Of all the things that aerospace company Boeing (BA) did not need right now, “powerful enemies” might be near the top of the list. Sadly, that is exactly what it got as Michael Bloomberg, of the eponymous news service, came out in force against Boeing and its space ambitions. Investors, meanwhile, shrugged this off, as shares were up modestly in Monday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Bloomberg took to the pages of the news service he founded and declared that NASA was spending way too much money on Boeing’s giant space rocket. Here, Bloomberg referred to Project Artemis, which is NASA’s plan to get astronauts back to the moon, which the United States has not done since way back in 1972. It depends on Boeing’s Space Launch System (SLS), which NASA looks to use effectively like the space shuttles of old.

Boeing, meanwhile, is the primary contractor of the SLS, and Bloomberg noted that the SLS project is too big for NASA’s budget. NASA so far, Bloomberg noted, has sunk nearly $24 billion into the project, despite no one actually getting off the ground with it just yet. Further, each launch of the SLS is said to cost a hefty $4 billion, which, as Bloomberg noted, was “quadruple initial estimates.”

A Mixed Bag in Asia

Meanwhile, Boeing faces some good news and some bad news in Asia. First, there are about to be a lot of used Boeing aircraft on the market in China, as China Southern Airlines looks to sell 10 Boeing 787-8 aircraft. That may not mean so much by itself, but according to Aviation A2Z, that represents the entirety of China Southern Airlines’ Boeing 787-8 fleet. However, it will still have 18 787-9 aircraft and over 650 aircraft total, which suggests its diverse fleet will remain so.

Finally, there was a win in Japan, as Boeing landed a $129 million contract to handle several “engineering change proposals” for the Japan Air Self-Defense Force’s line of F-15s. It is part of a larger effort to “modernize its air defense capabilities amid regional security concerns,” noted Defence Blog.

Is Boeing a Good Stock to Buy Right Now?

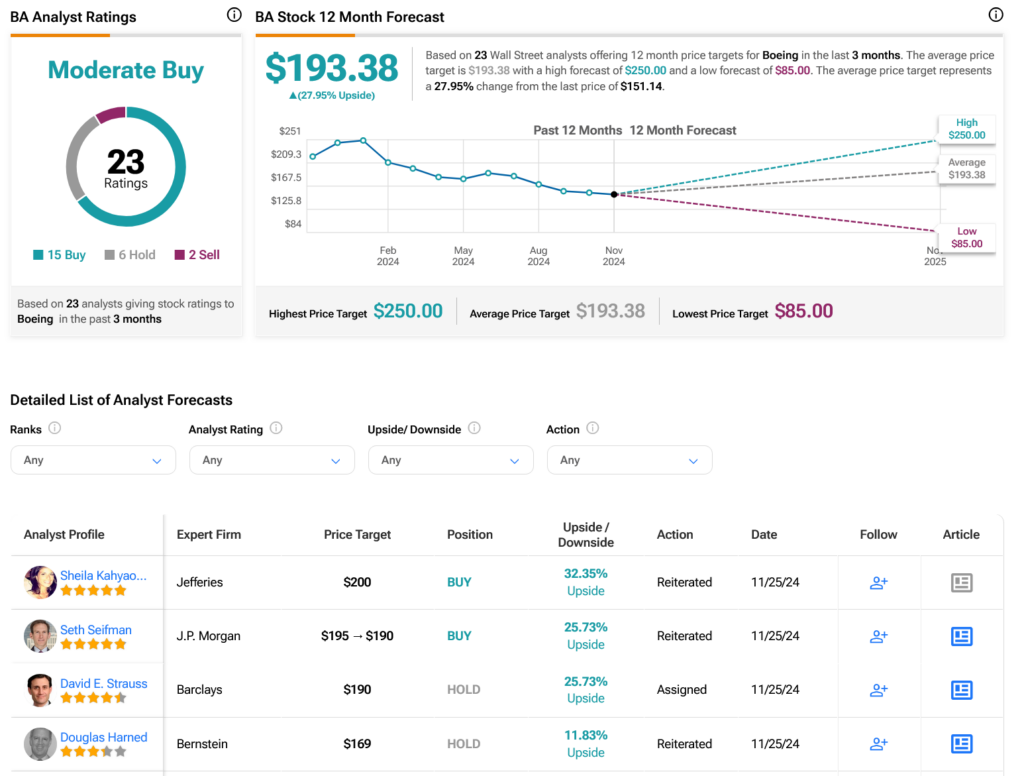

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, six Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 31.09% loss in its share price over the past year, the average BA price target of $193.38 per share implies 27.95% upside potential.