This year has been defined by a continuation of the tech bull market, with AI-focused stocks once again leading the way. However, after a bit of a lull earlier this summer, some on Wall Street thought maybe the rally had finally run out of steam. The rebound seen over the past month would suggest the pullback was only temporary.

That line of thought is the one taken at asset managing giant BlackRock. The firm’s tech experts have been looking at the current operating environment and taking a favorable view of what’s coming next.

“We believe earnings growth can remain healthy for the technology sector broadly, fueled by the build out of AI and a commitment to cost prudence on the part of tech firms,” BlackRock tech investors Reid Menge and Tony Kim recently said. “We believe the rapid evolution of AI and all of its ramifications makes investing in this space very much an active pursuit. Volatility such as that seen of late, while always unsettling, is not unexpected and could present buying opportunities in this exciting and, we believe, enduring theme.”

BlackRock’s confidence isn’t just talk; they’re backing it up with action. As the world’s largest asset manager, BlackRock is the second-largest investor in tech and AI giants Advanced Micro Devices (NASDAQ:AMD) and Alphabet (NASDAQ:GOOGL), signaling a strong belief that these industry leaders are poised for further growth. So, let’s take a closer look at what’s driving BlackRock’s bullish stance.

Advanced Micro Devices

The first BlackRock-endorsed name we’ll look at is AMD. This leading semiconductor company is known for its innovative processors and graphics cards that compete directly with other market giants Intel and Nvidia. Over the years, AMD has steadily grown into a key player in the industry, recognized for its CPUs and GPUs, which are popular in both consumer and enterprise segments. The company’s products are geared towards gaming, data centers, and AI, with AMD having a big presence in these markets.

AMD’s story over the past decade involves a huge turnaround from a company staring at bankruptcy to one that under the leadership of Lisa Su has managed to substantially eat into Intel’s dominance of the CPU space. Now it has its sights set on hauling in another runaway leader; Nvidia is the undoubted king of the AI chip segment, but AMD is seen as a company that can take away some of its market share. While not quite as spectacular as the gains made at Nvidia, it has also been showing some robust growth.

In Q2, the company generated revenue of $5.84 billion, in what amounted to a 9% year-over-year increase while beating the Street’s call by $120 million. Within that total, Data Center segment revenue surged by 115% compared to the same period a year ago to reach $2.8 billion. At the other end of the equation, adj. EPS of $0.69 also beat the Street’s call – by $0.01.

BlackRock already had a sizeable AMD position but gave it a boost during the quarter. It purchased an additional 5.8 million shares. BlackRock now owns roughly 130.38 million AMD shares, currently worth over $20.5 billion.

AMD also has a fan in Edward Jones analyst Logan Purk, who lays out the bull case. “We believe the company should deliver outsized growth for several reasons,” Purk said. “First, growing demand for data-center infrastructure should help drive accelerating sales of AMD’s chips, in particular graphics processing units (GPUs) and central processing units (CPUs). Second, while the acquisition of Xilinx adds new programmable chip products and end-markets to AMD’s business, we believe the company remains in the early innings of cross-selling and integrating Xilinx and AMD products. Management believes this opportunity could approach $10 billion. Finally, even though PC markets have started to rebound, we believe AI-enabled PCs could drive a longer upgrade cycle, supporting higher growth for the PC market. We believe our optimism is not fully reflected in the share price.”

Purk’s bullish stance is reflected in his Buy rating, although he hasn’t set a specific price target. (To watch Purk’s track record, click here)

