Among the growth sectors investors have focused in on in recent years has been artificial intelligence. Using AI to improve business efficiency is something many companies are after. For Upstart Holdings (UPST), this is core to its business model.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s use of AI and big data to improve the credit approval process for borrowers is really a breakthrough for the financial services industry.

Borrowers and lenders alike benefit from having a “truer” picture of the risk profile of borrowers. Lower interest rates for borrowers, and greater loan volumes for lenders, makes Upstart’s offering worth considering.

Indeed, this platform is one that’s seen incredible growth of late. This growth has propelled the company’s valuation into the nosebleeds, something that has hindered this stock in recent months.

Since hitting a high of more than $400 per share in October, UPST stock has since fallen to below the $110 mark at the time of writing. This move has come as investors have increasingly de-risked their portfolios, selling off companies with the steepest of valuations.

The question now is whether this sell-off was warranted or not. I think that Upstart’s previous valuation likely didn’t make much sense. However, at these levels, I think UPST stock is starting to look at lot more attractive.

Here’s why I’m bullish on Upstart right now.

Artificial Intelligence: A True Game Changer

About 90% of credit decisions in the United States are made using the FICO credit scoring system. This particular score determines the creditworthiness of borrowers. It uses various metrics to determine this, such as repayment history, existing history, and more.

Upstart Holdings argues that the existing FICO score misses several important areas. This company has used AI to integrate 1,600 data points to better understand a borrower’s repayment capability. These data points may include an individual’s job history or school records.

This nuanced method seems to be more approachable for borrowers who fail in meeting the trading criteria. This is also an ardent need, considering that the digital economy is far different from when FICO was launched.

Interestingly, as per Upstart’s internal study, there were 75% fewer defaults in AI-originated loans compared to the traditional way. It also results in 67% faster decision making.

Again, this business model is one I think investors ought to pay attention to, as the financial services industry gets disrupted by technology.

Upstart Expands into New Horizons

One of the things many investors note with Upstart is that this company is not a lender. Accordingly, Upstart carries zero credit risk. The company uses its algorithm to generate loans from banks.

In addition, it sells this technology to other interested organizations. One of the company’s partner banks has also eradicated FICO from its assessment system, honoring the AI algorithm.

What this means for Upstart is a very high-margin business, one unlike most financial services companies out there.

Upstart’s focus has thus far been on personal loans. The problem is, personal loans are a rather small percentage of the overall credit market in the U.S. Accordingly, Upstart is looking to branch out into other lines of business.

One of the key markets Upstart is targeting is the automotive lending market. The global addressable auto loan market is a whopping $1.3 trillion industry, and is growing quickly. This market is orders of magnitude larger than the personal loans business, making Upstart’s growth potential seemingly limitless.

Considering Upstart has been growing its top line in the triple-digit range of late, these sorts of expansions outside the company’s core business could prove to be growth accelerants.

Accordingly, those bullish on Upstart’s niche business right now may want to consider the future implications of the company’s disruptive business model.

Upstart’s aim is simple: go after car dealerships as a root of originations. To achieve this strategy, it acquired Prodigy, which is a car-dealer sales platform. Many experts believe this expansion could be the key to tremendous long-term revenue and earnings growth.

Wall Street’s Take

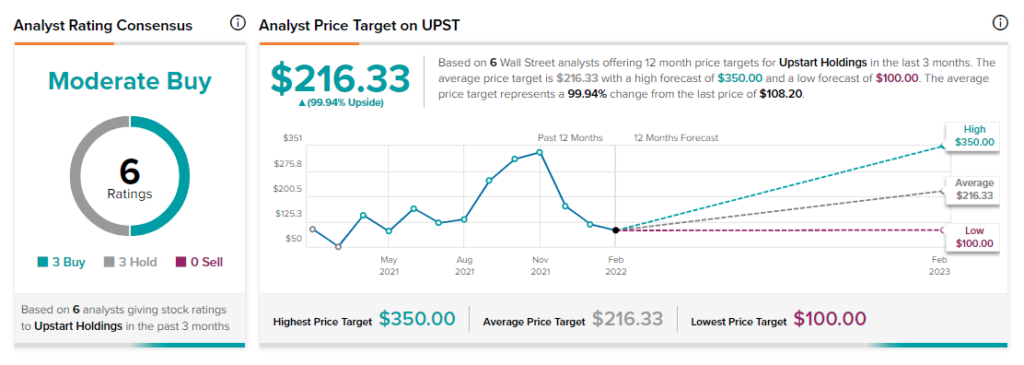

As per TipRanks’ analyst rating consensus, Upstart Holdings is a Moderate Buy. Out of six analyst ratings, there are three Buy recommendations and three Hold recommendations.

The average Upstart price target is $216.33. Analyst price targets range from a high of $350 per share to a low of $100 per share.

Bottom Line

Upstart’s business model is one long-term investors can get behind. However, the key issue many investors have with this stock is the company’s valuation. That’s fair — Upstart still trades at around 112 times earnings.

That said, Upstart is actually profitable, unlike many of its AI peers. This company has a model that’s proven, and works across a range of businesses. As Upstart expands into the auto loan market, there’s a lot to like about this company’s potential long-term trajectory.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure