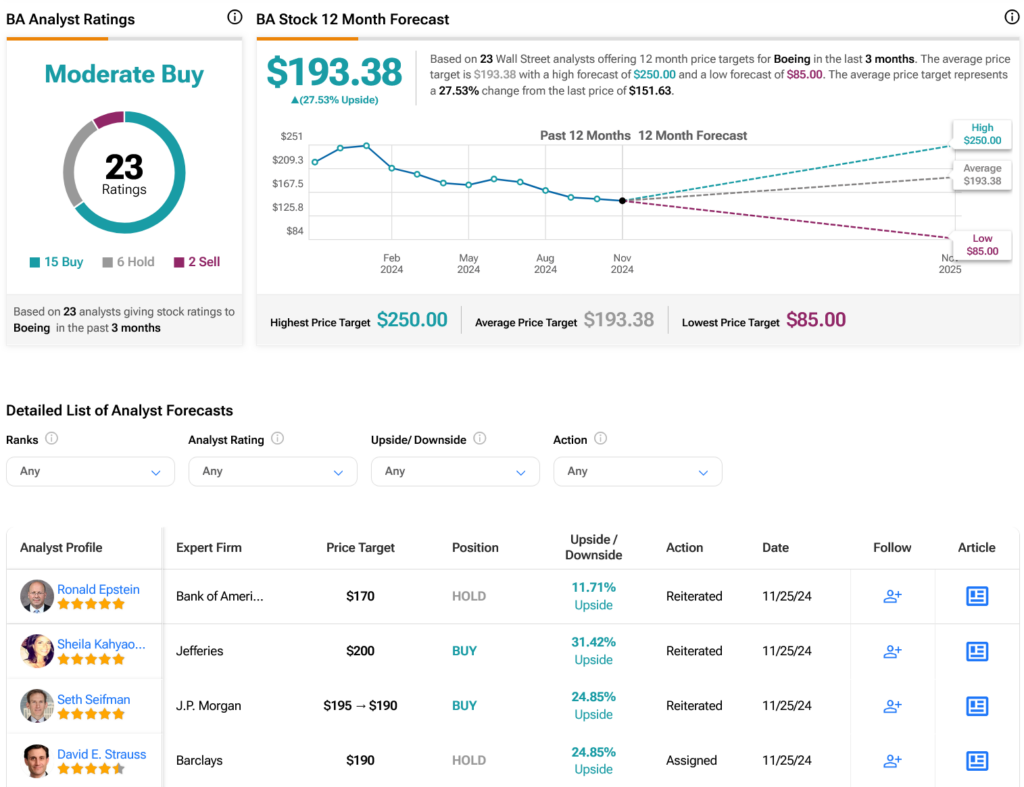

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, six Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 30.61% loss in its share price over the past year, the average BA price target of $193.38 per share implies 27.53% upside potential.