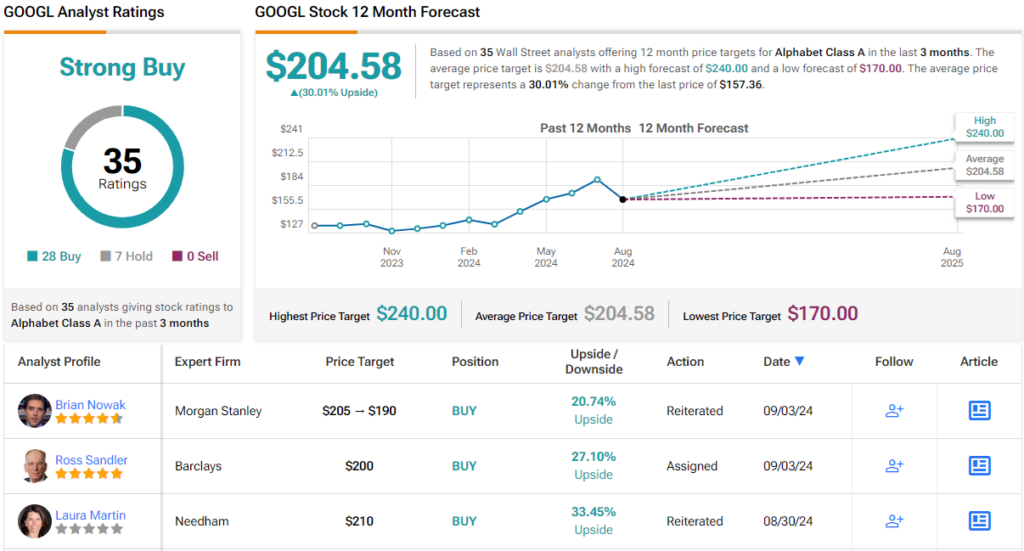

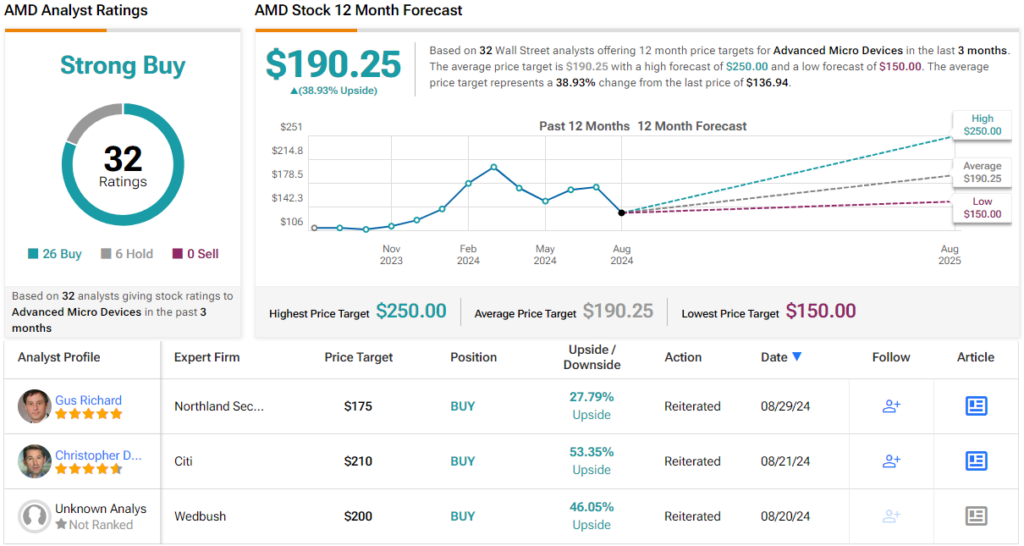

Other analysts do have price targets and the average on the Street stands at $190.25, a figure that makes room for 12-month returns of ~39%. Overall, the stock claims a Strong Buy consensus rating, based on 32 reviews that breakdown into 26 Buys vs. 6 Holds. (See AMD stock forecast)

Alphabet

AMD is a tech giant, but it has a way to go yet to reach the scale achieved at our next BlackRock pick. Google’s parent company Alphabet is the world’s 4th biggest by market cap, and really doesn’t need any introduction.

Alphabet has its fingers in many pies, from YouTube to self-driving cars with Waymo, AI research with DeepMind and various other endeavors. However, its primary breadwinner is its ubiquitous Search business, the search engine that dominates the online market. It is integrated into the lives of billions across the globe who use Google on a daily basis. In fact, such is its influence, that it prompted the U.S. Justice Department to file a civil antitrust lawsuit, alleging anticompetitive and monopolistic practices (a federal judge ruled in favor of the DoJ earlier this month although no remedies were offered).

But the US regulators are not the only ones putting Google under pressure. The rise of GenAI is posing questions regarding the prospects of Search’s ubiquity moving forward. The growing use of AI tools, including OpenAI’s widely used ChatGPT, is already beginning to undermine Google’s dominance.

Of course, Alphabet is deeply involved in countering the threat, and has developed Gemini, a suite of next-gen AI models designed to advance the capabilities of large language models (LLMs). Gemini is intended to power various Google products and services, offering more sophisticated AI-driven interactions.

BlackRock must sense Alphabet will have plenty to say about the way AI takes shape. During Q2, the investing giant loaded up on another 5.19 million GOOGL shares, bringing its total holdings to 421.08 million. These currently command a market value of almost $68.8 billion.

Goldman Sachs analyst Eric Sheridan sees the concerns that have been flagged up regarding the Search business as valid, but thinks GOOGL has what it takes to keep on being the leader it is today. “We continue to view Alphabet as well-positioned against both the current (mixture of desktop and mobile utility) and potential future (AI/ML; personalization; lowered friction to applications) computing landscapes,” the 5-star analyst said. “While we cannot refute the continued investor debate around the future of search, we continue to believe that Alphabet is positioned as an AI first company (scale of research, technical infrastructure, engineering talent, capital [both past and future] deployment, etc.) & an existing application/use base across which AI can be deployed.”

All told, Sheridan rates GOOGL shares a Buy, while his $217 price target implies the stock will climb ~33% higher in the year ahead. (To watch Sheridan’s track record, click here)

Sheridan’s view is one shared by 27 other analysts on the Street, while the addition of 7 Holds can’t detract from a Strong Buy consensus rating. At $204.58, the average price target suggests gains of 30% are coming over the next 12 months. (See Alphabet stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.